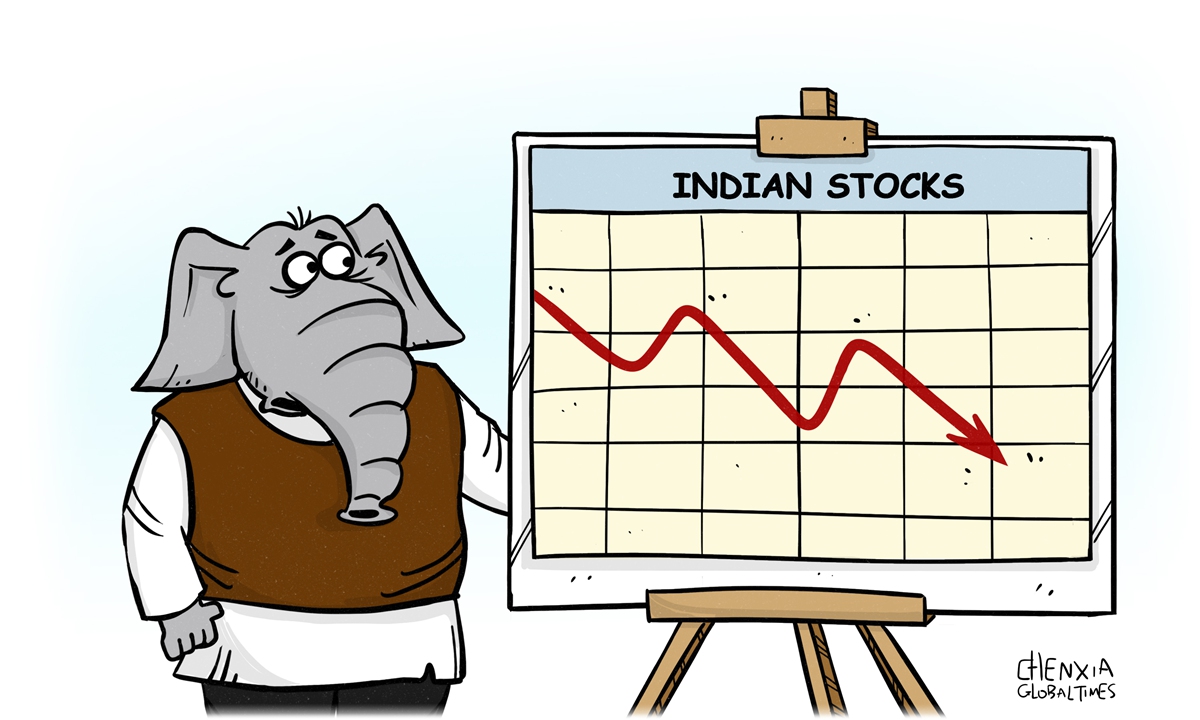

Illustration: Chen Xia/Global Times

The beleaguered business empire of Indian multi-billionaire Gautam Adani, widely reported as a close ally of Prime Minister Narendra Modi, is swirled in an evolving "credibility crisis," as a US-based investment company's report accused Adani Group of having long engaged in "stock market manipulation, accounting fraud and money laundering." Founded in the 1980s as a commodity trading group, Adani has become a conglomerate of both national and global significance.The fraud claims, made public on January 24 by Hindenburg Research, have spooked investors and caused voracious sell-offs of seven listed Adani Group companies. The relentless selling has wiped out a whopping $110 billion from the market value of Adani companies in the past two weeks, literally cutting the value of Adani's conglomerate in half. The Adani meltdown has also dragged down the overall Indian equities, with the NIFTY 50 index of Indian stocks dropping to its lowest level since October, defying positive investor sentiment during the same time span elsewhere in the world.

The shock and anxiety is spreading among global investors who rush to reevaluate their weighting of Indian assets, market watchers say. The Adani stock rout is sending shockwaves across India, with global institutions and investors increasingly fretting about the systematic risk the Adani crisis may cause to India's financial stability. On Friday, the outlooks on Adani Group's credit scores were slashed to negative by S&P Global Ratings, Bloomberg reported.

Whether the Adani saga will keep spiraling and cause a bigger financial crisis in India remains unknown and is to be closely watched. It is evident that Adani Group's plummeting stock and bond prices have raised serious concerns about potential wider complications on India's monetary system as well as the sustainability of India's economy. Last week, throngs of jittery investors chose to dump Indian stocks across the board, reducing their investment portfolio of Indian assets.

To keep the fear from wildly spreading, it is imperative for Indian authorities to launch a robust probe into Adani's business practices, to give investors a clear signal that any frauds and mismanagement will be taken seriously and dealt with - only doing so could help maintain investor confidence in India.

The Securities and Exchange Board of India, the market watchdog, on Friday launched a preliminary probe to examine the rout of Adani shares, looking into any "irregularities" or "scandals" ever committed by the conglomerate, whose businesses include sea ports, coal mining, building materials, new energy and other areas. And, the RBI, the country's central bank, is checking Indian banks' exposure to the Adani Group in a bid to prevent the crisis from deteriorating and jeopardizing the country's financial system.

Now it is still too early to portend whether Modi will come to Adani's rescue and when. Adani, chairman and founder of the conglomerate, one of the world's richest persons, is deeply connected with Modi, and he is a fervent supporter of Modi, according to Indian media, as they both rise from the populous Gujarat state, and, Adani is closely aligned with Modi's "vision" on growing the Indian economy.

Nevertheless, India's inherent economic problem is rooted in the government's pursuing "crony capitalism." Adani's rise and the fortunes of Modi and the ruling BJP party are closely tied. Modi was elected in 2014 on a pledge to crack down on the graft and corruption of the previous administration. It has been reported that the connection and entanglement between the Modi government and the Gujurat business titans, headed by Adani and Mukesh Ambani, another multi-billionaire businessman in telecom, oil, petrochemicals and retail, has become ever more intense in the past eight years.

Since January 24, Modi and his government ministers in New Delhi have largely kept silent on Adani's escalating market woes, although the embattled company denounced the American short-seller Hindenburg Research's report and allegations as "baseless" and "malicious" and "calculated attack on India." But Hindenburg has countered, asserting "India's future is being held back by the Adani Group, which has draped itself in the Indian flag while systematically looting the nation."

Most market analysts believe that Adani himself hasn't convincingly answered those blunt allegations raised by Hindenburg, so it is natural that investors' sell-off of Adani stocks went unabated last week.

The meltdown in share prices marks a dramatic turn of fortune for Adani himself, whose net worth has taken a massive hit from more than $120 billion before January 24 to about $61 billion on Friday. Through issuing IPOs and selling corporate bonds, Adani forged partnerships with and attracted investment from foreign giants as it pursues global expansion in sectors as varied as sea ports and electricity.

One of the biggest challenges faced by India is the perceived financial risk that investments may not generate the promised return, both because of the entrenched bureaucracy that can make it challenging to do business there, and also because of potential corruption and mismanagement issues.

Hindenburg accused the Adani group of "brazen" market manipulation and accounting fraud, claiming that a web of Adani-family controlled offshore "shell entities" registered in tax havens were used to facilitate corruption, money laundering and taxpayer theft. The most dramatic claims made by Hindenburg allege that Adani uses "shell companies" to manipulate the share prices of its listed ones.

The Adani crisis may have started a confidence crisis in Indian shares, and that could have broader market implications. On Friday, Adani responded to critics of his close ties to Modi, dismissing claims his companies had avoided government oversight. But investors remained highly suspicious. Credit Suisse and Citigroup's wealth arm are no longer accepting Adani bonds as collateral for loans, which means the investment banks have cut the lending value of bonds issued by Adani companies to zero.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn