Argentina’s expanded use of yuan will speed up Chinese currency’s internationalization, says expert

RMB Photo:VCG

Argentina has opted for the Chinese currency, yuan, to settle part of its debt with the IMF for the first time on Friday, joining the league of a number of countries which are expanding the stake of the yuan in their economies while reducing dependence on the US dollar.

The move will have a strong demonstration effect on emerging economies whose woes have been worsened by the US' rate hikes and inflation, experts said. With more of them pivoting toward the yuan and fleeing the greenback to fend off risks, the Chinese currency's internationalization is expected to speed up and its usage in international market will also expand, they continued.

According to the Xinhua News Agency, Argentina met a payment obligation with the IMF in yuan worth the equivalent of $1 billion, with a further $1.7 billion disbursed in Special Drawing Rights.

The Central Bank of Argentina has announced earlier it will allow financial institutions to use the Chinese yuan as a currency for deposits by individuals and legal entities. Financial institutions will be able to open both checking and savings accounts denominated in the Chinese currency, according to a statement released by the bank recently.

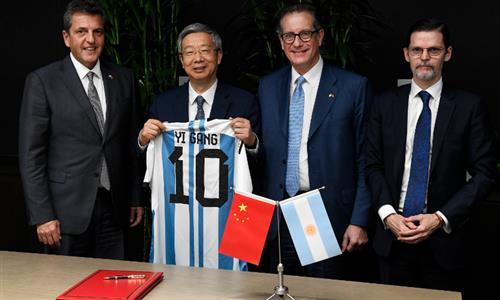

The move came after a visit by the Argentine Economy Minister Sergio Massa to China together with other government representatives in early June, during which a cooperation plan to promote the China-proposed Belt and Road Initiative was signed. Cooperation in monetary and fiscal matters is a central element of the plan.

"Argentina has chosen to deepen the use of yuan as it battles a debt crisis and a desperate US dollar position in the country, which will have a demonstration effect on other emerging economies who face similar problems," Liu Ying, a research fellow at the Chongyang Institute for Financial Studies, Renmin University of China, told the Global Times on Sunday.

Emerging and developing economies are struggling with a series of problems including currency depreciation, capital outflow and debt crisis, mainly caused by rising US interest rates.

"The ongoing rise in US interest rates is especially worrisome because it has been primarily driven by rising reaction shocks, which can have particularly pernicious financial and economic effects on emerging and developing economies," the World Bank said in a paper released earlier this year.

In comparison, the stable exchange rate of yuan contributes to its appeal in terms of the risk-aversion attribute as an international currency.

"Argentina's decision to expand the yuan's use is a step toward de-dollarization," Liu noted.

The gains for the yuan are also inseparable from China's economic power, as the world's second-largest economy offers great certainty and confidence amid global uncertainties and a complex environment, Zhou Maohua, an economist at Everbright Bank, told the Global Times on Sunday.

With the de-dollarization gathering pace as many countries seek alternatives to the greenback to reduce their dependence on the US, the internationalization of the yuan is gaining momentum since the start of the year.

Last month, Pakistan made a payment with the yuan for the first time to settle an oil import deal with Russia.

In Russia, the yuan is also becoming more and more popular. Over 70 percent of trade settlement between Russia and China is conducted in the Russian ruble and the yuan, and more countries are calling for trade to be carried out in their own currencies.