Illustration: Chen Xia/Global Times

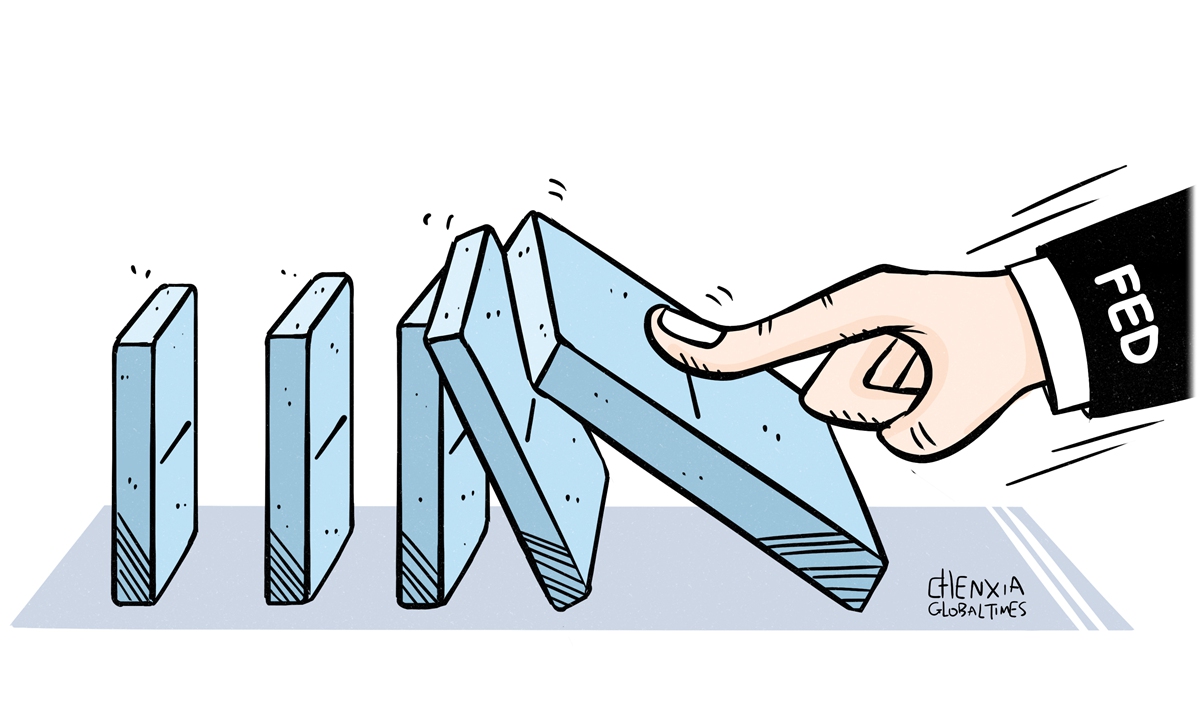

Blackstone, the world's largest private equity group, is grappling with concerns about its limits on fund redemptions. This is yet another example of the unbroken truth in the financial markets that liquidity matters, especially as the risk of a financial crisis looms.What has happened to Blackstone is a sign that the Federal Reserve's policies are already hitting global financial markets, and that any loophole could cause the entire levee to collapse. Blackstone sounded the alarm. And we must keep a close watch, while strengthening China's levees to prepare for the next financial storm triggered by the US, especially to prevent the Fed from exporting the crisis.

Blackstone may delay the launch of a new private equity fund designed for wealthy individuals to wait for fundraising conditions and financial markets to improve, the Financial Times reported over the weekend. The development came just days after the asset manager limited redemptions from its $69 billion Blackstone real estate income trust (REIT) amid investor rush for withdrawals, which has raised concerns not only over Blackstone's future growth but also over a potential liquidity crisis on financial markets.

While Blackstone Chief Executive Stephen Schwarzman on Wednesday defended the fund saying that redemptions in his firm's $69 billion non-traded REIT were driven by investors roiled by market volatility rather than dissatisfaction with the fund, the investor rush to withdrawals should still ring alarm bells across the financial markets.

In fact, the limits on fund redemptions by Blackstone's REIT is just one of several major bank runs recently. If anything, mass redemptions are a normal investor response to the weakening housing market and soaring interest rates. And the consequent financial events, such as Blackstone's limits on redemptions, are the inevitable results of Americans' excessive innovation in the financial sector over the years, which could be seen as a sign of a liquidity problem surfacing in the US.

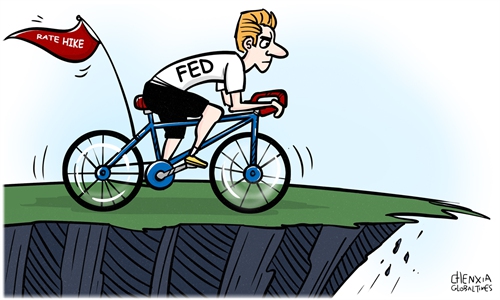

In order to tackle with high inflation, the Fed has executed aggressive interest rate hikes over the past months, leading to a rapid rise in market interest rates. As a result, the financial markets have gone from a flood of US dollar liquidity in previous years to a liquidity crunch nowadays, which drove up the financing costs for global real estate sector and hit assets such as REITs.

And given the current situation, it seems that the Fed's rate hike is unlikely to stop any time soon. After US consumer inflation rose 7.7 percent in October, Fed Chair Jerome Powell stated that the central bank could begin moderating its pace of rate hikes as soon as December. But Former Treasury Secretary Lawrence Summers warned recently that the Fed will probably need to raise interest rates more than markets are currently expecting because inflation remains too high. By any standard, it is generally expected by the market that the Fed is unlikely to stop raising rates until the second half of next year.

This also means that liquidity pressure will continue to rise in coming months. In this sense, the Blackstone run has actually sent an early signal of potential liquidity crunch, raising red flags for financial market players. This is because against the backdrop of tight liquidity, it will be more often to see investor withdrawals cause runs on various financial institutions, which may even lead to a systemic crisis across financial markets.

While the probability of a repeat of the "Lehman moment" is low, it is worth noting that financial crisis is essentially an unexpected liquidity crisis. With the consequences of the Fed's aggressive rate increases surfacing, it remains to be seen how much of a liquidity risk the Fed's tightening policy will create.

If there is a real possibility of another financial crisis in the US, its spillover effects may exacerbate the spread of international financial risks. The US needs to take the responsibility to avoid exporting more crisis to the world, while other economies need to be prepared for more financial uncertainties.