Illustration: Liu Xidan/GT

The majority of the Global South is choosing to mitigate their development risk by coming closer to China through embracing global trade, infrastructure connectivity, and political multipolarity, in the form of the BRICS and the Belt and Road Initiative (BRI).In contrast, the minority US-led West, due to zero-sum calculations and hegemonic intent, is talking about so-called "de-risking" from China. This policy has been coordinated through the G7 rich countries' club which seeks to maintain the US' undemocratic privileges over the rest of the world.

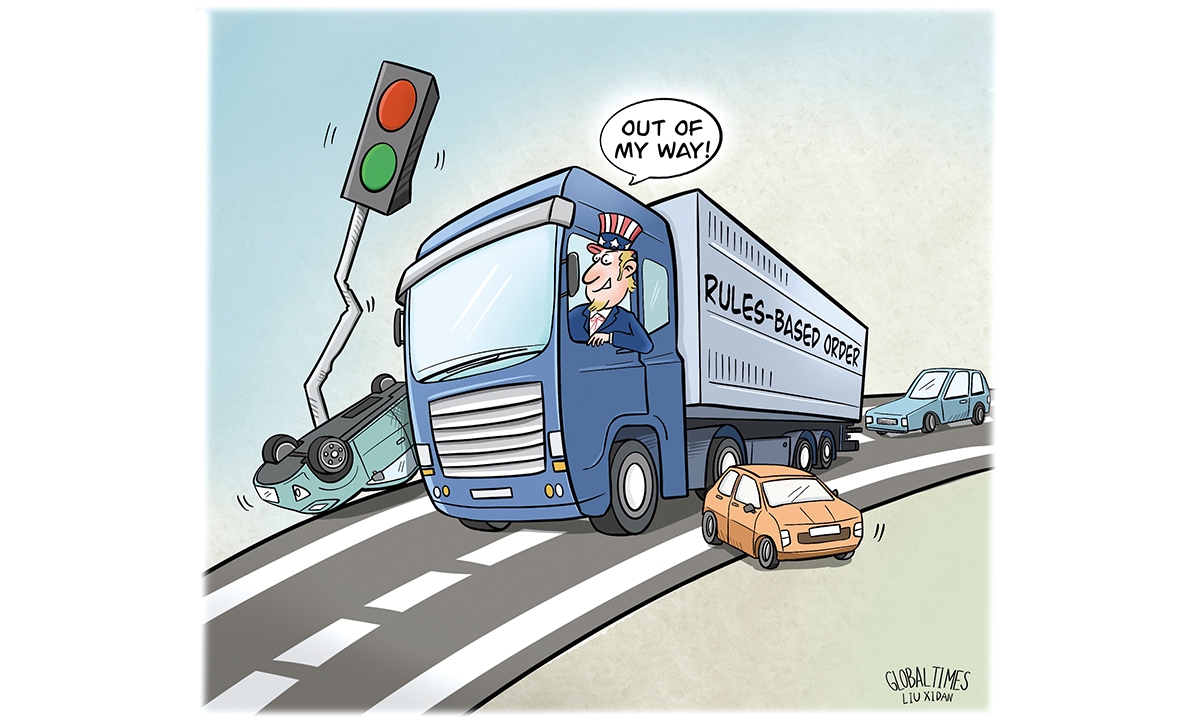

It has been raised by the West that China is risky due to not playing by international rules and as such they justify China's rise as a risk. However, this argument is spurious. China does play by the international rules, which are not the mysterious "rules-based order," a term for doing US bidding. Indeed, when it comes to international rules, a quick look at Western states shows that, despite mass democratic resistance, it was the norm to send their military forces to participate in the US-led illegal invasion of Iraq, which has sparked all manner of risks in global affairs to this day.

The risk to Western populations then comes not from China but from piggybacking with US rules-breaking which includes the use of Washington's Orwellian-sounding regime change organization - the National Endowment for Democracy (NED), which continues to interfere with China's sovereignty. Then there is a constant infringement of the Taiwan red line and US unilateral sanctions. These actions could risk further violent outcomes in East Asia that would have disastrous global outcomes.

