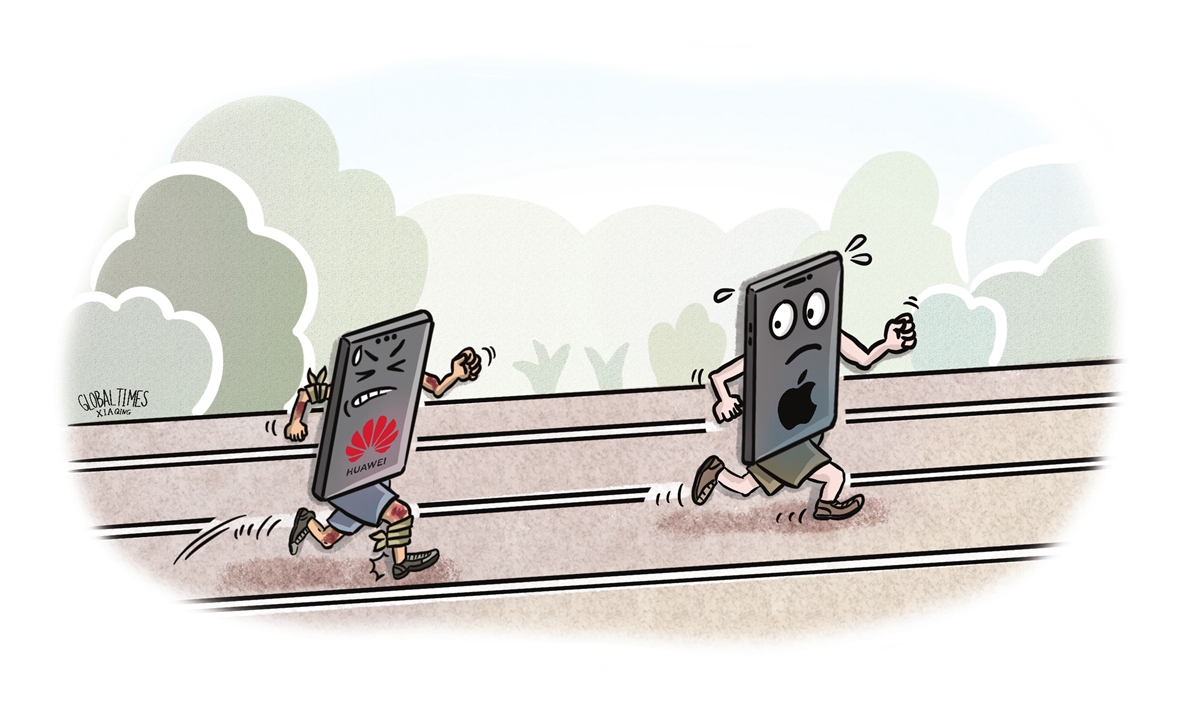

Illustration: Xia Qing/Global Times

Apple released the iPhone 15 series on Tuesday local time. I'm more interested in when Huawei will launch its new 5G series in the international market than news about Apple.

When I first moved to Brazil for work 10 years ago, Huawei smartphones were entering the local market. By the time I left Brazil to return to China in 2016, Huawei had shipped 10 million units across Latin America.

At the time, market share of Huawei's mobile phone in many South American countries reached double digits, with Brazil coming up short. But in the latest news, Brazil's telecoms regulator Anatel expects 5G networks to be turned on in around 1,610 regions by the end of the second half of 2023. That sets the stage for Huawei's latest models to enter Brazil.

Huawei smartphone has fallen from the No.1 position in global market share to just four percent share (Q1 2021) due to chip sanctions from the US. And that's also one of the reasons Apple has grown exponentially over the years, so much so that at one point its market capitalization topped $3 trillion, an all-time record.

According to information from the Demand Sage website, the iPhone currently holds a 27.6 percent share of the global smartphone market. While in 2019, Huawei phones had 16 percent and iPhone 13 percent.

The "resurrection" of Huawei's 5G phone is not good news for Apple. Apple's market value fell by $190 billion in the past few days. The main reason for this is that the Chinese market has always been the most important market for the iPhone.

Huawei's 5G smartphone disrupts Apple's recent "comfort." It may serve as a motivation for Apple to invest more in R&D for the creation of innovative and market-leading products.

Of course, Huawei 5G smartphone will have an impact on the iPhone only in China's domestic market, and the real battle will begin once they appear in overseas markets.

The main impact of Huawei's 5G mobile phone "reentering" the international market will still depend on whether the enterprising Made in China it represents in the global market can make a more significant breakthrough in the US' containment of Made-in-China products.

Washington's strategy of sanctions against China focuses on the need to squeeze Made in China out of the Western and global markets by reconfiguring the production and supply chains, to consolidate US dominance in the global market.

Even if Huawei's 5G mobile phones achieve a breakthrough, it will be challenging to regain market share. The mobile phone markets in the US and Europe have been divergent, especially considering the ongoing US sanctions and the restrictions on Huawei products due to security concerns. These factors have significantly impacted mobile phone users in both regions. Additionally, compatibility with Google services remains a crucial concern for users worldwide.

The launch of Huawei's 5G mobile phones will challenge the iPhone in the Chinese domestic market, and Huawei phones' market share will rise relatively quickly. But the iPhone will still occupy an absolute advantage in the US market; now, about half of the US smartphone users use the iPhone. This situation will mostly stay the same in the short term.

Two important questions must be considered: First, to what extent can Huawei take up the iPhone's market share in China? Second, and the most important, how can Huawei's 5G mobile phone capture more share in the global market?

With the advent of Huawei's 5G smartphone, it is foreseeable that Huawei's mobile phone will undoubtedly demonstrate its resilient and industrious spirit as it continuously evolves through the advancements of 5.5G, 6G, and 7G, thanks to Huawei's technological prowess, assembly production capacity and comprehensive backing from the "Made in China" initiative.

The aggressiveness of Made-in-China products in the global market represented by Huawei is undoubtedly not limited to mobile phones. That's what worries Washington the most.

The author is a senior editor with the People's Daily and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn. Follow him on Twitter @dinggangchina