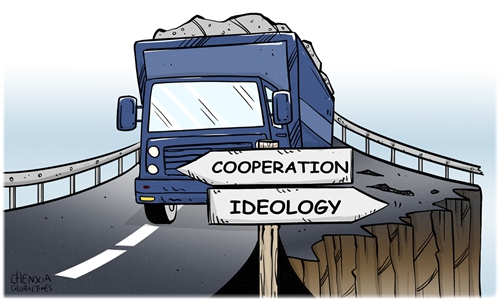

Illustration: Chen Xia/Global Times

With the price of lithium carbonate crashing amid an oversupplied market, one question worth considering is: how to avoid being caught in a geopolitical trap and ensure the stability of the global lithium industry and supply chains.The price of lithium carbonate, the key material for batteries to power electric vehicles (EVs), continued in free fall amid increased supply. On Tuesday, the spot price of lithium carbonate dropped to a more than two-year low of 124,000 yuan ($17,417) per ton, according to media reports.

Not long ago, the lithium shortage was a hot topic. Reuters published an article in January 2022 saying that lithium was in hot demand due to rapidly growing production of EVs that use lithium-ion batteries. At that time, there was a global supply shortage of the metal, with Western countries racing to bring on new mines to compete with China.

The lithium market has entered a period of surplus now. As a result, the price of lithium carbonate went into a free fall. On December 1, Reuters reported that benchmark lithium carbonate prices in China, Japan and South Korea stood at $18.50 per kilogram on November 30, down 77 percent from $81 per kilogram in November 2022.

So, what has happened? As the world shifts up a gear in its transition to EVs, lithium has been viewed by some Western political elites as a strategic resource for future technologies. They have tried to make critical minerals a new battleground for big powers.

In June 2022, the US and some of its economic partners announced the establishment of the Minerals Security Partnership (MSP), an initiative aiming to "catalyze public and private investment in responsible critical minerals supply chains globally."

Multiple efforts have been made to strengthen US leadership in the world by creating a parallel supply chain completely independent of China. This is one part of the economic "decoupling" or "de-risking" theory.

At a time when the US-led West tries to form a parallel industry chain to strengthen the control of strategic mineral resources, adopting a hard-line approach catalyzing public and private investment, an inevitable outcome is overcapacity, which refers to actual production capacity beyond market demand, or beyond the normal level of expectations. Put more bluntly, investment driven by geopolitical factors exceeds real market demand, disrupting the supply-demand balance and global supply chains.

A free fall in the price of lithium carbonate is the result of multiple factors, among them economic "decoupling," or forming economic "small circles" that exclude China, which may have a negative impact. The lithium industry may be a highly cyclical one, subject to a boom-bust cycle. So, it is normal to see two-way price fluctuations. However, the fluctuations may have been greatly amplified due to zero-sum geopolitical competition. The US-led West should take full responsibility for disrupting global supply chains.

Citing CITIC Futures, Reuters said in its report that the price of Chinese lithium carbonate will probably drop to as low as 80,000 yuan a ton in 2024, averaging at about 100,000 yuan by the end of this year, equivalent to production costs in Jiangxi, China's biggest producing region of the chemical.

China has advantages in lithium-related technologies. If the selling price of lithium carbonate is lower than the production cost in China, which will lead to cuts in production capacity, then other developing countries, many of which have relatively outdated production technologies compared with China, will suffer a bigger blow.

Some analysts forecast that the world could face a shortage of lithium as demand for the metal ramps up, which could come as soon as 2025. If this becomes a reality, it will cause more losses to the global EV industry.

In this context, it is necessary to avoid being caught in a "decoupling" push, which will continue to push up overcapacity and disrupt the global lithium industry chain. Economic rather than political factors should be allowed to determine the supply-demand balance.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn