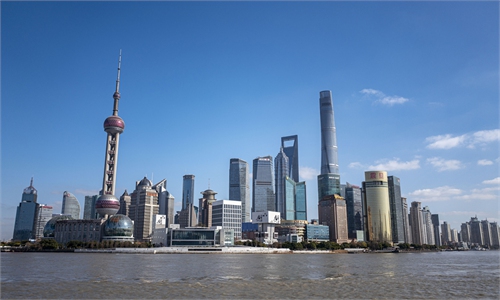

Lujiazui, a financial zone in Shanghai Photo: VCG

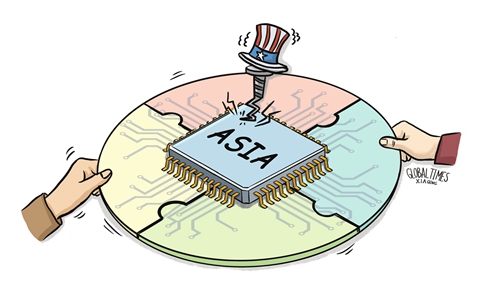

It seems that the US is about to expand its technological crackdown on China in the investment area, which may become another source of risks in economic and trade relations between China and the US, and bound to have a negative impact on US companies' investment in China.However, this move will not dent China's determination to attract more foreign investment thanks to the strong momentum of China's economy.

In a latest sign of Washington's containment to China's technology sector, a Bloomberg report, citing people familiar with the matter, said on Sunday that US President Joe Biden is prepared to request funding for an executive order in his March 9 fiscal 2024 budget, which would restrict US investment in certain advanced technology sectors in China.

While the move may mark the latest step by Washington to guard its technology advantage to maintain its global leadership in the economic, military and technological fields, such politicized restrictions may be translated into a huge disadvantage for the US, at a time when China is poised to open up its market wider to the rest of the world amid its economic recovery this year. It needs to be pointed out that US investment only represents part of all foreign investment globally, and as long as China does its own things well and makes itself an investment magnet for global investors, it is American businesses and capital, not the Chinese economy, that will end up being put on political shackles by their politicians.

Amid the current poisonous political climate in Washington, it is disturbing to see US economic and trade policy toward China is being arbitrarily distorted to satisfy the anti-China craze of some politicians, who don't bother to think how such policies as the curbs on investment in China will affect the interests of American investors.

Indeed, US Commerce Secretary Gina Raimondo just raised such concerns recently by saying that the US needs caution on investment curbs against China because there are many US pension firms that have invested people's retirement money in the nation. "You don't want to be overly broad. We want commerce, we want trade, we want global investment. Anything that's overly broad hurts American workers and the economy," she said in an interview at Bloomberg's office in Washington on March 2.

If anything, the stakes could be high if the potential order to restrict investment in China would greatly undermine the profitability of US capital in the country. According to tracking by Rhodium Group, which is a research firm with a focus on China, US investors have been carrying out about 3,000 transactions per year in China, with about 500 of those valued at more than $1 million, The New York Times reported.

More importantly, under Washington's ban, it is possible that some American investment may have to withdraw from China's supply and industrial chains, giving up their market space to competitors. As the US tightens curbs on China, US businesses need to give it a think where to find a market that can offer them such huge benefits as China.

Meanwhile, it could be expected that China will take countermeasures and adopt more products and technologies from other countries to replace US ones to reduce the impact of the withdrawal of US investment.

According to a Government Work Report submitted to the national legislature for deliberation on Sunday, China vows to make greater use of foreign investment. It will encourage foreign-invested enterprises to move into a broader range of sectors, and support more foreign investment in medium- and high-end manufacturing, research and development, and modern services, as well as in the central, western and northeastern regions.

As the US government tightens restrictions in both directions on US companies investing in China and Chinese companies investing in the US, those who want to make money in China need to think hard: Will you still be able to take advantage of the big market of China to make more money as comfortably as you did in the past?