GT Voice: Asia must jointly tackle external risks amid looming US-EU ‘subsidy war’

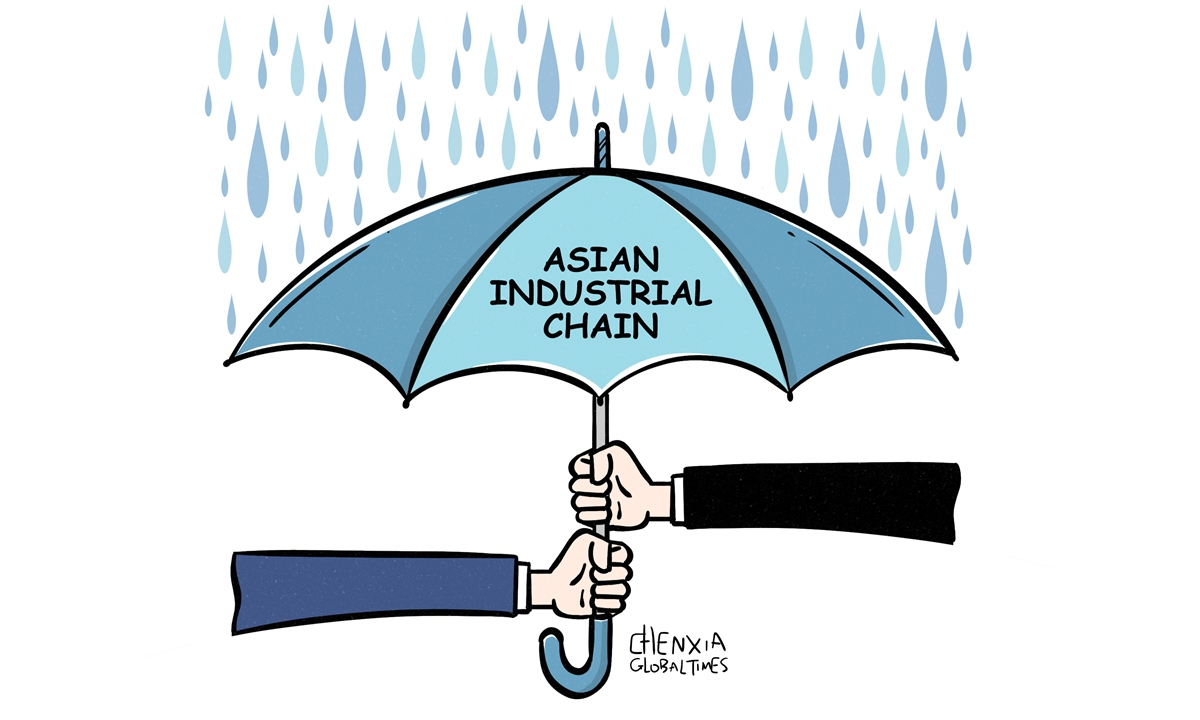

Illustration: Chen Xia/Global Times

At a time when the US and the EU are likely to be locked in what has been described as a looming "subsidy war" aimed at propping up local industrial chains, jointly preventing the potential loss of manufacturing jobs should become a top priority for economic and trade cooperation among Asian economies in the near future.The growing shocks of the restructuring of global industrial chains by the US and Europe on Asia has highlighted the urgency of Asia's need to consolidate the development of industrial chains. If Asian economies cannot coordinate on the same front, then regional industrial chains will be divided. This is a crucial matter for not just China but also South Korea, Japan and ASEAN, given their integrated industrial chain.

It should be pointed out that for Asian economies like Japan, South Korea and Vietnam, it would be naive to think they would benefit from the US' suppression of Chinese industrial chain. The US-led clique on the chip sector has made it clear that they will only get hurt in the US' pursuit of more self-interests.

The EU is preparing a significant subsidy push to allow EU companies to remain competitive, Politico reported, citing two senior EU officials. The EU officials also referenced the idea of a "European Sovereignty Fund" as a countermeasure in response to Washington's Inflation Reduction Act.

It is rather normal that the EU is at growing risk of deindustrialization and has an urgent need to revert that trend given high energy prices caused by the Russia-Ukraine conflict and the US' practice of violating the principles of free and fair trade. However, a tit-for-tat subsidy war between the EU and the US will have adverse global implications. To a certain extent, this would mean that the global economy will be characterized by more fragmentation and protectionist measures, which could be translated into more challenges for Asian industrial chains.

Ever since US President Joe Biden signed the Inflation Reduction Act into law, which encourages consumers to "Buy American" when it comes to products like electric vehicles, European governments have been concerned that the act will likely undermine the European manufacturing sector by putting European firms at a disadvantage and pressuring businesses to relocate new investments to the US.

With communication with the US through diplomatic channels appearing futile, it seems increasingly likely that the EU will have to respond in kind to protect its own industrial chains from being undercut. If anything, this could be a policy shift that raises a red flag for Asian economies.

In the latest sign of that policy inclination, EU nations agreed on Wednesday to pursue a 43 billion euro ($44.4 billion) plan to boost the bloc's semiconductor production, with an ambitious goal of producing 20 percent of the world's semiconductors by 2030, Bloomberg reported.

The chip industry is highly globalized, and over the past few decades, as a result of the division of labor through globalization and the huge market demand, Asia has become the region with the most concentrated chip production capacity. Now as the US and the EU are both aiming to reconstruct the current pattern of the global semiconductor industry, the old balance of the industrial chain will be sabotaged, which will bringing shocks to the Asian semiconductor industrial chains.

Indeed, semiconductors could only be one example of Asian industrial chain facing various risks. High-tech sectors such as new-energy vehicle manufacturing are also likely to bear the brunt of the rising anti-globalization sentiment.

Under such circumstances, while adhering to support for globalization and free trade, Asian economies need not only to guard against the potential artificial shift of manufacturing sector to the West, but also to further strengthen regional industrial chain cooperation to fend off external risks. From another perspective, changes in external environment will offer opportunities for further integration of Asian industrial chains in the high-tech sector.

In terms of the high-tech sector, despite geopolitical headwinds, China has accumulated manufacturing and market advantages after years of development, gaining an important position in the Asian industrial chain. Still for the sake of regional industries, major economies like China, Japan and South Korea should increase communication so as to enhance the regional competitiveness in the tech-intensive industrial chain.

Moreover, China and ASEAN have highly complementary industrial chains and resource distribution structures. Therefore, as China seeks to upgrade its free trade zone with ASEAN, it is possible to make industrial chain cooperation and the development of a common market a focus to promote industrial upgrading and unleash economic potential.