The Bund in Shanghai ushers in a large flow of tourists on October 1, 2023. Photo: VCG

Editor's Note: One major aspect of Western media's vilification of Chinese economy is their assertion that "China is slipping into deflation." However, with China's consumer price index returning to positive territory in August, the fallacy has been debunked. The sinister intention behind Western media's hype over "deflation" is to peddle fear and anxiety, frightening away global investors. The Global Times interviewed renowned economist Yao Jingyuan, a special researcher of the Counselors' Office of the State Council, to point out the absurdity of Western media's hype of "deflation" and to clarify the improvement of China's economic recovery.

Yao Jingyuan Photo: VCG

Deflation is an economic phenomenon that refers to a continuous decrease in the price level of goods and services in an economy, which often disrupts expectations for investment and consumption and undermines prospects for economic growth.

Fundamentally, deflation and inflation both stem from monetary issues. The current inflation plaguing many Western economies is due to an excessive issuance of currency, while conversely, the cause of deflation is a shortage of money supply on the market.

Whether it is during the battle against the three-year COVID-19 pandemic or the post-pandemic recovery since the beginning of this year, China has consistently maintained prudent financial policy from an overall perspective. There is no basis for deflation to occur in the country.

In theory, the proper growth rate of M2 supply in an economy should be equal to the sum of GDP and CPI. However, in recent years, the growth rate of M2 in China has been in the double digits, indicating a relatively loose monetary supply so as to stimulate the economy. Therefore, the Chinese economy does not have any issues related to insufficient currency issuance.

Since the outbreak of the pandemic, although China's CPI has remained at a low level, it has been largely stable. The main reason for the low CPI is that during the pandemic, the central government clearly proposed "to stabilize the Six Fronts and guarantee the Six Priorities" as the strategic goals to ensure basic livelihoods.

In terms of stabilizing consumer prices, China has significantly ramped up efforts to accelerate supply-side structural reforms. As a result, the overall supply in Chinese society is abundant, and as a result, there is no significant upward trend in prices.

