Stabilizing lithium market

China continues to play a crucial role in new-energy industrial chain: analysts

Brine pools at a local producer's Lithium mine in Calama, Antofagasta region, Chile. Photo: VCG

Amid a global pursuit of new-energy sources to reduce carbon emissions, lithium batteries that allow for more efficient use of energy have become prominent in industries varied from smartphones to electric vehicles (EVs).

Argentina, Bolivia, and Chile, South America's "ABC" lithium-producing countries, were reportedly considering joint policies to set the sale price of the mineral through an alliance similar to the Organization of the Petroleum Exporting Countries (OPEC), news site cankaoxiaoxi.com reported over the weekend, citing a report from Agencia EFE.

The hope is to influence lithium prices in the same way that OPEC sets production levels to influence the price of crude oil, the report said.

Along the same lines, ministers of the three countries want to agree on prices and harmonize production processes, as well as set guidelines for practices addressing sustainable industrial, scientific and technological development, according to the report.

More stable prices

The purpose of the lithium alliance is to avoid price volatility, which has a big impact on lithium suppliers, Zhang Xiang, a research fellow at the Research Center of Automobile Industry Innovation of the North China University of Technology, told the Global Times on Sunday.

An OPEC-like lithium alliance will likely be able to play a role in stabilizing lithium resource prices, Chen Jia, an independent research fellow on international strategy, told the Global Times on Sunday.

According to the International Energy Agency (IEA), the new-energy supply chain can be roughly divided into five parts: mining, material processing, cell components, battery cells and production such as manufacturing of EVs.

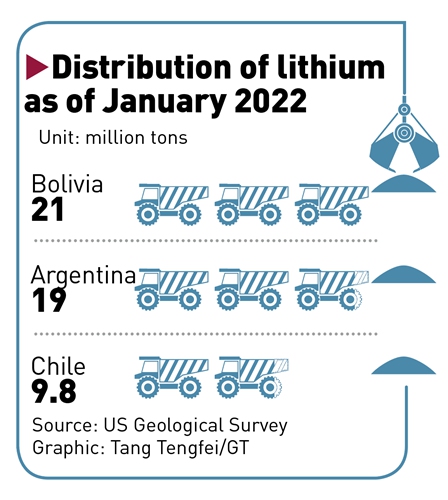

The alliance will have a direct influence on the upstream of new-energy industries - mining, analysts said. Argentina, Bolivia, and Chile account for nearly 65 percent of the world's proven lithium reserves, with production reaching 29.5 percent of the world's total in 2020, according to media reports.

China, however, dominates the downstream of new-energy supply chain, according to IEA. Today's battery and minerals supply chains revolve around China. China produces 75 percent of all lithium-ion batteries in the world. While China is a large consumer of lithium ore, it imports 65 percent of its lithium feedstock. About 6 percent of China's lithium carbonate imports come from Chile and 37 percent from Argentina, according to media reports.

Therefore, analysts also said that while a lithium alliance can help stabilize prices and production, more cooperation and industrial integration, especially with China, is conducive to the stability of the global supply and industrial chains.

Supply chain cooperation

Although lithium batteries are the mainstay of EV and new-energy vehicle (NEV) batteries, the price of lithium will fall once other types of batteries begin to permeate the market, said Zhang.

"The alliance can engage in a direct dialogue with the EV and NEV companies, and both sides can negotiate not only the price; but also the development pathway and technological needs of lithium batteries in the future," said Zhang.

China, as the largest NEV producer and sales market for years, will provide vast cooperation opportunities, analysts said. By 2025, China is projected to sell 7.5 million NEVs, accounting for 48 percent of global market share, according to the IEA

Analysts noted that cooperation between Argentina, Bolivia and Chile with China is crucial, as the three countries account for about 30 percent of global lithium production, with Australia accounting for the majority of shares remaining.

Lithium is usually extracted from South American salt flats by pumping brine into ponds and then processing the lithium, which crystallizes when the water evaporates. It takes time and investment to build infrastructure, where China can be a long-term partner, analysts said.

The lithium alliance, if successfully established, can reverse the Western control and suppression on lithium resource countries, given the leading position of the three countries in reserve, said Chen.

But uncertainties remain for the establishment of the lithium pricing alliance, analysts warned.

"At present, lithium resources have not reached the strategic weight of petroleum resources. Meanwhile, the recent energy crisis has inhibited the global development of the new-energy industrial chain in the short term," said Chen.

According to the research fellow, there are practical technical obstacles to harmonize production and industrial policies in the three countries. It is not easy to reconcile production capacity with technological progress, such as within OPEC.

Even if the lithium alliance can be formalized, it cannot immediately dictate the price of lithium ore, given the relatively small proportion in lithium output, Bai Wenxi, chief economist of IPG China, told the Global Times on Sunday.

A mine worker takes water samples from a brine pool at a local Lithium mine in Calama, Antofagasta region, Chile. Photo: VCG