Illustration: Chen Xia/Global Times

Despite Washington's ill-intentioned chip war, China is still an irreplaceable market for US chipmakers, including Nvidia, which has now undergone increasing pressure on supporting stock price.Some long-term investors of Nvidia are cutting bets on the stock as analysts believe the rush around artificial intelligence (AI) has pushed the company's valuation too far. On May 30, Nvidia achieved a significant milestone by surpassing the $1 trillion mark in market capitalization, making it the first-ever chipmaker to join the trillion-dollar club. In the year so far, the stock is up about 170 percent, boosted by investors' recent focus on AI. That makes Nvidia twice the size of the second-most valuable chip firm, Taiwan Semiconductor Manufacturing Co (TSMC), which is the world's largest maker of microchips.

The overweight of Edmond de Rothschild Asset Management at Nvidia, a position it has held since at least late 2020, is now "much less," Bloomberg reported, citing the company's global chief investment officer Benjamin Melman. In other words, the firm believes Nvidia's valuations have set too high.

On May 24, Nvidia reported revenue for the first quarter ended April 30 of $7.19 billion, down 13 percent from a year ago. Although Nvidia's net profit was $2.043 billion, an increase of 26 percent year-on-year, currently Nvidia has to answer a question: how to support its stock price, consolidate market confidence, and continue breaking new ground after it hit a $1 trillion market cap.

The US chipmaker is emerging as a critical player in the booming field of AI, but its position in China has been complicated by the US-initiated chip war against China. In 2022, US government's policy restricting sales of Nvidia's newest chips to China puts up to $400 million of the company's quarterly sales into jeopardy. Nvidia founder and CEO Jensen Huang Jen-hsun was quoted by media reports as saying recently that the Biden administration's ongoing chip war with China could cause "enormous damage" to US technology companies.

China is a significant market that Nvidia doesn't want to lose. In the fiscal year ended January 2023, markets in the Chinese mainland, Hong Kong and Taiwan accounted for a whopping 47 percent of Nvidia's global revenue, according to media reports. This scene is quite ironic, while China-US relations are at a crossroads amid Washington's "decoupling" or "de-risking" from China calls, Nvidia has become a big victim.

Huang said recently that the company, which has been barred by Washington from selling its most advanced chips to customers in China, must "run very fast" to stay competitive, the South China Morning Post (SCMP) reported. Huang has also warned that China will cultivate its own chip companies in response to tensions initiated by the US.

That is half-right. Washington's ill-intentioned chip war has accelerated China's push for a more independent chip sector, but at the same time, China has repeatedly reaffirmed its commitment to further opening up its vast domestic market for foreign high-tech companies despite growing protectionism pursued by some Western countries, particularly the US. China will continue to welcome US-funded firms to develop in the country.

After decades of hard work, China has gradually developed several competitive advantages, and for instance, its distinct market advantages. Most top US chipmakers have significant exposure to China. The more vigorously some US politicians act in suppressing China's rise, the more resolutely China will fight back, with market advantages serving as a trump card in China's hand.

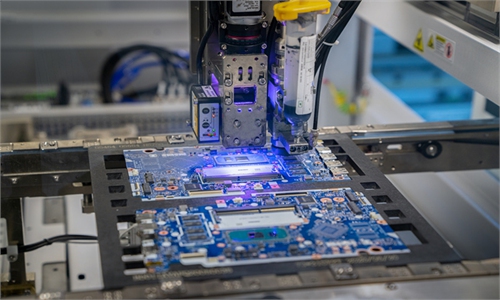

China has become known as "the world's factory." This, in turn, led to a significant surge in demand for chips. An optimal solution is to rely on China's comprehensive capability in manufacturing sector to expand its market advantages and to make its industries stronger, and finally win the chip war initiated by the US.

We believe US chipmakers will ultimately choose Chinese market over Washington's geopolitical posturing. In recent weeks, some top US CEOs, including Tesla CEO Elon Musk, JPMorgan Chase CEO Jamie Dimon and Starbucks CEO Laxman Narasimhan, have been seen visiting China. If Nvidia's Huang becomes the next US CEO travelling to the Chinese mainland's market, Washington may be dissatisfied, but Huang should make a decisive and wise strategic choice between the market and Washington's geopolitical brinksmanship.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn