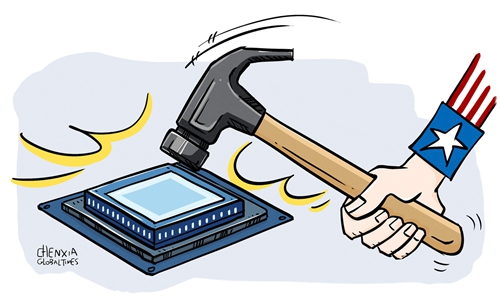

Illustration: Chen Xia/GT

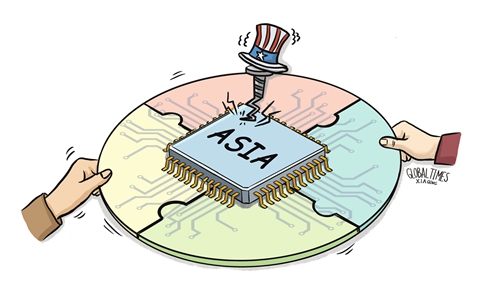

Germany plans to further restrict Chinese influence in Europe's biggest economy with legislation that expands screening of foreign investment, Bloomberg reported, citing Germany's Handelsblatt. This comes as some business leaders express concerns that European countries may follow the US in contemplating stricter regulations on investments in China, which could have a negative impact on German and European economies.After US President Joe Biden earlier this month signed an executive order that would prohibit some new US investments in China in sensitive technologies, Reuters reported on August 10 that the European Commission is in close contact with the US administration and "looks forward to continued cooperation on this topic." This has raised concerns among local business communities.

Some German economists were quoted by media reports as saying that there would be a risk of excessive regulations if Germany followed the US to further strengthen restrictions on investments in China. They said that the EU should avoid any negative impact that the US' ban on new investments in China may have on the European economy.

Chinese economists are also carefully evaluating the negative impact of the US' restrictions on the Chinese and global economies. By attempting to contain the rise of China, Washington has opened a Pandora's box, allowing a political plague to infect some individuals, causing them to lose their rationality and objectivity.

If European or other Western countries become infected with this political plague, there is no doubt that both the Chinese and global economies will be affected.

In considering their own interests, European politicians should maintain strategic sobriety and prioritize the development of their domestic economies, rather than focusing on so-called security issues and investment restrictions that disrupt global supply chains.

China is analyzing the US restrictions on investments in China, and many analysts believe more proactive policies will be rolled out to deal with these challenges. While increasing arbitrary investment restrictions by the US and other Western countries are undermining their investment cooperation with China, China - by contrast - unswervingly moves to expand opening-up and improve the business environment to stabilize foreign investments.

In a continuing effort to beef up policy support and promote inbound investments, China's State Council on August 13 made public guidelines regarding further optimizing the foreign investment environment and intensifying efforts to attract foreign investments.

Assistant Commerce Minister Chen Chunjiang said on August 14 that the ministry will work with relevant departments to implement the guidelines, and policies and measures have been introduced to support foreign-funded research and development centers and attract foreign investments in the manufacturing industry.

The Chinese market remains increasingly attractive to foreign capital, and global businesses, which are encouraged by policy support, are eyeing expansion in the market. The net inflow of foreign direct investments to China rebounded in July, reaching the second-highest level in nearly a year, officials from the State Administration of Foreign Exchange said on Tuesday.

The wave of visits by CEOs of foreign companies to China since the beginning of this year is continuing.

For example, Vimal Kapur, CEO of Honeywell, said on Tuesday in Beijing that China is an important market and important research and development base for Honeywell, and Honeywell plans to deepen cooperation in China in several fields. Lars Fruergaard Jørgensen, CEO of Novo Nordisk, also expressed the company's commitment to the Chinese market on Tuesday in Tianjin.

The new round of investment restrictions shows that Washington, once again, uses so-called economic security as an excuse to politicize, weaponize and instrumentalize economic issues. It also coerces its allies to "decouple" from the Chinese economy, trying to exclude China from the global industrial chain. In response, China will inevitably take countermeasures, stimulate economic development and further open up its market to attract foreign investment.

We believe that global investors will vote with their feet by choosing the Chinese market and business opportunities. European and Western policymakers should understand that any attempt to counter market forces using administrative power will ultimately fail.