A view of a production line of a smartphone factory in India. Photo: VCG

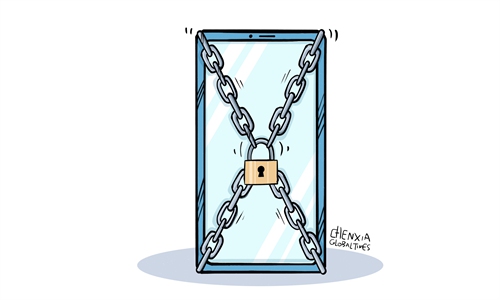

There is no shortage of media reports claiming that Apple Corporation's major contractors have been planning more production capacity in India, which has been widely seen as an important indicator reflecting Apple's supply chain shift away from China.

While it is undeniable that India has indeed made some progress in its manufacturing sector in recent years, which has been touted by some media outlets as having the potential to become the "next China," the challenges ahead to become a major manufacturing hub are not to be underestimated.

The latest example is a report from the South China Morning Post, which said on Tuesday that Apple contractors looking to establish a robust manufacturing supply chain in India are not expected to achieve economies of scale in the South Asian country in the near term, because only a small number of electronics parts suppliers from China have established a presence in India, to support Apple's major contract manufacturers.

If anything, the report highlights one of the major challenges Apple's contractors may face in production in India, namely the lack of local supply chain support. How to make key components suppliers to invest and set up new factories in India is a problem for not just Apple contractors, but also for India's manufacturing ambitions.

While it is laudable for India to be able to attract high-profile major contractors to invest in local production capacity, it must be pointed out that a large number of upstream companies are essentially needed for India to develop the so-called Apple supply chain. Without enough local industrial chain support, Apple contractors will have to face higher manufacturing costs, which will be intolerable for any manufacturer in the long run.

At present, Apple has more than 180 suppliers scattered around the world, of which about 150 are from China. Such a broad-based supply chain is not easy to transfer. According to a Bloomberg Intelligence estimate, it would take about eight years to move just 10 percent of Apple's production capacity out of China.

From another perspective, this may point the way forward for India's next push in terms of developing high-end manufacturing after it used various incentives to attract investment from Western manufacturers, which reflects the necessity for India to renew business enthusiasm, especially among Chinese companies in investing in India.

In doing so, India must first provide a better investment environment for manufacturing companies that are not just limited to high-profile ones, but also those smaller ones.

In fact, the investment risks in India have made not only Chinese companies, but also those from other countries hesitant in entering the Indian market despite its demographic dividend.

According to Indian media reports, 2,783 foreign companies closed their operations in India for various reasons between 2014 and 2021. Considering there are only about 12,000 active subsidiaries of foreign companies in India, the proportion of foreign capital leaving the country is shockingly high.

Therefore, while offering generous subsidies and other stimulus to attract high-profile manufacturers, India needs to focus more on improving the country's overall investment climate. Upgrading manufacturing strength must be promoted in a comprehensive way to achieve the desired results. Efforts should be made in areas including policy openness and predictability, streamlining bureaucratic procedure, reducing the impact from the entanglement of vested interests, ensuring fair treatment to Chinese companies, and improving labor training, among others.

What also needs to be advised is that India should not be fooled by Western manufacturers and research institutes, and it would be naive if India thinks it can replace China in the short term. India's position in the global industrial chain can only elevate if it makes a solid effort to improve its own policy environment, raise the level of its labor force, and gradually strengthen its manufacturing competitiveness.