Sequoia spin-offs show US geopolitical games are liability for Silicon Valley venture capital

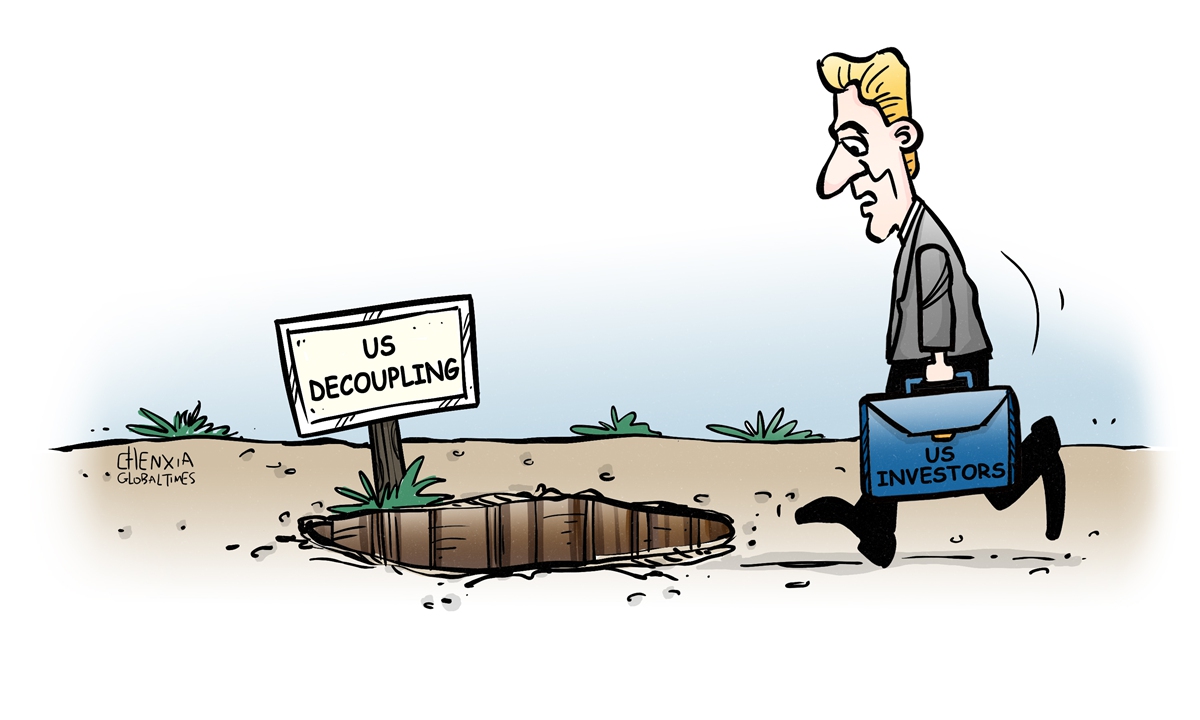

Illustration: Chen Xia/Global Times

Sequoia Capital, one of Silicon Valley's most prominent venture capital firms, is breaking itself up, separating its US and China operations by spinning out its Chinese unit into an independent company, the New York Times reported on Wednesday. The company said its global footprint had become "increasingly complex" to manage, but it is generally believed there are not only economic considerations, but also geopolitical elements behind Sequoia's split.Several days ago, a US Treasury official was quoted by the South China Morning Post (SCMP) as saying that Washington is working on new regulations that would limit capital flows into sensitive technologies in China such as semiconductor and artificial intelligence (AI). If the SCMP's report is true, it is very likely that US-based venture capital firms such as Sequoia will be badly affected. Since it entered China in 2005, Sequoia has made bets on fast-growing Chinese tech companies such as Alibaba and TikTok parent ByteDance.

If Washington continues politicizing and weaponizing sci-tech issues, restricting the flow of US investment into Chinese companies working on chip, AI and quantum computing, US investors are likely to be the first and major victims. Sequoia's dramatic move to split its business is, to some extent, a signal that the risk of escalating geopolitical tensions is a growing liability in Silicon Valley. Washington should take responsibility as the chief antagonist behind the increasing uncertainty.

In recent weeks, the US has frequently expressed its desire for dialogue with China. However, it seems there are questions within even domestically in the US about whether Washington genuinely intends to put an end to its high-stake chip war and stabilize economic relations with China. Sequoia's decision reflects US business community's concern about deteriorating relations between China and the US. This should sound the alarm: the US has witnessed increasing divergences between political and business communities over China-related issues. The Biden administration needs to correct its policy toward China, through its practical actions to stabilize bilateral ties and regain trust from the US business community.

According to the New York Times report, Sequoia has more than $53 billion in assets under management in the US and Europe, $56 billion in China and $9 billion in India and Southeast Asia. No matter how hard Washington works on its "decoupling" from China push, from the perspective of the US venture capital titan, the Chinese market remains irreplaceable.

The situation has become very clear now. Washington's "decoupling" campaign can no longer continue. The US business community has moved to pressure Washington to stop playing games. An increasing number of executives of financial giants from the US and other Western countries have recently visited China and expressed their confidence and commitment to the Chinese market.

Following visits by JPMorgan's chief Jamie Dimon last week and by other global financial executives in March, Citigroup's CEO Jane Fraser this week made her first trip to China since taking up the CEO role in March 2021. Fraser said on Monday in Beijing that the US bank has full confidence in China's economic and financial development and will continue to expand its Chinese business, signaling a commitment to the Chinese market similar to Dimon and other global financial executives have made.

American and Western financial companies should indeed maintain confidence in the Chinese market, as China will unswervingly continue to expand financial opening-up and continue to improve the business environment for foreign companies. In recent years, in the face of severe and complicated domestic and foreign situations, China's financial industry maintains a positive trend toward high-level opening-up.

The financial opening-up measures implemented by China in recent years include the removal of restrictions on the proportion of foreign capital in banks and life insurance companies, and the substantial reduction of quantitative thresholds for foreign capital access. In addition, China is encouraging foreign-funded institutions to participate in the development of China's wealth management, aged care and other fields. China has continuously expanded the business field of foreign-funded banks and foreign-funded insurance companies, facilitating their expansion of footprint in the Chinese market.

"Decoupling" the financial sector between China and the US is impossible. A series of signals indicate that the US is willing to promote dialogue with China, but the US still needs to take more concrete actions to soothe US business elites' anxiety and rebuild confidence. If the US continues to practice "decoupling" in the name of "de-risking," it will only create more problems for American companies.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn