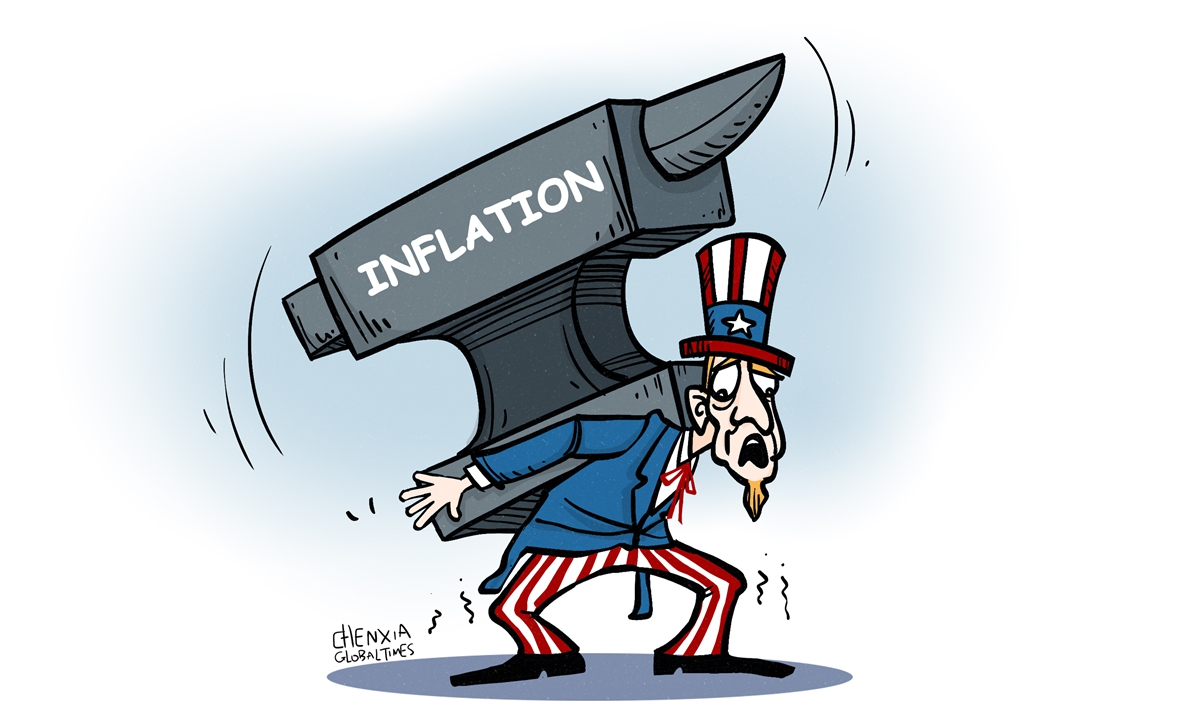

Illustration: Xia Qing/Global Times

Investors expect the US Federal Reserve to maintain interest rates at current levels during its upcoming meeting on Tuesday and Wednesday. If the Fed really does so, another question arises: Will US inflationary pressure continue to climb? It is evident that the US is currently caught in a monetary policy dilemma.US inflation accelerated in August for a second straight month. The Consumer Price Index rose 3.7 percent in August year-on-year, up from 3.2 percent in July. On a month-to-month basis, prices rose 0.6 percent, compared with a 0.2 percent gain in July.

Whether the Fed hikes rates this week or leaves them unchanged, one thing is certain: There is limited policy space for the US. Since March 2022, the Fed has raised interest rates by 525 basis points to control inflation. The US central bank has currently set its benchmark overnight interest rate in the 5.25-5.50 percent range, a level last seen just prior to the 2007 housing market crash, and which has not been consistently exceeded for about 22 years. If the Fed continues adopting aggressive rate hikes, continuously tight monetary policy will increase the likelihood that the US economy will fall into a recession. The Fed has to be cautious in its actions.

The US added 187,000 jobs in August, but the unemployment rate jumped unexpectedly. Analysts said the figure was roughly in line with the monthly average seen from 2010-2019 but considerably below the white-hot job gains that marked the pandemic recovery.

If the Fed continues raising interest rates, it may have to slow down the pace of hikes; otherwise, rising interest rates will put heavy pressure on the US job market. That's what the Biden administration does not want to see, especially before the 2024 US presidential elections.

There is only limited room for the US to adopt aggressive rate hikes, although a fresh sign of rising inflation pressure is adding difficulties for the US economy. Without the constraints of the Fed's extremely tight monetary policy, will inflation continue to rise in the coming months? Some analysts are already worried about whether there will be a "second wave" of inflation in the US.

Gas prices were the largest contributor to the CPI's acceleration in August. As reported by CNN, the oil market's fluctuation has been driven by concerns about supply. For instance, Saudi Arabia and Russia surprised the market by extending their supply cuts through the end of the year.

US oil prices climbed above $90 a barrel on Thursday for the first time in 10 months, threatening to push gasoline prices even higher and heating up inflation across the economy. If oil prices are still on an upward spiral, it will probably mean US inflation has not peaked yet.

Some politicians in Washington project that inflation could drop to about 3.3 percent by the end of this year and to 2.5 percent next year. However, an increase in inflation means the US economy would be further from the target rate, and the level of uncertainty would rise.

In the face of economic uncertainty, if the Fed continues raising interest rates, a stronger dollar will likely depress economic growth in developing countries. That's why the upcoming Fed meeting is receiving widespread attention. Amid economic uncertainty, it's crucial to strengthen industry and supply chains among developing countries to withstand external shocks such as a strong dollar.

Asian economies should be prepared for currency depreciations and find ways to avoid them. As the world has entered a period of turbulence, only cooperation can help economies deal with external risks.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn