Samsung’s profit plunge underscores damage US ‘chip war’ has on the global semiconductor sector

Samsung Photo:VCG

Together with its peers, Samsung Electronics appears to have borne the brunt of the current US chip hegemony that has completely disrupted the supply and demand balance in the global chip industry, leaving these tech giants to facing ongoing uncertainty.

The South Korean tech giant said on Friday that it expects operating profits to dive by more than 96 percent year-on-year to 600 billion won ($455 million) in the first quarter of 2023, marking a 14-year low.

While its detailed earnings, including divisional breakdowns, are not available yet, analysts generally believe that its semiconductor loss, which could be up to $3 billion in the first quarter, may be the main reason behind its performance slump.

If anything, Samsung's announcement to make a "meaningful" cut to chip production adds to evidence that its chip business is suffering. It was not long ago that Samsung indicated it had no plan for an "artificial cut" in production.

As for its reasons, the world's biggest memory chip maker said in a statement that demand dropped sharply "due to the macroeconomic situation and slowing customer purchasing sentiment, as many customers continue to adjust their inventories for financial purposes." It is true that demand for everything from smartphones to personal computers has subdued amid fears of a global recession, leading to sharp fall in both the price and demand of memory chips, but this is only a superficial reason. Fundamentally speaking, the US attempt to crack down on China by weaponizing the chip supply chain is to blame for the imbalance between supply and demand in the global semiconductor sector.

Intel ended 2022 recording its worst financial results for the past two decades, with annual earning falling by more than 60 percent and revenue down by 20 percent.

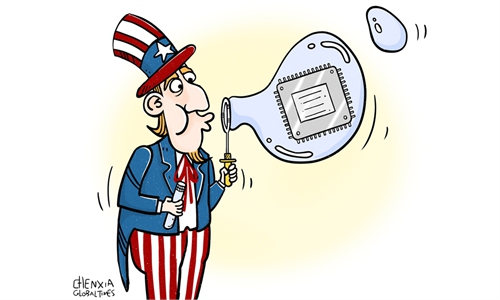

By building the so-called 'Chip 4 Alliance', the US has made no secret of its intention to rope in major players, such as South Korea and Japan, in the semiconductor supply chain to follow Washington's lead in controlling on exports of semiconductor-related products and technology to China. But in a technological cold war that is likely to render chips no longer the product of global collaboration, no one will be the winner, and chipmakers are probably among the first to bear the brunt of the change.

China is the largest market for the global semiconductor industry, which is indispensable to the industrial chain of any chipmaking giant. When chipmaking companies are unable to sell high-end chips to China because of the US ban, that means they will have to face more intense competition in the low- and mid-end chip market in China, as the US-initiated "chip war" against China has forced the latter to pursue technological innovation and develop its own semiconductor supply chain so as to reduce the risk of being cut off by the US and its allies.

Customs data showed that in the first two months of this year, China's imports of integrated circuits fell 26.5 percent compared with the same period last year. The acceleration of the replacement with Chinese-made chips may, to a certain extent, explain why global chipmakers have cut production. US chip company Micron said in November last year that it was reducing DRAM and NAND wafer starts by approximately 20 percent compared with the fiscal fourth quarter 2022.

According to the US-based Semiconductor Industry Association, global semiconductor sales fell 20.7 percent year-on-year to $39.7 billion in February from $50 billion.

It is the US that has ratcheted up pressure on its allies to ban their companies from selling chips at will and is making chipmakers the cannon fodder in the US "chip war". If the US had not pushed for technological "decoupling" to suppress China's development, the global chip industry would not have faced as much uncertainty as it does now. And if the supply of semiconductor products were always free and unimpeded, there would not be so many countries trying to secure their supply chain by building domestic chip production capacity . The US is to blame for disrupting the global semiconductor supply chain.

As for the US' allies in Asia, the economic damage now may serve as a timely reminder that China, South Korea and Japan working together should come first, rather than the latter two countries falling in line with US strategy that goes against their own economic interests.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn