China urges Canada to stop suppression of Chinese firms

Lithium companies decry Ottawa’s divestment order

China, Canada Photo: VCG

The Chinese companies, when reached by the Global Times on Thursday, insisted that their affected investments were in compliance with Canadian regulations and asked for an explanation from Canadian authorities over the decision.

While the move is regarded as a fresh sign of Canada's hostility against Chinese firms, following in the US' footsteps, its impact on the Chinese companies and China's lithium industry will be very limited, business representatives and experts said, pointing to China's diversified sources of supplies and Canada's small share in the industry.

Citing national security, Canada's federal government said on Wednesday that Sinomine (Hong Kong) Rare Metals Resources Co, Chengze Lithium International and Zangge Mining Investment (Chengdu) Co must divest their stakes in three separate lithium miners.

Commenting on Canada's move at a regular press briefing on Thursday, Zhao Lijian, a spokesperson for China's Foreign Ministry, said that the Canadian side generalizes the concept of national security and artificially sets up obstacles to normal economic and trade cooperation between Chinese and Canadian enterprises, which runs counter to the principles of the market economy and international economic and trade rules it advertises.

"The Chinese government will continue to firmly safeguard the legitimate rights and interests of Chinese enterprises," Zhao said, adding that the move is not conducive to the development of the relevant industries and damages the stability of the global industrial chain.

Gao Lingyun, an expert at the Chinese Academy of Social Sciences in Beijing, told the Global Times on Thursday that "so-called national security is just an excuse, and this move is a precise example of the Canadian government's politicization of trade issues at the expense of Canada's own interests."

Gao said that the Canadian government is backing away from its promises to investors, "which obviously has a negative impact on its credibility," adding that this will make companies from China and elsewhere that had planned to invest in Canada to think twice.

Canada's decision came just days after the country's government introduced tougher rules covering its critical minerals sectors, making it harder for foreign companies to pursue deals, according to media reports.

The decision, however, is expected to have a limited impact on the businesses of the Chinese companies involved, according to industry insiders.

When reached by the Global Times on Thursday, the Chinese companies involved expressed confusion and pledged to look into the matter at the earliest opportunity.

An employee with the investor relations department of Zangge Mining Co told the Global Times that the company isn't fully aware of the issue and it's seeking more information.

"Of course, our investment is in compliance with local regulations… it is impossible for us to invest so much money and then let it go to waste. There is a need for an explanation [from the Canadian side]," the person said, "we must negotiate to resolve it."

The company has no local lithium ore development business in Canada. The Canadian Ultra Lithium Inc, which the company invested in this year, only has the exploration rights to lithium ore projects in Argentina and Canada, and the investment amount is not large, about 20 million yuan ($2.73 million), according to media reports.

"We just noticed this news and are further verifying this matter," an employee of Chengxin Lithium, the parent company of Chengze Lithium International based in Hong Kong, told the Global Times on Thursday.

All the investments in the company in Canada are in compliance with local regulations, not to mention that the process of applying for the investment was also approved by the Canadian government, the person said.

The employee said that the company had only invested money, and there was no actual business activity. A local firm, Lithium Chile Inc, is responsible for the exploration of the mines.

Despite the sudden disruption, the company said that there would be only a minor impact on its global business, given that its current supply does not significantly depend on Canada.

"We have our own mines in [Southwest China's] Sichuan Province and Africa, while the Canadian mine accounts for a small proportion of our global business," the person told the Global Times.

Sinomine Resource Group Co also said the decision by Canada would have a very limited impact on its business operations. An employee told a conference call that the company's subsidiary received the notice early Thursday.

In addition to the equity investment in Power Metals Corp, the Tanco mine in Canada, a subsidiary of Sinomine Resources, has a beneficiation capacity of 120,000 tons per year, and production and shipments are being carried out in an orderly manner as planned, according to media reports.

But the matter only affects the Power Metals transaction and will not affect the operation of the Tanco Mine in Canada, according to the employee.

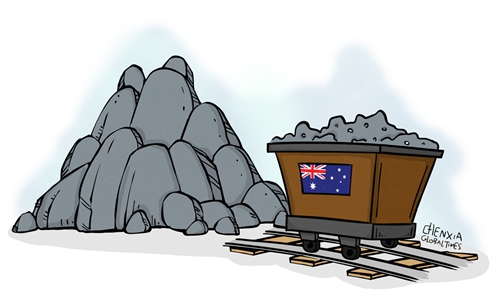

China is one of the largest lithium-producing countries, ranking third after Australia and Chile, and China's cooperation with Canadian companies in the lithium industry worldwide is limited, an industry expert said, indicating a limited impact on the Chinese lithium industry.

On the contrary, Canada has a stronger need for international cooperation in the field, including with China.

Canada had limited production of lithium from 2014 to 2019 and none in 2020. Several companies are working to develop lithium projects in various parts of the country, but with no substantive outcome so far.

Four countries (Chile, China, Russia and the US) accounted for 91 percent of Canada's lithium imports, according to the report published on the official website of the Canadian government, indicating a strong need for imports.

During a recent trip to Washington, Canada's Industry Minister Francois-Philippe Champagne called on the US to invest in Canadian mineral projects to reduce reliance on China, according to Canadian media outlet CBC.

Experts said that Canada needs cooperation with major international lithium exploration companies and players like China to stabilize its supplies, and seeking decoupling will be going in the opposite direction.