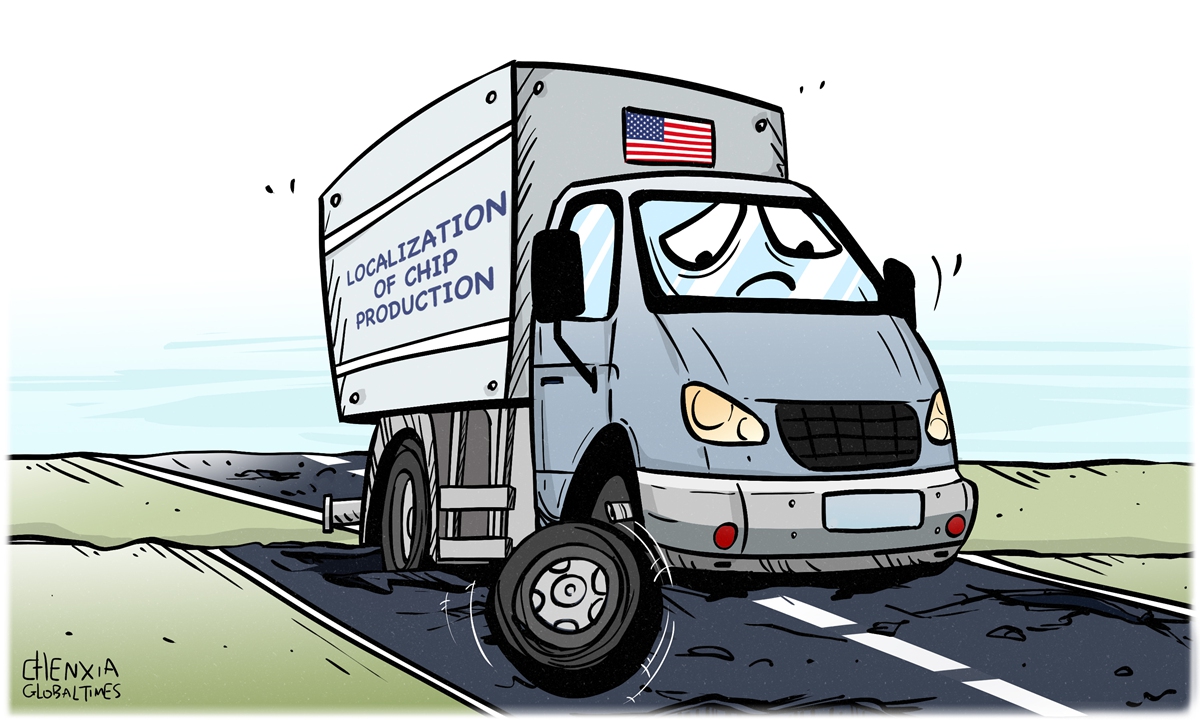

Illustration: Chen Xia/Global Times

As the US-initiated tech war against China drags on, the US Semiconductor Industry Association (SIA) has warned that there won't be enough engineers, computer scientists and technicians in the US semiconductor industry to support a rapid expansion during this decade.

The US chip strategy got off to a high-profile start in 2022, but now, it may be forced to decelerate.

Chipmakers are on course to add about 115,000 jobs by 2030 in the US, Bloomberg reported on Tuesday, citing data from the SIA. But based on a study of current degree completion rates, about 58 percent of those projected positions could remain unfilled.

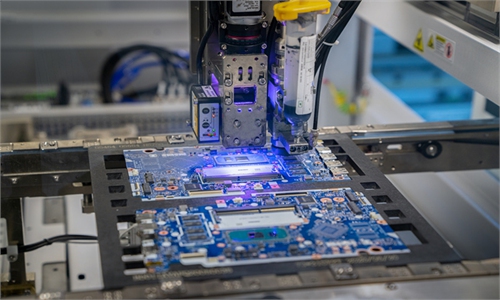

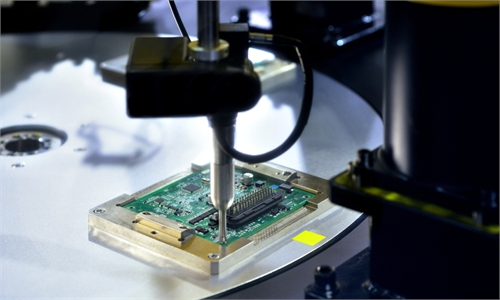

The SIA's study was released after media reports that Taiwan Semiconductor Manufacturing Corp (TSMC) had delayed the start of production at its factory in the US state of Arizona. During an earnings presentation, TSMC Chairman Mark Liu said the plant, which has been under construction since April 2021, faced a shortage of workers with the "specialized expertise required for equipment installation in a semiconductor-grade facility," according to the BBC.

The US has embarked on a major push to bring chip manufacturing back home. In August 2022, US President Joe Biden signed into law the CHIPS and Science Act, which the White House boasted will "poise US workers, communities, and businesses to win the race for the 21st century." TSMC's investment is one of the most high-profile cases supporting US semiconductor ambitions.

The company said in December it would more than triple its planned investment at its new Arizona plant to $40 billion, as Biden visited and hailed the project. He was quoted by media reports as saying "American manufacturing is back, folks."

It's only been a few months, but more people have realized that TSMC faces difficulties and challenges in manufacturing chips in the US. Thanks to a skilled labor shortage, crumbling infrastructure, inflation, rising energy costs and supply chain disruption, productivity in most US manufacturing sectors is substantially below that in Asian countries. The reality is that the US semiconductor manufacturing picture is less rosy than political elites suggest.

Sales are another major challenge. As global demand stutters, the previous semiconductor shortage in the market has turned into a surplus. Against this backdrop, the US has imposed export restrictions including measures trying to cut China off from certain semiconductor chips made in the US and anywhere in the world with US equipment and technologies, further compressing the market space for made-in-US chips.

China is the world's largest semiconductor market. In 2022, China reportedly represented about 60 percent of worldwide semiconductor sales. The US is trying to squeeze China out of the global semiconductor industry chain and curb high-end chip exports to China, but this has also caused significant problems for the US chip industry.

It's not only the US but also its allies, including Japan and the Netherlands, that are wondering: where is the market? This is likely to intensify competition between the US and its allies as they try to find new chip markets outside of China, thereby reducing corporate profits.

For example, for TSMC's planned plants in the US, even if they can produce chips, whether they can sell them and whether they can make a profit are all challenges they need to face.

Faced with issues in both production and sales, the US has had to slow down its semiconductor strategy. In contrast, China has taken significant steps to prop up its semiconductor industry.

The SIA said in 2022 that if the Chinese mainland's semiconductor development continued its strong momentum and assuming that growth rates of industries in other regions stayed the same, the semiconductor industry in the mainland could generate $116 billion in annual revenue by 2024, capturing upwards of 17.4 percent of global market share.

This would place the mainland behind only the US and South Korea in global market share. Will the US semiconductor strategy succeed? We don't need to rush to answer this question. Time will give us the answer.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn