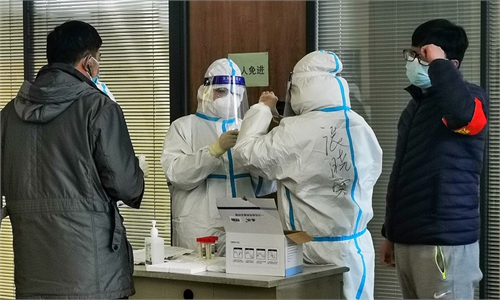

Residents in a community in the Liwan district in Guangzhou, South China's Guangdong Province, take nucleic acid testing on November 9, 2022. Photo: VCG

The Shanghai and Shenzhen stock exchanges have said they will closely review domestic nucleic acid testing firms’ IPO application and strictly vet their application materials, including their operational sustainability.

“The Shenzhen Stock Exchange has conducted a full review of relevant companies in line with the IPO conditions and review standards for the ChiNext board. Close attention has been paid to the relation between the nucleic acid testing business and their main business, the sustainability of their revenue as well as whether they still meet IPO conditions after excluding their nucleic acid testing business,” the bourse said in a statement on its website on Monday.

The exchange said that it will maintain its policy related to the ChiNext board and strictly control market entry and prudently conduct relevant firms’ IPO procedure. The Shanghai Stock Exchange made a similar statement on Monday.

Their comments came as several PCR testing companies including Dakewe Biotech Co Ltd, Jiangsu Cowin Biotech Co and Xiamen Zeesan Biotech Co recently obtained the regulatory greenlight list.

However, questions remains over the sustainability of their businesses as the PCR testing firms all posted eye-popping revenues in 2020 when the pandemic was at its worst, which is also an issue that the regulators have taken into account.

Recently, some nucleic acid testing firms’ IPO applications appear to have been delayed, for instance, Xiamen Zeesan Biotech Co registered more than two months after it obtained approval in September, Beijing Business Today reported.

According to a review document released by the Shenzhen Stock Exchange, the company has been scrutinized by the bourse about excessive revenue volatility for their COVID-19-related products.

Another PCR testing firm Beijing Ribio Biotech Co said the revenue of the company’s COVID-19-related products and services are projected to fall, as the pandemic is gradually brought under control, according to Beijing Business Today.

As mass nucleic acid testing has been an effective tool to identify COVID-19 cases in China, the number of PCR testing companies has increased rapidly. By April, the country has 13,100 qualified testing institutions, and nearly 150,000 people working in those firms, according to data released by the State Council joint COVID-19 prevention and control mechanism team.

Global Times