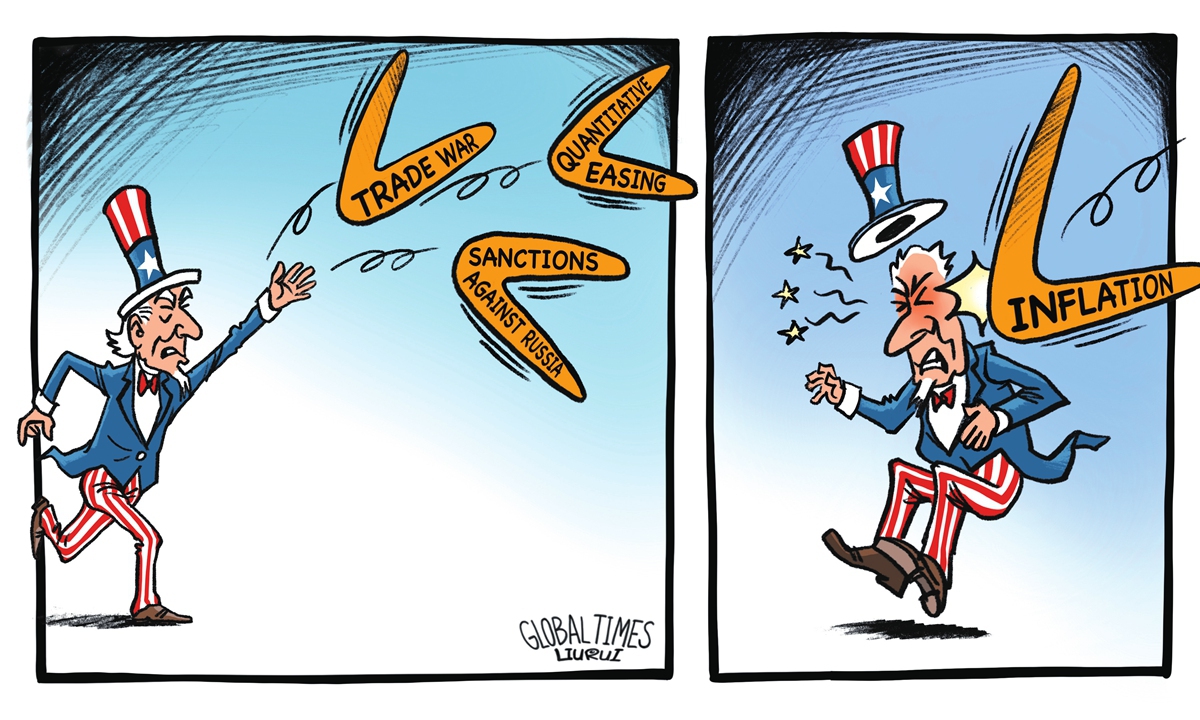

Illustration: Liu Rui/GT

Recently, the US Federal Reserve, the central bank, hinted that the policymakers are likely to raise the benchmark federal funds rate two more times in 2023 to above 5.5 percent - a prospect that immediately cast a thickening cloud on global markets, as investor are already spooked by the aggressive Fed tightening in the past 15 months.It is plausible that the US and the EU need higher rates and moderate recessions in order to tamp down inflation, which is increasingly trenched through the economic system of the developed countries.

Inflation is 20-nation euro area is too high, at more than 6.4 percent now, which is set to remain elevated from some time, said Christine Lagarde, president of the European Central Bank, on June 27. And, Jerome Powell, the Federal Reserve chair, said on June 29 that "inflation pressures continue to run high, and the process to get inflation back down to 2 percent has a long way to go."

To cater to American ordinary households' grievances that the consumer prices have been rising too fast, eating away at their savings and aggravating the cost-of-living crisis, the US central bank has raised its policy rate to above 5 percent from near zero in March 2022. It skipped raising rates in June for the first time in 11 policy meetings, but Powell did not rule out that officials could return to back-to-back rate moves again.

In contrast to the developed countries' predicament facing one of the stickiest inflation in history, the major emerging economies, including China, Russia, Saudi Arabia and Brazil, are doing just fine, with 0.2 percent, 2.5 percent. 2.8 percent and 3.9 percent consumer price rises in May over the corresponding period last year, respectively.

Chinese government's decision to go piecemeal in post-pandemic economic stimulation, refraining from the downpour-style stimulus seen in the US and the EU economies, has contributed to the very low inflation in the first half of 2023, though China's economic growth has also averted a blockbuster surge which is unsustainable. Inflation is likely to be controlled within 1.5 percent rise through 2023, while GDP growth is expected at around 5 percent.

Compared to the US, the EU and other Western economies, it is an extraordinary feat for Russia to successfully tame consumer price rises, as the country has been blanketed with the most sweeping economic and financial sanctions by the US-led Western countries since the breakout of the Russia-Ukraine military conflict. And, Russian economy is expected to pose a meaningful growth of around 2-3 percent in 2023, despite facing the draconian Western sanctions.

A growing number of Western readers are baffled by their stubborn inflation in contrast to Russia and China, and they start to seek answers. "Our mainstream media are always criticizing 'authoritarian' governments, but they won't explain why Russian inflation, at 2.5 percent, is lower than most developed Western countries, although Moscow is subject to our sanctions," one commentator bemoaned.

It is understandable that Russia has done a lot to maintain domestic market stability since the conflict with Ukraine erupted. Its huge deposits of fossil-fuel energies and large grain harvest, plus maintaining normal trade exchanges with China and many other non-Western economies, have all helped Russian market stability and low consumer prices. The US government's efforts to crush and destroy Russian economy through sanctions have largely failed.

However, getting the US' own inflation rate down to around 2 percent is not easy, and would require a moderate recession, to do it. For many years, that the country has been able to keep its inflation at 2 percent was largely a result of inexpensive goods provided by China, the world's factory, and other low-wage developing countries. But Donald Trump's senseless trade war with China, by drastically raising the tariffs on $350 billion Chinese goods, triggered the US inflation to raise its ugly head, which has become ever sticker and embedded with the US economy through Joe Biden's reckless "decoupling" or "de-risking" attempts.

After the US government has knocked its brains to place hundreds of Chinese enterprises and institutions on its sanctioning list, it is hard for China not to retaliate. The tit-for-tats will inevitably lead to disrupted global supply chains and higher prices for almost everything.

Some in the US are griping about corporate greed for aggravating inflation, but the Biden government 'anti-globalization" bid is causing a fracturing and fragmentation of the world economy, which rolls back on corporate efficiency and lead to price surges. And, the severe income inequality among rich and poor households has made the problem ever harder to address.

In a nutshell, the worst spike in inflation that many developed economies have seen in decades underscores the global forces driving prices higher, namely the disruptions set in motion by the trade war, the pandemic, the sanctions on Russia, and the growing fragmentation and breakdown of free trade and globalization.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn