Does 'Chinese garlic threatening US national security' rhetoric signal escalation of Washington’s trade war against Beijing?

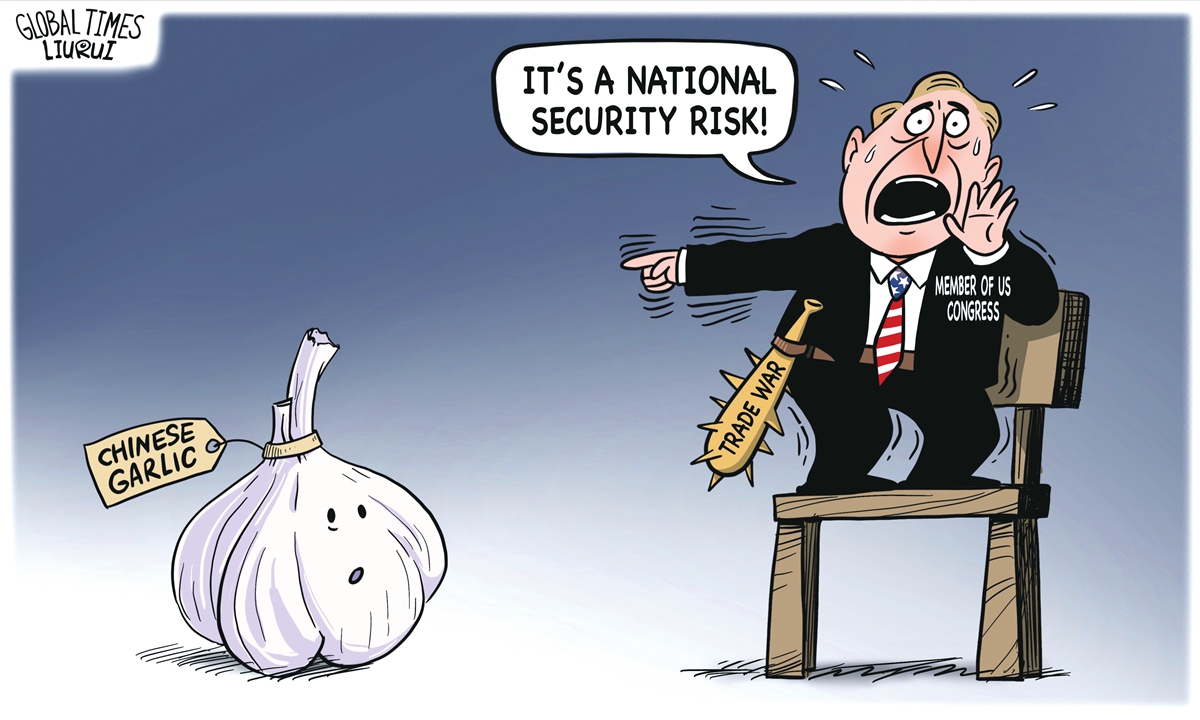

Delusional. Illustration: Liu Rui/ GT

A US politician argues that importing garlic from China threatens US national security. This is not a tale of black humor but rather a warning that Washington may escalate its trade war against Beijing.According to the BBC, Republican Senator Rick Scott has urged the commerce secretary to launch a government investigation into the potential impact on national security caused by garlic imports from China, alleging that Chinese garlic is unsafe.

The senator's argument is based on the assertion that Chinese garlic, including the possibility of the garlic being grown in sewage, presents serious health concerns.

These claims have long been debunked and are now being resurrected by a US politician. Such a revival is not accidental. It potentially signals a forthcoming escalation in the US-launched trade war with China and suggests that the US market for Chinese products is still being restricted. The "decoupling" has not ceased and shows no signs of ceasing.

China is the world's leading garlic producer and a major garlic exporter to the US. In recent years, the US has repeatedly increased tariffs on Chinese garlic, citing anti-dumping measures, with American garlic growers and producers supporting these restrictions. Consequently, Chinese garlic exports to the US have sharply declined, significantly impacting Chinese farmers.

According to Scott, the US Government Accountability Office (GAO) has found that unpaid anti-dumping and countervailing duties are concentrated in a few products. Fresh garlic was the top product with unpaid duties totaling over $500 million.

Despite recent growth in US garlic production, the gap left by Chinese garlic is primarily being filled by Spain and other countries. As a result, there has been a continual rise in the price of garlic in the US market.

While Chinese garlic exports to the US represent a small fraction of overall US imports, they form part of the Trump administration's tariffs imposed on approximately $370 billion worth of Chinese goods.

According to statistics from The American Action Forum, tariffs on items such as toys, paint and soap cost consumers around $50 billion annually. This has undeniably played a pivotal role in driving the highest inflation experienced by the US in 40 years.

Will this prompt the US government to readjust its economic and trade ties with China? Not at this moment. It is premature to conclude that inflation will ultimately end the US trade war.

The trade war initiated by the Trump administration has transformed into a protracted test of the economic resilience of both sides, crucially impacting job opportunities.

The US continues to impose high-end sanctions, primarily seeking low and middle-end alternatives to curb Chinese products. While immediate replacements may not be feasible, they could still keep importing the items from China until they find any substitutions. Overall, the US remains committed to the strategic displacement of Chinese manufacturing within the industrial and supply chain, including recent measures targeting so-called forced labor by banning imports from three Chinese companies.

Despite ongoing growth in China's exports to the US, the continued advancement of this strategic displacement has created uncertainty for the future.

It is currently unclear to what extent the US can endure the costs of such a strategy or whether policy adjustments will be made to alleviate the mounting pressure on the US economy. The question remains: How far will the "decoupling" extend before it halts?

As a result, economic and trade relations between China and the US have entered an unpredictable phase, marking a significant shift in global economic and trade ties.

China will not rely on the US being unable to withstand pressure to break the chain and adjust policies. Chinese companies cannot wait for the US to find a replacement and then find ways to adapt.

More Chinese manufacturers are seeking to maintain export stability in the US while also beginning to find new markets and links. This change can be seen from China's export data over the past year or so.

The challenge for China lies not only in how to expand and stabilize export channels and scope, but more importantly, in the process of such an adjustment, in how to consolidate the stability of the global industrial chain and supply chain. This involves reconstructing the international trade order, including the provision of support for this order in all aspects such as logistics, online shopping, finance, among others, which is the most intense game between China and the US in the global trade scenario.