Illustration: Chen Xia/Global Times

The probability of the US economy slipping into a recession in the next 12 months has hit 100 percent, according to the new Bloomberg Economics model projections released on Monday. The forecast is a sharp jump from the 65 percent probability in the previous update.In addition to the data model, forecasts of Wall Street economists for the probability of a US recession are also rising. A separate Bloomberg survey of 42 economists predicts the probability of a recession over the next 12 months now stands at 60 percent, up from 50 percent a month ago.

While US President Joe Biden has said the US will avoid a recession and that any downturn would be "very slight," the rise in recession expectations indicates how poorly the Biden administration has fared in terms of both boosting the economy and bringing down inflation, which will be a fatal weakness for Democrats in the upcoming elections. Even though the Fed has repeatedly hiked interest rates to rein in the soaring cost of living, US consumer inflation rose 8.2 percent over a year earlier in September, marking the seventh consecutive month that saw the consumer price index jumping above 8 percent.

At a time when various US economic problems have snowballed into a potential downturn, the fact that the Biden administration has still ratcheted up its suppression against China's technology shows that there are serious problems with Washington's overall foreign policy, which will only aggravate its economic problems instead of easing them.

Fundamentally speaking, everything the US has done in foreign policy is to maintain its hegemony. Disregarding the costs, Washington imposed sanctions on Chinese tech companies, cracked down on Chinese manufacturing and created divisions in global industry chains, in an apparent attempt to maintain the US' advantageous position in global supply chains and maximize US' interference in and prevention of China's development.

This month, the US government announced a sweeping set of export controls, including a measure to cut China off from certain semiconductor chips made anywhere in the world with US equipment. The US selectively ignores the fact that "decoupling" and confrontation in the semiconductor sector may hurt Chinese companies but could also fuel inflation in the US, precipitating a recession to happen even sooner.

In Europe, by fanning the flames in the Russia-Ukraine conflict, Washington has manipulated global energy markets to serve its own strategic interests while sending weapons to Europe for the benefit of its oil and arms groups. They have all turned a blind eye to Europe's pain and losses, as well as the economic damage of the geopolitical event to the developing world.

On the economic level, the Fed's aggressive rate hikes show that it only cares about how to lift the US economy while bringing down inflation so as to maintain US economic hegemony.

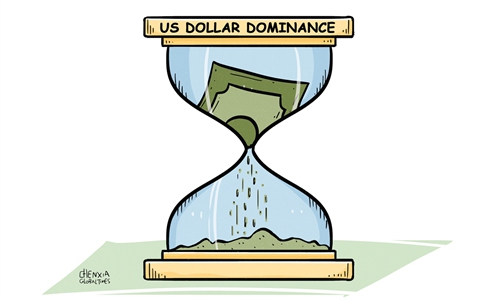

With dollar hegemony, the Fed is less motivated to address the problems caused by the US' blind and unlimited money printing, and tries to export the crisis to the rest of the world by taking advantage of a super strong dollar.

However, frequent interest rate hikes that have contributed to the abnormal appreciation of the dollar with the purpose of defusing inflation may backfire, with rising financing costs and increasing export prices. More importantly, the US adopted a strong dollar policy to maintain its economic hegemony, only to see the credibility of the dollar become exhausted by its irresponsible policy.

The serious split of US foreign policy in both political and economic terms from the global development trend has actually heralded the beginning of the decline of its hegemony.

A growing number of countries are exploring the path of "de-dollarization," hoping to avoid the spillover effects of Washington's hegemonic policy. It's becoming one of their priorities in decision-making, and they are considering how to protect their own interests from US policy by pursuing diversification of the international monetary system.

It all means that US hegemony is destroying itself.