Double 11 Photo: VCG

Photo: GT

China's biggest annual shopping festival, which falls on November 11 each year, kicked off presales on Thursday, with e-commerce platforms striving to improve services for consumers as well as the sustainable growth of industrial chains, rather than engaging in fierce price wars.

The new trends highlighted the initial achievements of the recent regulatory overhaul of the platform economy, whereas the expected robust sales during the month-long super shopping spree reflect the vitality of China's consumption market, industry analysts said.

Presales for the Double 11 festival on domestic e-commerce platform JD.com kicked off at 8 pm on Thursday, while presales on Alibaba's Tmall are set to begin on Monday.

In addition to large-scale promotion activities such as heavy discounts and red packets, the decade-old shopping festival will show some positive trends this year. For instance, platforms such as JD, Tmall and Suning all announced best price guarantees for consumers during the month-long festival.

Between October 24 and November 13, Suning will refund the difference to consumers if there is a price cut in the goods they buy on the e-commerce market, according to a press release the company sent to the Global Times on Thursday.

Another new trend is the rise of smaller platforms during the event that is usually dominated by industry giants. In particular, short video platforms such as Douyin and Kuaishou have become major players during the festival thanks to the rise of livestreaming sales.

JD earlier said that it will release new mechanisms and launch new services to help more small and micro-sized enterprises to establish stores on JD and bring sustainable growth for them. The platform will provide real-time warehouse and logistics data for retailers to realize digital management of supply chains and improve operating efficiency by about 50 percent.

Alibaba's Cainiao Network said that as of Friday, 370 million imported goods shipped from more than 200 ports around the world have been stocked in warehouses in preparation for the Tmall Double 11 pre-sales in three days' time.

Cainiao opened more than 400 sea, land, air and rail routes covering countries and regions including Europe, America, Japan and South Korea, and 80 percent of Cainiao's bonded warehouses support door-to-door delivery, covering more than 250 cities across the country.

"With consumers becoming more rational and practices more regulated, it's a trend for internet firms to improve their services to increase customer stickiness during the grand shopping spree," independent e-commerce expert Lu Zhenwang told the Global Times on Thursday.

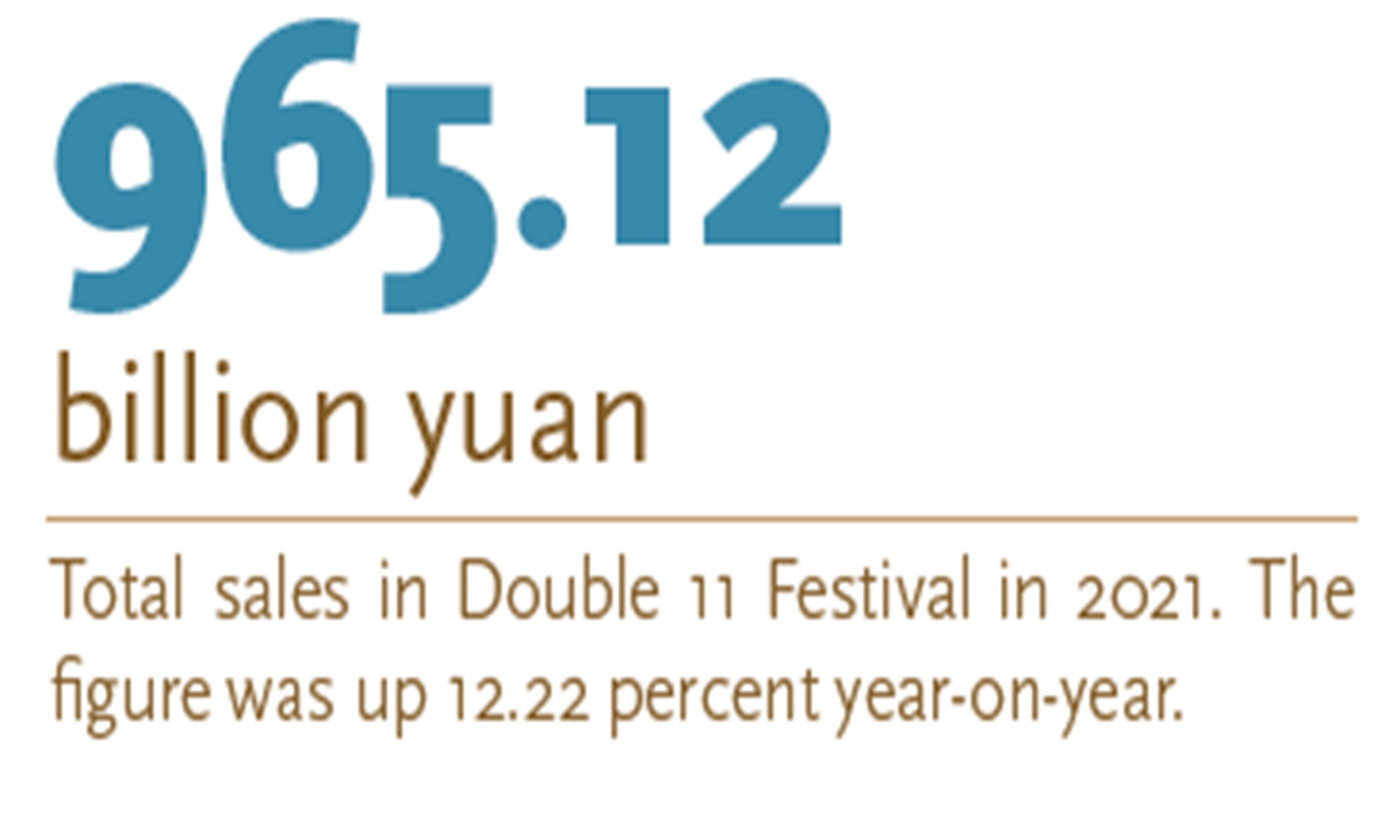

Instead of competition for sales among e-commerce platforms, the event is more important in stimulating the consumption sector as a whole, Lu said, noting that the Double 11 sales may set new records.

While platforms don't release real-time data for presales, a variety of indicators show that sales will likely maintain strong momentum this year, with some analysts estimating new records.

In a sign of full confidence in the sales performance of the shopping festival, retailers increased inventories. According to business news site nbd.com, domestic washing and personal care brand Bee & Flower has stockpiled 250,000 boxes of shampoo and conditioner, with its warehouse expanding by three times to more than 10,000 square meters.

Backed by the large-scale shopping spree, domestic demand is expected to further rebound in the fourth quarter, especially with the consumption upgrading, Zhang Yi, CEO of iiMedia Research Institute, told the Global Times on Thursday.

"Thanks to a substantial improvement in the living standards of rural residents through poverty alleviation, there is a huge demand among them for consumption upgrading," Zhang said, noting that e-commerce platforms and livestreaming will help drive consumption in the rural areas.

Despite COVID-19 resurgences in some regions and disrupted global supply chains, China's domestic consumption has shown an apparent rebound thanks to effective policy measures.

The country's retail sales reached 3.63 trillion yuan ($501.5 billion) in August, up 5.4 percent year-on-year, accelerating 2.7 percentage points compared with July, the National Bureau of Statistics' data showed.

Officials have stressed stimulating market demand to fire up an economic recovery by various means. A State Council executive meeting on September 21 reiterated that policy measures to boost investment and consumption will be advanced on a priority basis, including fiscal and financial support for key infrastructure projects throughout the country.