SK Hynix gets one-year waiver on chip gear in China, showing difficulties for US 'harshest' ban

Washington's 'harshest' chip ban faces difficulties: expert

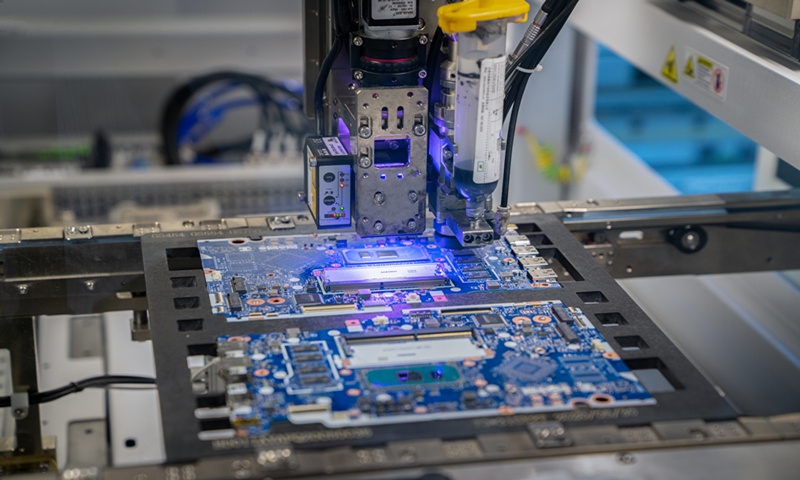

A chip manufacture machine Photo: VCG

The US government will allow SK Hynix to keep receiving chip equipment needed for production facilities in China for one year, letting the South Korean chipmaker maintain production in the country, the company told the Global Times on Wednesday, vowing "utmost efforts" to maintain stable operations at its plants in China.

The move came just days after Washington issued what said to be the "harshest" export ban on chip technology in another attempt to thwart China's semiconductor development last week

Analysts said the waiver indicates the difficulties the US faces in pushing forward the new curbs, which will heavily disrupt the global chip sector, while also demonstrating that the role of China's market is difficult to shake despite years of US sanctions.

The US government on Friday announced a broad set of technology export controls, including a ban on shipments of certain semiconductors made anywhere in the world with US equipment to China, further intensifying its so-called tech decoupling push and threatening to wreak havoc in the highly globalized chip supply chain.

Reuters reported on Tuesday that US chip toolmaker KLA Corp will cease offering some supplies and services from Wednesday to China-based customers, including SK Hynix, in compliance with recent US regulations, citing a source familiar with the situation.

In response, SK Hynix told the Global Times in a statement on Wednesday that the US Department of Commerce's Bureau of Industry and Security (BIS) assured the company, as well as its current suppliers and business partners, that it is still authorized to engage in activities necessary to maintain current production of integrated circuits in China for one year without further licensing requirements.

"Our discussions with the [US] Department of Commerce led to an approval to supply equipment and items needed for development and production of DRAM semiconductors in Chinese facilities without additional licensing requirements," read the statement.

"Continued supply of equipment means a stable provision of memory chips to the world," SK Hynix said. "Along with the South Korean government, we will continue our consultations with the [US] Department of Commerce and make our utmost efforts to operate our plants in China in a stable way, while continuing compliance with applicable laws and regulations."

"The move clearly shows the difficulties for the US to kick China out of its 'chip friends circle,' and to implement the curbs on the ground," Ma Jihua, a veteran telecom observer, told the Global Times on Wednesday.

Pressuring industry giants to "decouple" from the Chinese mainland itself is also like walking a tightrope for the US. With the importance of the Chinese market, the US is worried that the efforts might backfire if it pushes "too much," Ma said.

It also shows that the position of the Chinese market in the chip industry chain is difficult to shake, Ma said.

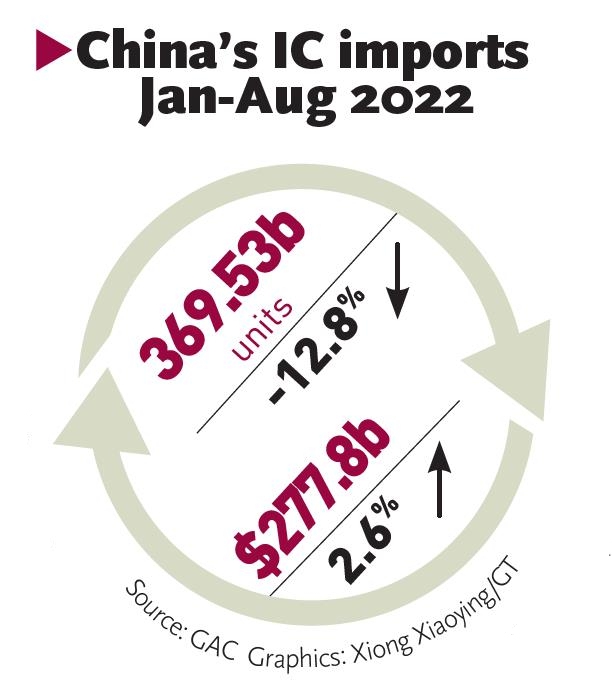

Industry players have warned that if the new measures are strictly implemented, it could put as much as 30 percent of some US and global chip industry giants' total revenue at risk because China accounts for one-third of their total revenue.

China's IC imports Jan-Aug 2022 Graphic: GT

Reuters previously reported that the Biden administration may also spare Samsung from the brunt of new restrictions, citing sources.

"We didn't receive any relevant information," Samsung China said when contacted by the Global Times on Wednesday.

Across China, Samsung runs a NAND flash memory chip plant in Xi'an, Northwest China's Shaanxi Province, and a chip packaging plant in Suzhou, East China's Jiangsu Province, according to a report from The Korea Herald on Sunday.

SK Hynix has a DRAM manufacturing facility in Jiangsu's Wuxi city, a packaging facility in Southwest China's Chongqing and a NAND flash plant in Dalian, Northeast China's Liaoning

The US may also issue waivers or licenses to more companies to reassure them in hopes of getting their further cooperation with more of its rules. Meanwhile, the US will use other means to force South Korean companies to do other things, such as setting up factories in the US, experts forecast.

"The Biden administration is rather concerned that firms' resistance to new rules it proposed is getting higher and their willingness to cooperate is getting lower," Ma said.

The US' "over-pressing" on China's chip industry also shows the anxiety of the Biden administration, as it's eager to get "results" and win political points before the midterm elections, Ma said.

The US has been unable to curb China's chip development over the past four years, and it won't succeed now, said Ma.

Commenting on the US' new export ban, Mao Ning, a spokesperson for China's Foreign Ministry, said on Saturday that the US' new export controls will hinder international tech exchanges and economic cooperation, and undermine the stability of global industry and supply chains and the recovery of the world economy.

The US' politicization and weaponization of technology, economic and trade issues will not stop China's development, but will only hurt the US itself, the spokesperson added.