Thus, de-risking is nothing less than a continued attempt to prevent China's development and maintain the global military and economic dominance of the US. In win-win terms, China's development is the least risky proposition for the entire world.

Due to China's peaceful rise and opening-up, Western states have flocked to China to invest and profit handsomely from China's cheap labor and huge consumer market. During the 2008 financial crisis, which spread around the world, China's lending and growth mitigated the risk to the global economy, sparked by irresponsible use of US financial capital.

China's economic model is risk-averse. In the West, the profits from the China-West wealth generation partnership have gone into "yachts" while living standards for ordinary people are declining. In contrast, China has spent wisely investing in its people from the ground up and building world-class infrastructure.

The adage "no good deed goes unpunished" rings aloud. China's wisdom from social construction, economics, and geopolitics is something to be studied and engaged with, not jealously pushed back against. Considering China has shown to be the most steadfast measured partner one can get, de-risking from it is in itself incredibly risky. In contrast, being tied to US hegemonism is risky for those who value development and peace.

Clearly, there is a discrepancy between the real material conditions that should be used to determine global risk and the ideological subjective use of risk in the name of US interests. This contradiction can be used to awaken the consciousness of Western masses and elites to seek solidarity with the rest of the developing Global South, which China is part of. They need to recognize why the global majority support China.

On an optimistic note, changing the narrative from "decoupling" to "de-risking" may already signal a decoupling of US deep state extremism vis-à-vis their European satellites, who are not willing to join the US' risky economic and military suicide mission but are nevertheless too weak to resist openly.

After all, the Ukraine conflict was based on another flawed risk assessment where Germans were told that it was too risky to import Russian energy. However, now they have one less supplier and are at the mercy of more expensive US energy imports. Resisting and protesting openly is evidently risky as has been well demonstrated by the non-resistance to the serious Nord Stream allegations, which claim further US rules-breaking by conducting a terrorist act on its "allies."

As European living standards decline there is a rising consciousness in Europeans to balance the US risk with China's stability. France has signaled its willingness to disobey US hegemonism by moving closer to China by reaffirming the Taiwan question and Germany has decided that it will not give up the Chinese market at the US behest.

Some argue that in the real world, there will be no difference between the outcomes of decoupling and de-risking as decoupling would have been economically impossible and de-risking has yet to be implemented or well-defined. However, at least a consciousness that China cannot be separated from the West may mitigate the risk of conflict as the US' China outlook moves from utter lunacy to irrationality.

We will have to wait and see what de-risking will ultimately entail. Perhaps efforts to de-risk, whatever they may be, will simply come up against more material barriers. After all, nothing can change the fact that Germany, after doing a real risk assessment, is moving manufacturing to China. Consequently, de-risking may eventually be a hollow ideological term that just like the needless Build Back Better World plan proves unworkable in the material world and both may be confined to the dustbin of history.

This assessment may be too optimistic but at the very least the broader language of risk invites a more open and multifarious view of the world. Decoupling by its nature points to a world divided into two. On the other hand, risk is multifarious, dynamic, and reflexive. It asks us to question our assumptions and to evaluate every aspect of our lives based on real-world conditions rather than entrenched dogma, which invites catastrophe.

For Europeans and the wider West, this language of risk can be a catalyst for a deeper examination of geopolitical issues and global relations based on real-world sober risk-averse calculations. They may come to their senses and decide that the non-integration of Europe into the wider markets of Eurasia due to sanctions, war, and poor infrastructure connectivity risks their prosperity. Non-integration wastes Europe's natural geographical potential and economic advantages by risking turning it into an unnatural "island" dependent on transatlantic routes for its economic welfare.

Risk is a real-world material calculation based not on propaganda and the wishes of others let alone others who have proven to be the riskiest of actors when it comes to the global economy, peace, and development. The West and indeed the rest of the world must bear this basic fact in mind and soberly make a risk assessment based on the real material world and not blindly risk their futures by gambling on hegemonic risk-taking for what is a failed ideological cause.

The author is an independent international relations analyst who focuses on China's socialist development and global inequality. opinion@globaltimes.com.cn