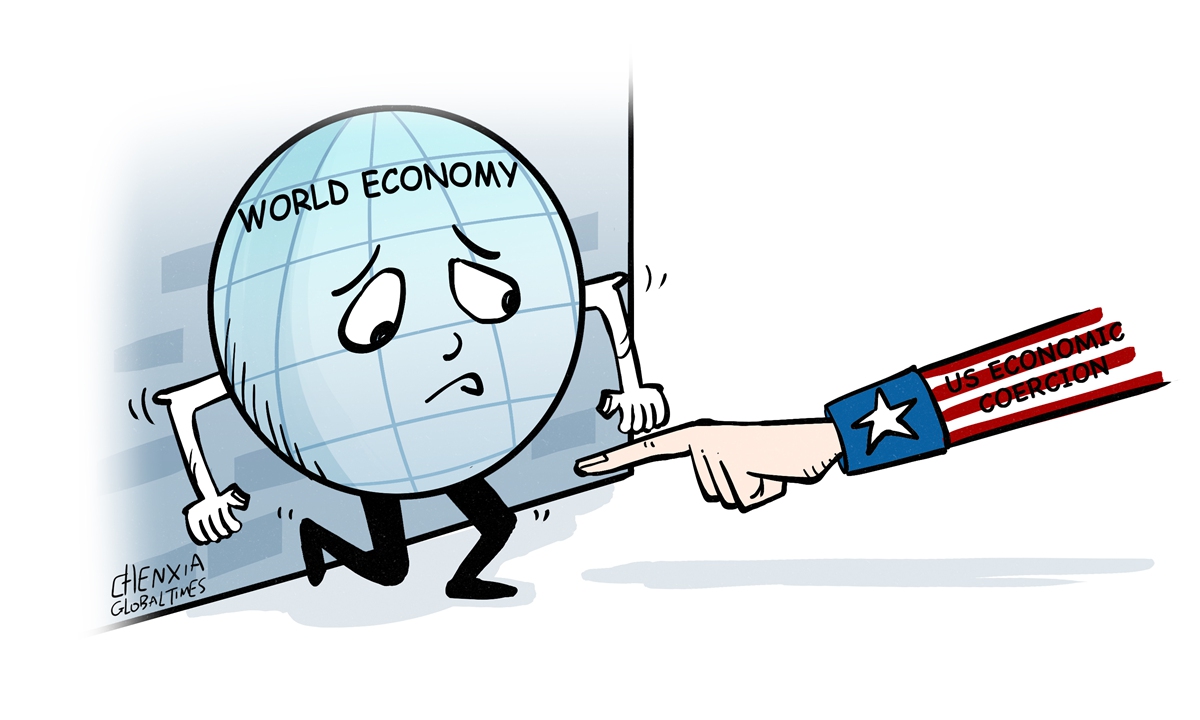

Illusration: Chen Xia/Global Times

In the face of current global economic challenges including declining trade, falling investment and high inflation, the G7 Hiroshima Summit between May 19 and 21 did not offer any solutions to promote global economic recovery from the perspective of global economic governance, but stressed the importance of countering "economic coercion" instead.

This term is actually a new type of demonization of China concocted by bad faith actors in the West in the face of weakening economic leverage. Their real intention is to attack China and suppress China's economic development.

It should be pointed out that China has been focused on its economic development from reform and opening-up. China has never politicized economic issues due merely to achieve geopolitical gains. China has been acting in accordance with its own laws and WTO trade rules. Therefore, it is sheer nonsense to accuse China of "economic coercion."

On the contrary, the US has adopted a series of economic coercion moves against many countries across the world in the past, and this kind of economic coercion intends to use the hegemony of the US to dominate the world. During the G7 summit, the US mobilized this term to contain China's economic development. Daniel Drezner, a professor at the Tufts University, also wrote in an article in Foreign Affairs magazine noting that successive US administrations have abused economic sanctions and economic coercions.

Moreover, the US has adopted economic coercion in many fields. For example, The US-Japan Semiconductor Agreement of 1986 imposed a 20 percent market share provision opening the Japanese market to foreign producers over a five-year time frame. However, Japan has not achieved this percentage till today. This is why the US keeps suppressing Japan as part of the international chip trade, which has disrupted the entire global semiconductor supply chain. The US also intends to form an alliance of economies that includes Japan and South Korea to suppress the development of the Asia-Pacific region, especially China's chip industry, as the cost of chip manufacturing in the US is 30 to 50 percent higher than in the Asia-Pacific region.

In addition, US trade controls have also deployed a variety of long-arm jurisdiction tactics. This kind of economic coercion by the US is not only aimed at some countries that the US regards as rivals, including Russia and China, but also some American allies. The US economic coercion has expanded from the trade and technology fields to culture, education and other fields. The US has actually formed American-style diplomatic coercion. It has become the most important reason for repeated setbacks and failures of US foreign policy over recent memory.

After the G7 summit, a notable development occurred that received global attention is that executives of American and European multinational companies have visited China intensively, opposing the US' "decoupling" from China and the US' demonizing China in the name of "de-risking." Therefore, some multinational companies from the US and the EU lined up to come to China.

These CEOs who recently visited China include Tim Cook of Apple, Pfizer CEO Albert Bourla, and Tesla's Elon Musk. This shows that American and European companies have been optimistic about the Chinese market, and oppose the US and the West labeling China as "economic coercion" and suppressing China in the name of "de-risking."

We should see that the "de-risking" that the US talks about is actually "de-opportunities." The intensive visits of these corporate executives to China reflect optimism about opportunities in the country, and the "de-risking" by the US and European governments at this time are to let these multinational companies miss these new opportunities.

In fact, the so-called "de-risking" is an isolating approach that disrupts the global industrial supply chain under the current situation. Many multinational corporations from the US and EU have bravely said no to it. This is an unprecedented phenomenon in recent years, and we expect to see more in the future.

Addressing a meeting in Shanghai on May 30th, JPMorgan Chase CEO Jamie Dimon said that JPMorgan is committed to China business despite growing tensions between the US and China. The largest US bank and the largest investor are optimistic about China's economic performance. This shows if Western countries use "de-risking" to prevent their businesses from investing in the Chinese market, this actually violates the laws of the market and is a real economic coercion.

The author is a former Chinese vice minister of commerce and executive deputy director of the China Center for International Economic Exchanges. bizopinion@globaltimes.com.cn