China-Germany cooperation potential continues to rise as both sides increase engagement: expert

Investment opportunities continue to grow on back of strong bilateral relations

A manufacturing plant belonging to a German firm in Suzhou, East China's Jiangsu Province Photo: VCG

Editor's Note:Despite some Western voices calling for Germany to "decouple" from China, China-Germany ties remain robust following the latest visit by German Chancellor Olaf Scholz, which injected new momentum into the relationship. The Global Times reporters Zhao Jucheng and Xiong Xinyi (GT) recently interviewed Hermann Simon (Simon), inventor of the "Hidden Champions" and a famous German expert in strategy, marketing and pricing, who shared his insight on bilateral cooperation.

GT: In the past decade, with the high-quality development of the Chinese economy, what new trends have you observed in the development of China's hidden champions? You recently said that China's hidden champions are more ambitious than German counterparts, how did you come to this conclusion?

Simon: When I gave speeches on the topic in Europe, typically 10 percent of audiences raised their hands when I asked them who wants to become hidden champions. When I asked the same question to Chinese audiences of entrepreneurs and young people, 50 percent raised their hands.

Chinese entrepreneurs and young people are enthusiastic about the hidden champions concept of becoming global market leaders. They are very ambitious, hardworking, and innovative. I see them as the strongest competitors of German hidden champions in the future.

There have been three trends for Chinese hidden champions to develop in the past decade.

The first one is innovation. Ten years ago, Chinese hidden champions were competing on low costs and prices, whereas they have upgraded their innovation, especially in certain fields like artificial intelligence (AI) and robotics.

The second aspect is globalization. The companies have gone more international, and do not confine themselves to China. The Chinese hidden champions understand that China's market is very large but only accounts 19 percent of the global market, while also aiming to catch 81 percent of the international market opportunities.

The third one is an extension of globalization related to culture and mentality. The young managers of hidden champions are more internationalized with good English skills and are more familiar with doing business in other countries.

GT: Due to the changing global political and economic situation as well as the huge impact of the COVID-19 epidemic, some Chinese hidden champions are taking a different approach from their German counterparts, such as being more inclined to diversify their businesses or less committed to globalization. How do you view this phenomenon?

Simon: There are two directions enterprises can go. If the traditional home market is saturated and does not grow much longer, companies can internationalize or diversify. The German hidden champions clearly go for internationalization and globalization to become one of the leaders in the global market.

The other route is diversification. I observe with quite a few

Chinese entrepreneurs that they tend to diversify because there are so many opportunities in China, but I think that as a risky strategy and typically does not lead to global market leadership.

My recommendation is to stay focused and conquer the global market. But there are even limits to that so that enterprises may have to diversify, but only focus leading to world class.

Hermann Simon

GT: How do you evaluate the recent visit by German Chancellor Olaf Scholz and a delegation of 12 German enterprises?

Simon: It was very important as it was the first visit of a Western leader [to China] since the COVID-19 outbreak. Leaders of the countries must meet in person to get to know each other to build trust, which has contributed to an improvement of the relations.

When you look at the relation between Germany and China, it's a very specific one. China is our biggest trading partner. German companies are heavily engaged in China, and run more than 2,000 factories there. Most of them are from the hidden champions. Whereas Chinese companies are only in a very early stage of building a presence in the German market.

I expect a big wave of investment. I met hundreds of Chinese automotive suppliers who want to come to Germany. Currently, a couple of new Chinese factories are under construction. The biggest one is from the battery manufacturer CATL, which already started with test production. We will see many more Chinese investments in Germany to build up a stronger manufacturing base and German investments in China are actually continuing.

What we hope from a German perspective is that we will not be impeded and affected by the trade conflicts between China and America, that we can still do business based on good relations with China.

GT: What is your take on many voices in the West calling for "decoupling" from China?

Simon: When we look at the period from 1990 till 2010, exports were growing twice as fast as the gross domestic product (GDP) of countries. Since 2014, exports grow more slowly than GDP, but this does not mean the end of globalization. It means that exports are increasingly substituted by foreign direct investments (FDI).

More FDI and less growth of exports is a kind of "decoupling" but a different kind of globalization. For instance, a German hidden champion said it gets 200 parts from China and assembles them locally, which can't be completed without a component. The company needs to manufacture and source more parts in Germany, while strengthen production in China as it put out a higher part of the value chain into China.

