Illustration: Chen Xia/Global Times

The degree to which China's economic recovery in 2023 will affect global energy market is now a topic of great concern as almost every media report on oil prices is mentioning the prospect of China's recovering energy demand, such as the Bloomberg report entitled "Oil's Advance Takes Breather as Investors Assess China Reopening" on Monday.There is no denying that since China's optimization of anti-COVID-19 response, Chinese oil prices have gained a certain momentum. As of Friday, the average wholesale price of domestic 92-octane gasoline rose by 354 yuan ($52) per ton from the previous week, with the price of diesel almost unchanged.

Indeed, oil prices appear to be on an upward trajectory, not just in China, but also in India, the world's third-largest oil-consuming and importing nation. It is important to note that despite the rally in crude prices last week, the overall trend showed oil prices are still in a correction phase, rather than staying at previous high levels. At present, both Brent and West Texas Intermediate crude are about 40 percent down from the peaking levels recorded in March 2022.

The current situation in the global oil market may, to a certain extent, explain why it is widely believed that China's upcoming economic recovery, if robust enough, is bound to boost oil prices this year. But energy consumption alone is far from representing the entire implications of China's economic revitalization, which is expected to be one of the decisive factors in the global economic development this year.

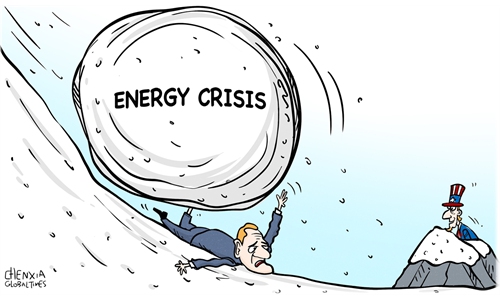

The world is facing multiple crises posed by the COVID-19 epidemic, geopolitical conflicts, rising energy and food prices, among others. With so many negative factors, global economic growth is heading toward a sharp slowdown. In particular, high inflation is likely to force policymakers to continue tightening monetary and fiscal policies, exacerbating expectations for a recession and resulting in more stringent challenges for some emerging economies. Last week, the World Bank slashed its 2023 growth forecasts to 1.7 percent, the slowest pace outside the 2009 and 2020 recessions since 1993. In its previous Global Economic Prospects report in June, it had forecast 2023 global growth at 3 percent.

Against this backdrop, the world needs China's economic recovery to inject new momentum into the global economic growth as its upward trajectory independent of the world's slowdown is expected to be a great lift for the world economic recovery in terms of supply chains, trade, tourism and among others.

In this sense, an overemphasis on rising energy demand as a result of China's economic recovery could be one-sided and even inaccurate. This is because while China is the world's largest energy consumer, its rising energy demand due to economic recovery doesn't necessarily mean shocks to the global energy supply. For starters, Chinese oil and gas production has been growing over the years. In 2022, China National Petroleum Corp hit a new record high in terms of oil and gas output. Second, China's installed capacity of renewable energy has exceeded 1.1 billion kilowatts, with power generation capacity of hydro, wind, solar and biomass all ranking first in the world. Third, China has inked long-term and stable procurement agreements with major energy suppliers and has been actively diversifying its energy importing sources. So China won't cause a price spike in the global energy market.

Now the biggest problem in the international energy market is the politicizing and weaponizing of energy issues, especially since the Russia-Ukraine conflict. This is actually a problem in the supply chain, not production or demand side. There is also strong political will in the US media outlets and experts playing up China's economic rise as the reason of global energy price volatility. Therefore, to prevent the global energy market from seeing increased volatility, it is crucial to promote international cooperation to address the problem, including stopping the US from politicizing energy issues and abusing its hegemonic power in the market.