Japan joining US’ chip export ban against China could leave its semiconductor industry stifled: experts

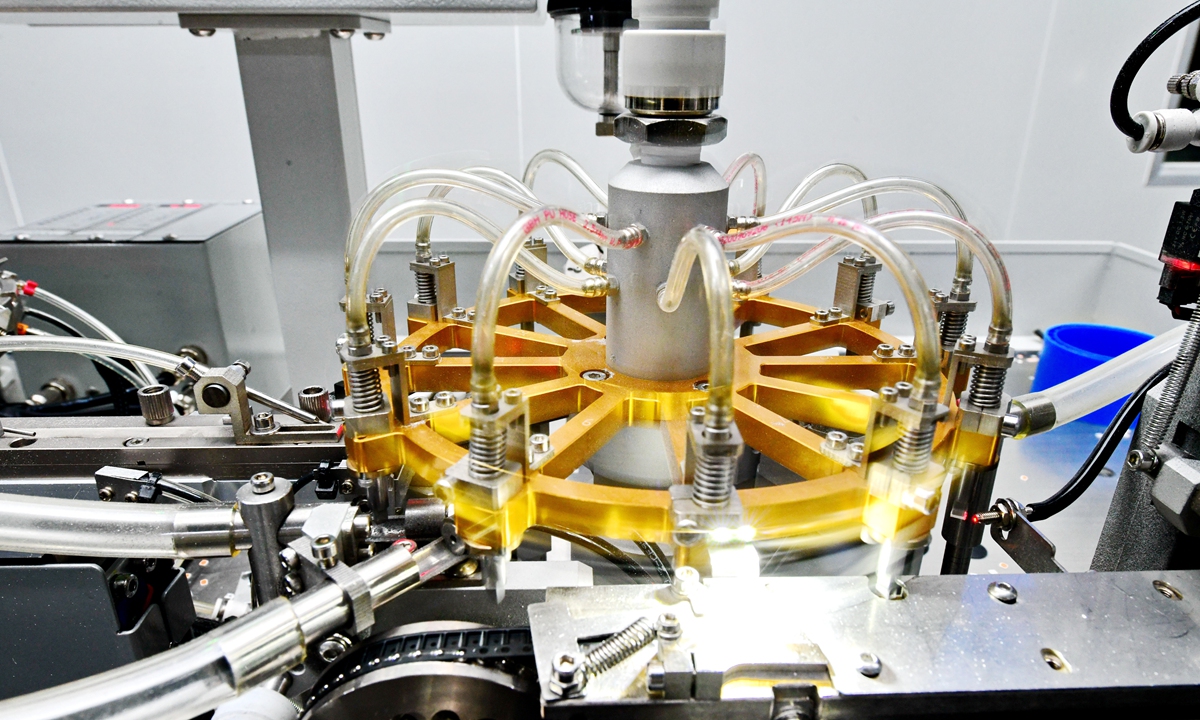

Manufacturing equipment of semiconductor products Photo: VCG

Japan, once a semiconductor giant half a century ago but then brutally beaten down by the US, is reportedly moving to join the US in expanding chip export controls on China, as leaders of the two countries are set to meet on Friday.

"For better or worse, Japan's semiconductor strategy is moving in accordance with what the US wants," a chip industry source was reported as saying by Reuters, while Chinese experts said that the Japanese government is losing independence even in its advantageous industry. If it keeps letting itself become a "sidekick" of the US, Japan's semiconductor industry could be completely strangled in the next five to 10 years, they warned.

At a press briefing on Friday, Chinese Foreign Ministry spokesperson Wang Wenbin said in response to the possible semiconductor export restrictions that the US has repeatedly abused export controls, politicized and weaponized economic and trade issues, imposed economic coercion on allies, and maliciously suppressed Chinese enterprises by decoupling supply chains, which seriously undermines market rules and the international trade order. It will not only harm the legitimate rights and interests of Chinese enterprises, but also damage the stability of the global supply chain.

US President Joe Biden and Japanese Prime Minister Fumio Kishida are set to meet in Washington on Friday. A senior US administration official told media that the two leaders are expected to discuss security and global economy issues, as well as semiconductor exports to China.

American officials have been quick to play down the differences between the two allies while touting an ever-closer strategic alignment with Japan, praising Tokyo's plan for its biggest military buildup since World War II as its rivalry with China in the region grows, Reuters reported on Friday.

"I think there's a very, very similar vision of the challenges," a senior US official said on Wednesday, according to the report, adding that while Japanese export restrictions may not be exactly the same as US controls, "I don't think the Japanese question the basic premise that we need to be working closely together on this."

However, Japan's hesitation is evident. The Kishida administration, while admitting its country is broadly in line with the goals of the White House, has been vague about to what extent it will join in.

The hesitation comes largely from the country's leading chip producers' reliance on China to thrive. According to media reports, Japan is a top producer of specialized tooling equipment needed to manufacture advanced chips, and its companies hold 27 percent of global market share.

Tokyo Electron, Japan's leading chip manufacturing equipment maker, relies on China for about a quarter of its revenue.

Japan's semiconductor industry in the 80s and 90s was once in the world's absolute leading position, holding half the global share in the late 1980s. But it was later suppressed by the US in various ways, including export restrictions similar to today's, which allowed chipmakers in South Korea and China's Taiwan to make deeper inroads into the industry.

According to a report by the White House in June 2021, the world's semiconductor manufacturing capacity is now concentrated in East Asia, with China's Taiwan accounting for 20 percent of the global total in 2019, followed by South Korea, Japan, the Chinese mainland and the US.

Japan still has some residual advantages in the industry, leading not on key links but in some upstream technology, such as optical technology. But on the whole, Japan no longer has much say in this field, Lü Xiang, an expert on US studies and a research fellow at the Chinese Academy of Social Sciences, told the Global Times on Friday.

The interests of Japan and the US in this regard are definitely not the same, the expert noted, as the US has its own upstream suppliers in Europe and has little room left for Japan.

"If Japan is to tie itself to the US-desired semiconductor closed loop that excludes China, it will seriously reduce Japan's few existing advantages. In the next five to 10 years, if such a closed loop is really formed, it will cut off Japan's ability to independently develop the global market, and the Japanese semiconductor industry could be utterly stifled," Lü warned.

While on the technological front Japan still has some strength, its political positions are completely manipulated by the US, and it's growing even more reliant now with the current government seeming much weaker and more helpless, observers said.

Apart from discussions on semiconductors, Japan and the US are expected to expand cooperation in areas including artificial intelligence, quantum and other cutting-edge technologies in a bid to counter China. A joint document is expected to be released on strengthening the Japan-US alliance after the leaders' talks.

In addition to cutting off supply chains for China, top defense and diplomatic officials from both countries have vowed to strengthen their military alliance and security cooperation, citing the "greatest strategic challenge" from China. Chinese experts said that a closer military alliance with the US, while adopting a more aggressive posture, would mean a more dangerous position for Japan, and the provocative military alliance would not be welcomed by regional countries.