Two German companies in the mining technology sector have also moved their whole value chain and set up competing centers in China. As Germany no longer does coal mining, which still plays a very important role in China. It means we currently experience a total reconfiguration of the global value chain.

An important mandate behind it is to find the best location in the world for each activity. For example, a hidden champion may set up a competence center for AI in China because of better conditions to develop products and process than in Germany. On the other hand, Chinese automotive manufacturers all have design centers in Germany, especially for premium cars because they say the highest competence to design premium cars is in Germany.

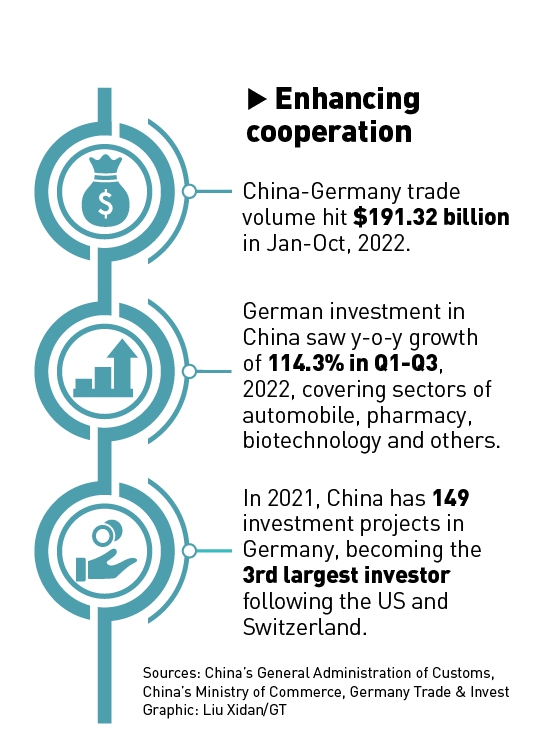

Graphic: Liu Xidan/GT

GT: Some multinational giants have said that they want to move out their industrial chains from China in light of the COVID-19 epidemic. The US has imposed sanctions on Chinese chip and other industries and companies. What are the impacts on Chinese enterprises and the global economy?

Simon: It's very important for China to improve the relations to America. It's equally important for America. Because the competences in technologies are distributed all over the world. China is leading in areas like AI and railroad. America is leading in some areas. Germany or Europe are leading [in other fields], and combining these competences is very important.

Inflation is a serious threat for all economies. Trade conflicts are impeding the development of new products of international cooperation. Governments should do their utmost to reduce the trade conflicts. It's very important for each economy to work peacefully based on trust with other countries, and for companies to do the same, international cooperation and exchange is a very important way to well-being for all countries.

GT: What is your forecast of China's future economic development following the 20th National Congress of the Communist Party of China (CPC)?

Simon: I visited China in 2019 and hope to come back next year and communicate with local enterprises.

If we look at the past, the growth of China's economy has been spectacular. And what maybe even more impressive than the pure growth rate is the innovativeness. While the government provides guidelines, the work has to be done by the companies and the entrepreneurs.

One tendency is very positive that the Chinese government seems to create better conditions for mid-sized companies and the growth in the future will come from mid-sized companies which are innovative, flexible, agile, and can globalize their businesses. They will be more important for the future growth of China than the large corporations.

GT: The report to the 20th National Congress of the CPC highlights support for development of sophisticated and specialized enterprises that produce new and unique products. What is your comment on this policy?

Simon: As you mentioned, there is a certain emphasis on helping and fostering these companies.

What we see in the global market is that so-called business ecosystems play an increasingly important role. Modern products and technologies are becoming very complex, so that one company may not have all the competence needed to develop a solution for one of the big challenges.

One famous example is the ecosystem for extreme ultraviolet lithography machines, a collaboration between three companies, including the Dutch company ASML, German company Trumpf, which contributed lasers, and Zeiss from Germany, which offered the optical system. Their combined efforts have created a practically global monopoly of the extremely high technology.

That is a very important development route for Chinese mid-sized companies to cooperate within China and internationally to supply the very complex products we need, and we will have in the future.