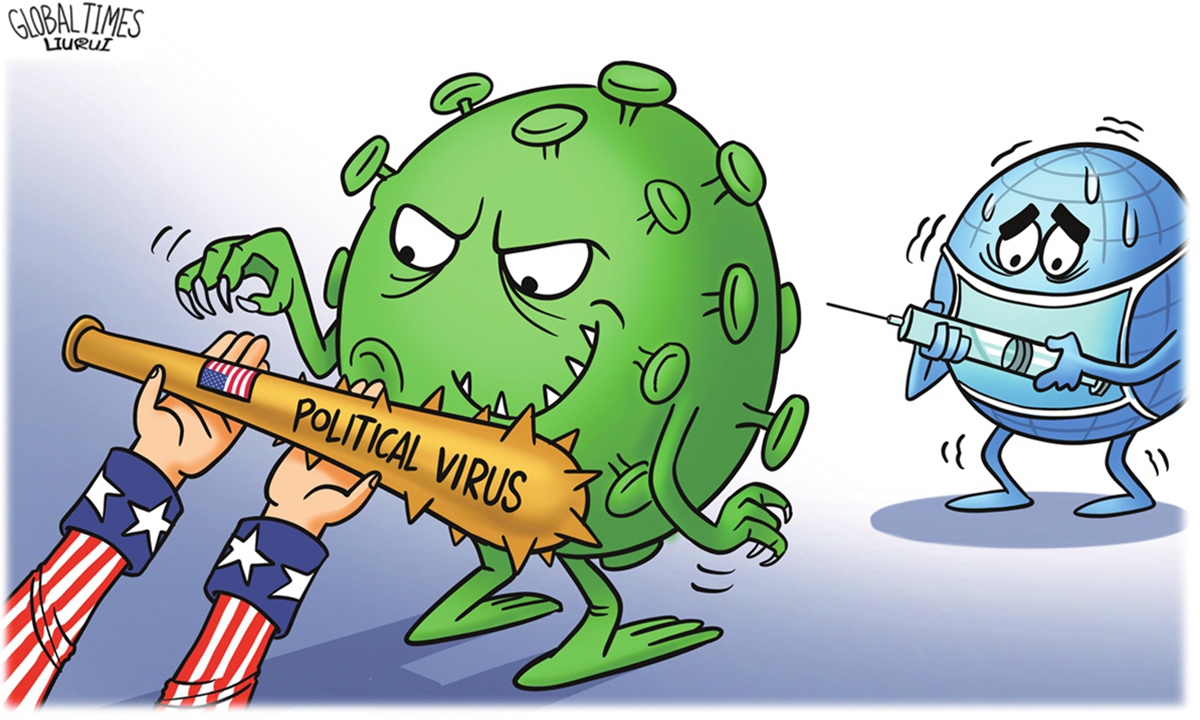

Illustration: Liu Rui/GT

Making a reasonable argument is not a term in Washington's dictionary in the China-US power game.Ned Price, US state department spokesperson, said on Monday that the US hopes China can address the current COVID-19 outbreak as "the toll of the virus is of concern to the rest of the world given the size of China's GDP, given the size of China's economy."

His remarks aren't surprising at all. Washington has been putting and will go on to put all of China's policies and measures under the prism of China-US competition. That means the wordings of the US side will be all about shaping an international atmosphere that benefits only the US.

When China's role in the global economy is mentioned, some very recent examples can be cited. In the just-concluded World Cup, products made in Yiwu, China's small commodity hub, have accounted for nearly 70 percent of the market share of World Cup merchandise, ranging from national flags, soccer balls to jerseys, according to the Yiwu Sports Goods Association. Made-in-China products, including but not limited to projectors and leggings, injected vigor into Black Friday, a traditional shopping bonanza in the West that kicked off on November 25, reports show. Last but not the least, the US announced in late November that it will extend its tariff exclusions for some Chinese medical products for an additional three months in order to continue to fight the COVID-19 pandemic.

Responding to Price's remarks, Chinese Foreign Ministry spokesperson Mao Ning said on Tuesday that in the past three years, China's COVID policy has provided maximum protection to people's lives and health, minimized COVID's impact on socioeconomic development, and bought precious time for understanding the virus on the basis of science, for research and development of vaccines and therapeutics, and for vaccinating more people across the country. We have achieved the most effective results at minimum cost.

Washington does not have a say in China's influence on the world economy. Kristalina Georgieva, managing director of the IMF, said earlier this month that recalibrating COVID policies "can be very good for the Chinese people and economy, and also good for Asia and the world economy." Morgan Stanley raised its forecast for China's GDP in 2023 to 5.4 percent from its previous outlook of 5 percent, predicting that a rebound in activity will come earlier and be sharper than expected.

China is the only country that has earnestly fought the battle against COVID with strict measures for three years, unlike the US, which had given up fighting the virus long long ago. Just because China has taken the lead in reining in COVID, it is able to resume businesses and production in an efficient manner. In 2020, China was the only major world economy to grow in that pandemic-ravaged year. In 2021, China's GDP was $17.7 trillion, accounting for 18.5 percent of the global total.

In an interview with the Global Times, Sean Doherty, head of International Trade and Investment and member of the Executive Committee of the World Economic Forum, said that China shows tactical resilience in maintaining flexible supply chains amid the pandemic, while describing China as a role model in facilitating trade domestically and a leading power in the WTO's investment facilitation discussions.

However, it's another story in the US. Washington wasted no time politicizing the virus, launched an ideological warfare and divided the world when unity was badly needed the most amid the global public health crisis.

When the US needs to boost its economy, it tends to turn to unlimited quantitative easing, referred to as printing money wildly, which is aimed at attracting inflows of financial capital. But when its measures led to high inflation, which has been especially severe during the pandemic, the US starts to raise its interest rates, time and again. The aim is to make the US dollar stronger, attract investment capital from investors abroad seeking higher returns on American bonds and interest-rate products. But for other countries, the endless interest rate hikes are making it more and more expensive to service their dollar-denominated debts, causing currency depreciation and worsening inflation on their own soil. With the kits, like quantitative easing and raising interest rates, in its tool box, the US has been reaping benefits and wealth from the world.

This is the truth: When China makes contributions to the world economy during the pandemic, Washington is busy making deliberate transfer of wealth from the world to the US.

Despite Price's rhetoric, the world will see which side has been the problem. If Price does cares about the world economy, he should have advised the White House to restrain itself when disrupting global supply chains and provoking conflicts and even wars.