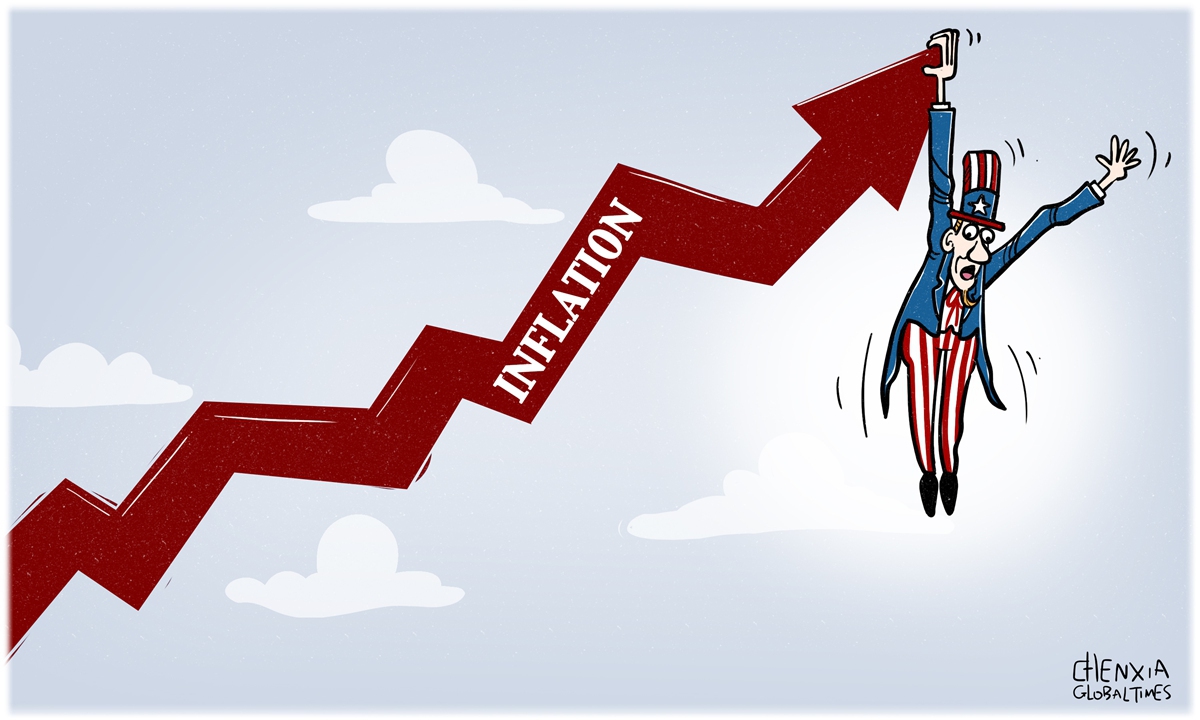

Some voices in the West claim that relatively low price levels indicates that China's economy is slipping into deflationary territory, which is untrue. If one compares China's price level with that of developed countries like the US and Europe, which are plagued by inflation, it is evident that China's economy has maintained stability amid the pandemic, largely ensuring the livelihood of the Chinese people.

Despite the impact of the pandemic, the Chinese economy remains highly resilient. The well-being of the entire society has been ensured. When comparing with other major economies in the world, China has achieved an important result in macroeconomic regulation by maintaining low and stable prices during the post-COVID recovery stage in the face of multiple pressures and headwinds.

It is unwise for the West to accusing China of slipping into "deflation" instead of their studying how to solve their own inflation woes, which have led to risks of economic stagnation and rising burdens on their residents.

This year, as the Chinese economy has been on a steady rebound and is gaining momentum to grow, there has been a gradual increase in prices. Despite China's consumer prices tipped into deflationary territory in July, they soon returned to positive territory in August, which indicates there is no continuous decline trend in the price level, let alone entering the "dangerous new phase" as claimed by The Wall Street Journal in August. The "deflation" fallacy has been debunked.

In fact, China's September economic data reflected a number of positive changes, including the factory activity bouncing back to expansion territory, and the retail data showing a significant domestic consumption rebound during the National Day and Mid-Autumn Festival holidays. With the strong consumption performance during the holidays in early October, it is expected that prices level and economic vitality in China will continue to improve for the better in the fourth quarter.

Recently, there are two important indicators to observe the actual state of the Chinese economy. One is the number of railway passengers and tourist volumes during the National Day and Mid-Autumn Festival holidays. Almost all tourist sites are crowded with sightseers, which completely contradicts the claims by Western media that Chinese consumers are not spending. The warming consumption remains a crucial driving force for the Chinese economy.

Another indicator is the prices of commodities. Recently, commodity price index has started to rise. The prices of major commodities such as steel, coal, non-ferrous metals, chemicals, and other materials have increased. This upward trend indicates an increasing demand from downstream manufacturing and processing industries. The rise in commodity prices signals a stabilization and improvement in the industrial sector, particularly in manufacturing and processing.

In a nutshell, the Chinese economy has maintained largely stable and resilient, as the country has followed the "seeking progress while maintaining stability" proposed at the Central Economic Work Conference in December 2022.

Why would the policymakers set that principle for China's economic recovery in the first place? The policymakers recognize the internal and external challenges faced by the economy, including weak external demands following the unprecedented assault of the three-year pandemic. And, they also recognize that the Chinese economy is transforming from high-speed growth to high-quality development.

The so-called "collapse theory" hyped by the Western media relies on outdated perspectives and assessment criteria. In the past four decades, China's economy has experienced rapid growth, tilting the observation of China's economy toward speed numbers and quantity indicators. China's economy is currently undergoing a transition from high-speed growth to high-quality development, and the most important indicators to observe the economic performance are those related to high-quality development.

Regarding the recovery of China's economy this year, the pessimistic views and criticisms from Western media fail to mention that this recovery is happening after the shocks caused by the three-year-long pandemic, and it is also facing significant challenges due to global economic headwinds.

The Chinese economy' "collapse theory" propagated by the West for decades is failing again, as China's overall economic production keeps on improving now. In this new historical stage as China's economy transitions from high-speed growth to high-quality development, if one wants to learn the real condition of China's economic performance, the most fundamental aspects are the indicators of quality of growth, including tech innovation, green development, and coordinated development.

The author is a special researcher of the Counselors' Office of the State Council. bizopinion@globaltimes.com.cn