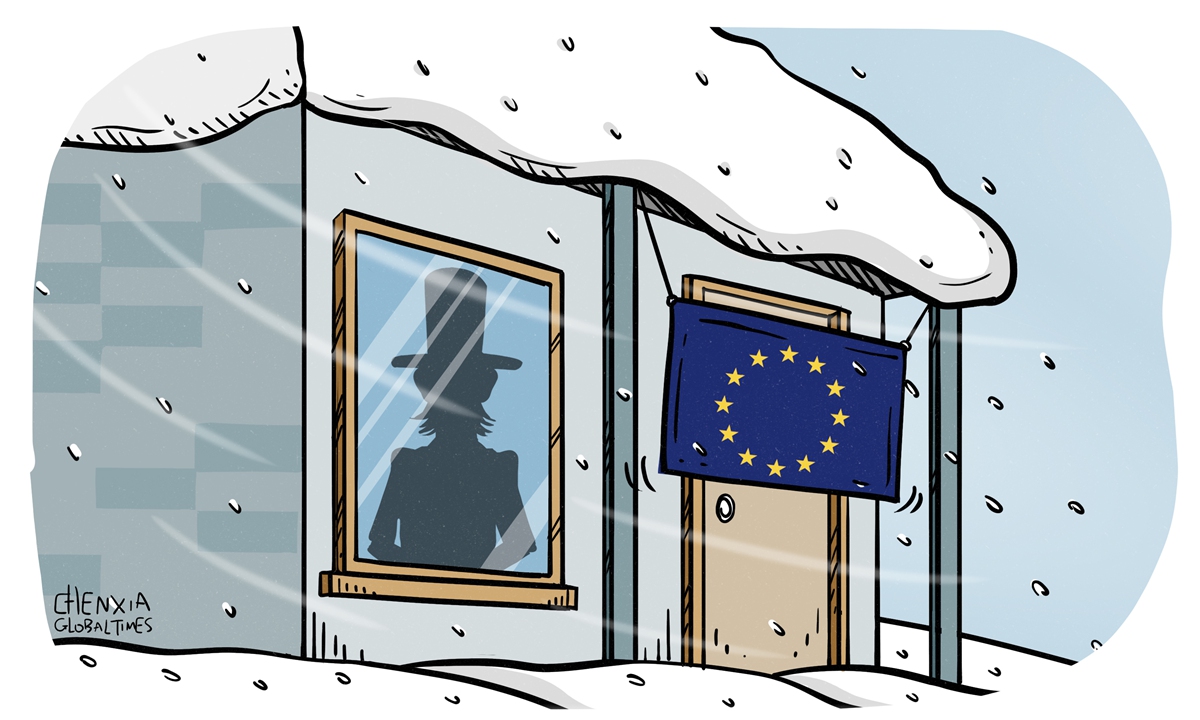

Illustration: Chen Xia/Global Times

The European economy is facing a winter of despair and growing risk of recession, being exacerbated by a deepening energy crisis. EU policymakers should take all the blame for an anticipated lengthy decline of their collective economic influence, as they failed to dissuade and prevent the US from expanding the world's biggest and most intrusive military bloc NATO up to the doorstep of Russia, which ignited the standoff and fierce conflict in Ukraine today.Every single warning light is now flashing red for European countries. The military clash between Russia and Ukraine, an uneven recovery from the COVID-19 pandemic and a drought across much of the continent have conspired to create a severe energy crisis, skyrocketing inflation, supply chain disruptions and, ultimately, darkening prospect about Europe's future.

The explosion in a section of the Nord Stream 1 pipeline is a nightmarish scenario for the continent, clobbering European manufacturing and tens of thousands of European households, which will face electricity cuts or power rationing this winter. Until 2021, Europe depended on Russian imports for about 40 percent of its natural gas as well as a significant share of its oil and coal needs. Now those supplies have been largely cut off.

