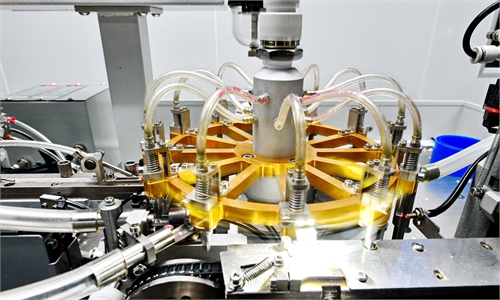

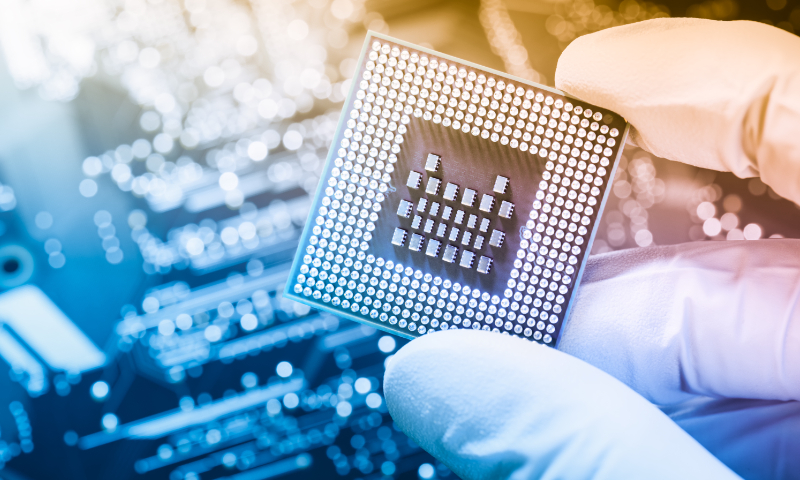

chip Illustration: VCG

The US is reportedly planning to expand restrictions on semiconductor-related exports to China, which shows that the curbs have not been as effective as Washington thought and have only put US firms under risk, Chinese industry analysts said on Sunday.

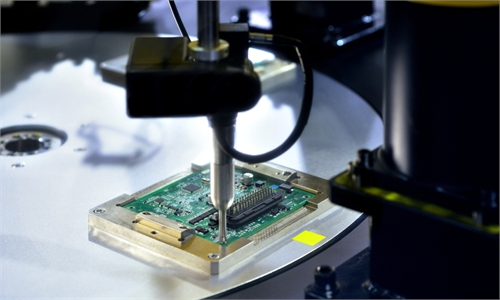

Washington is working to further expand restrictions on exports of chipmaking machines to China, potentially doubling the number of machines that require special licenses for export, Bloomberg reported, noting that about 17 of the multimillion-dollar machines currently require licenses for export to China.

"If the previous restrictions were effective, there would be no need for Washington to keep trying to enhance them," Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times on Sunday.

There is no denying that the restrictions on core technology exports - such as lithography machines - to China may delay the country's development of advanced semiconductors, but most of the manufacturing gear itself is not beyond the production capacity of Chinese developers, Xiang said.

"By pushing Chinese companies to choose domestically produced semiconductors and manufacturing gear, it only speeds up the growth of domestic industries," Xiang noted.

Chinese chip producers have seen substantial growth in the past two years, and the effect of both quantitative and qualitative change is emerging, Ma Jihua, a veteran industry analyst and a close follower of China's chip industry, told the Global Times.

Chinese companies have greatly promoted import substitution and also gained more market share across the world, analysts noted.

China's imports of integrated circuits dropped 26.5 percent year-on-year to 67.58 billion units in the first two months of 2023, while the import value fell 24.9 percent to 329 billion yuan ($47.6 billion), data from the General Administration of Customs revealed.

Citing Chinese firms' continuous investment in research and development (R&D), analysts said the curbs may affect the nation's development in the short term, but they will speed up the drive for self-sufficiency in the long run.

China's R&D spending totaled 3.087 trillion yuan in 2022, and its investment in basic research increased from 49.9 billion yuan in 2012 to about 195.1 billion yuan in 2022, official data showed.

Players from the US and its allies are facing a different and less promising future as they may be forced to retreat or partially retreat from the world's largest semiconductor market, analysts noted.

US firms have seen declining share prices and were forced to warn investors that losing the Chinese market may cost them dearly in revenue.

In the fourth quarter of 2022, Intel Corp's revenue dropped 32 percent year-on-year to $14 billion. The company recently decided to cut its dividend payout to the lowest in 16 years and planned to scale back big investments to save cash, according to Reuters.

Meanwhile, many leading US tech firms have been laying off staff. It is the US companies and "of course, the US allies' companies, which the US never cared about" that will ultimately pay the price, Xiang said.

The US has been forcing or cajoling its allies to join its curbs against China, and has reportedly reached agreements with the Netherlands and Japan.

Though the CEO of the Dutch chip-gear giant ASML Holding has complained about losses under the US restrictions, the Dutch government followed Washington's steps and announced plans on Wednesday to impose additional export restrictions on the "most advanced" semiconductor technology to China.

By interfering in normal economic and trading activities, such moves seriously hinder the operation of the global supply chain and technological advancement, analysts stressed.