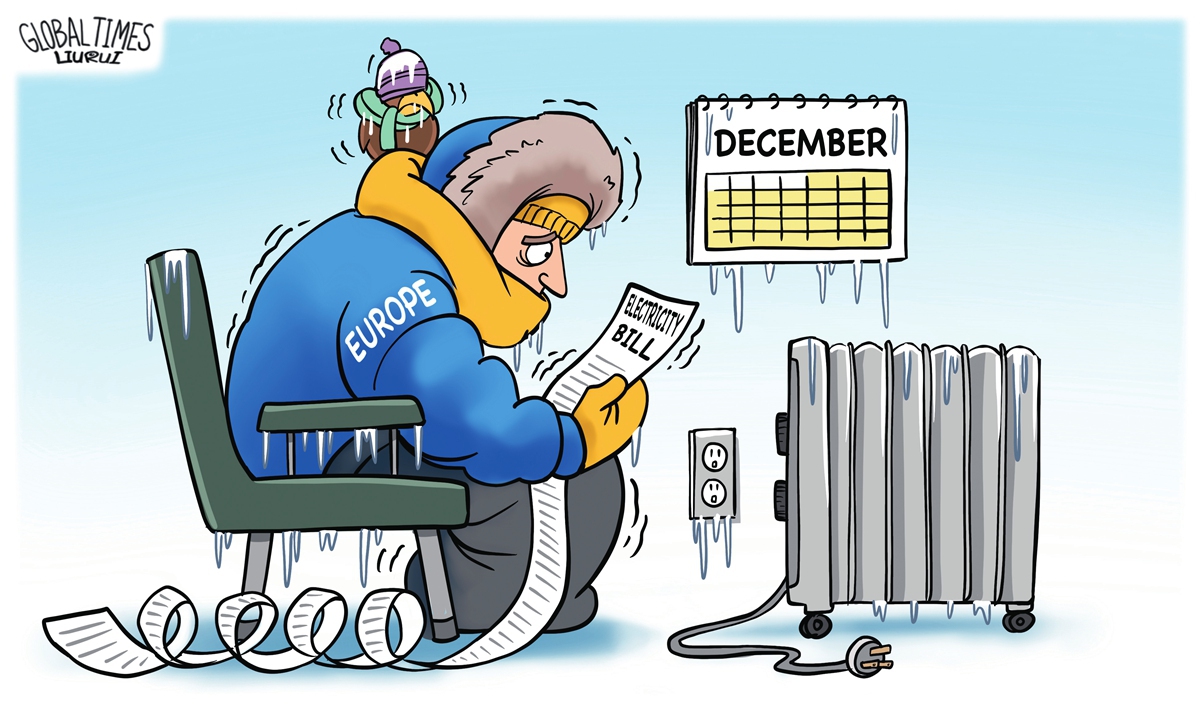

EU rising energy prices Illustration: Liu Rui/GT

The European Commission on Tuesday proposed a set of emergency measures aimed at cushioning consumers from high gas prices ahead of winter, which include launching joint gas purchasing by EU countries and setting a temporary "maximum dynamic price" on trades at the Title Transfer Facility (TTF) Dutch gas hub, Reuters reported.As Europe is heading into a tough winter, with skyrocketing energy prices, high inflation and a potential recession, some EU member states share the desire to impose a price cap on all gas, not just the small volumes still coming from Russia.

Germany, the EU's biggest gas buyer, and the Netherlands are skeptical about a cap, worrying that it could drive up demand or make it harder for European countries to secure gas supplies.

Against this backdrop, the EU's latest effort in tackling high energy prices has fallen short of imposing a forceful cap on gas prices. The EU's proposal actually shows that the price intervention idea has some serious obstacles and difficulties.

If a price cap results in a complete cutoff of Russian gas supplies, the EU may face a shortage in the coming winter. Fundamentally speaking, insufficient supply is the major problem facing the bloc, and a price cap will not help reduce demand, while it poses a risk of cutting supplies. That means the EU needs to find an approach to curb demand while securing supplies, or else demand that exceeds supplies could push up prices.

Amid the energy standoff with Russia, the EU had hoped that the US could be its "savior," but it turns out that liquefied natural gas (LNG) from the US is priced much higher than Russian gas. French President Emmanuel Macron recently couldn't help but complain that US gas is too expensive, saying France is "paying four times more than the price you [the US] sell to your industry." According to some media, US companies can earn more than $100 million per tanker of LNG bound for Europe.

In early October, German Chancellor Olaf Scholz proposed a plan to bring down gas prices by forming a buyers' alliance with energy-hungry countries in Asia - such as Japan and South Korea - to convince big exporters like the US to lower prices on the sidelines of an informal summit in Prague. But the reality is the bloc's bargaining power is very limited when it comes to US LNG supplies.

What's worse, as an energy crisis looms, the EU's manufacturing sector is on the verge of significant changes. The situation in the European auto sector may be evident of the trend. In a report titled "Winter is Coming," S&P Global Mobility said the auto industry's supply chain "may face extensive pressure" from soaring energy costs or even power cuts.

"With energy prices in Europe skyrocketing ... a harsh winter could place certain automotive sectors at risk of being unable to keep their production lines running," the report said.

To lower energy costs, some European automakers are moving production lines out of the region, and one of the main destinations is the US. Recently, several major European carmakers like Volkswagen, Mercedes-Benz and BMW have announced plans to invest more in the US.

Since the energy crisis is unlikely to be solved in the short term, European manufacturing is set to suffer more shocks and face a potential downturn.

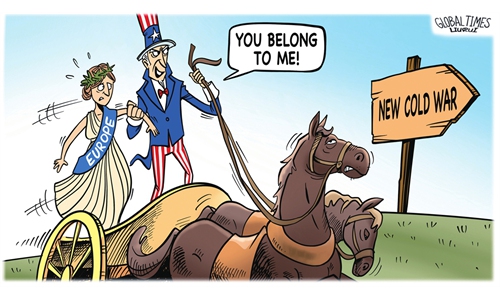

French Economy and Finance Minister Bruno Le Maire recently said the conflict in Ukraine must not end in US economic domination and a weakening of the EU.

Some Europeans seem to be aware that they've apparently fallen victim to US global strategy.

Europe is tied to the US on security issues and follows the US' lead. The US is profiting from this situation, but Europe is facing difficulties in pushing forward with regional integration as a result. It is also increasingly difficult for Europe to build itself as an economic power on par with the US. The Russia-Ukraine conflict has actually left Europe at a crossroads. Europe can either continue the current status of following the US or pull off united and coordinated development so as to stop the US from benefiting from the EU's loss.