Compared with the US where gas prices have tripled in 2022 from a year ago, prices in EU countries have soared at least eightfold on average. Meanwhile, imported liquefied natural gas (LNG) to EU, mainly from the US, a frequently touted alternative to pipeline gas, is considerably more expensive and increasingly unaffordable. In normal times, energy accounts for merely a small proportion of GDP for most advanced economies, but it has an outsized impact on inflation and input costs for all sectors because of its ubiquity in consumption.

The energy crisis in Europe will inevitably cripple the continent's auto industry, as severe gas supply shortages and restrictions on energy use has greatly ramped up the pressure on automakers. It is forecasted that during the fourth quarter, all European automakers will face 30-40 percent capacity drop. And, metal smelters, aluminum manufacturers, glassmakers and fertilizer producers are particularly vulnerable to high natural gas prices. This means that many industries across Europe will be forced to scale back their operations or shut down production completely.

Some statistics show that the energy crisis means some EU countries forfeit at least 6 percent of their annual GDP, which will be worse than the economic consequences of the 1973 Oil Embargo led by the Organization of Arab Petroleum Exporting Countries. Meanwhile, European households, forced to pay surging energy bills, will have less money to consume other items, which will significantly draw down Europe's economy in the coming months.

As a result of EU countries' manufacturing slowdown, the euro zone is exporting less. The EU economies suffered a trade deficit of 201 billion euro in the first half of 2022, in sharp contrast to a trade surplus of 121 billion euro for the corresponding period of 2021. Also, Europe faces growing possibility of igniting another financial crisis. Many European economies, Italy in particular, are facing an enlarging gap of fiscal revenues and expenditures.

Increasingly, Europe faces the prospect of seeing local manufacturing, industrial jobs and capital being drawn and channeled to the US. The US has sufficient oil and gas reserves, so its economy is in much better shape now.

For many months, European leaders have been oblivious to the fact that the US is taking advantage of the military conflict in Ukraine, although the US and its allies in Europe have colluded to impose a series of expansive economic and financial sanctions on Russia. Since the Russia-Ukraine conflict erupted, US oil giants and exporters have cashed in massively on LNG exports to energy-starved Europe. Data show that a US LNG tanker will make a staggering $100 million in profits through exporting gas to Europe.

Adding to this, the US Fed's incessant interest rates increases to tamp down inflation have cut into the EU's financial system. The value of the euro has depreciated by about 20 percent this year, while the Fed has vowed to continue its monetary tightening by raising rates. The European Central Bank seems to have fallen into a trap. If it refuses to follow the Fed and raise rates, European capital will be funneled to the US and the euro will continue to depreciate. If it decides to raise rates, Europe will likely slip into a serious recession.

Moreover, to attract European manufacturing enterprises to move to the US, the Biden administration and the Democratic-controlled US Congress approved the so-called Inflation Reduction Act, which pledges tens of billions of dollars of subsidies for US-based production lines, from electric cars to areas of the green economy.

The extent of the damage to the European economy is becoming clear. The euro zone's big four economies - Germany, France, Italy and Spain - have all had their growth forecasts for 2023 downgraded by the IMF. It is true that the 27-member EU faces the real danger of accelerating loss of its economic competitiveness, resulting from their confrontation with Russia, as well as being taken advantage of by the US. Meanwhile, the shrewd politicians in Washington are instigating European leaders to "decouple" from China, whose economy is now making up 18.5 percent of the world's total and is expected to regain pace from 2023.

As recently as 2005, the EU accounted for as much as 20 percent of global GDP, and it might account for just half of that amount by 2030, if the EU economy shrinks by 3 percent in 2023 and 2024 and then resumes its tepid pre-pandemic growth rate of 0.5 percent annually, while other economies grow at 3 percent. The US is content with Europe's diminishing economic power, forcing the continent to play an increasingly junior role, with Washington dictating all the terms in their partnership.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn