China's stronger recovery in 2024 a big opportunity to provide boost to the world: WEF Managing Director

Photo:Xinhua

Editor's Note:

This year's annual meeting of the World Economic Forum (WEF) took place in Davos, Switzerland, from January 15 to 19. Under the theme of "Rebuilding Trust," the event attracted nearly 3,000 leaders from 120 countries. What are the opportunities and obstacles to rebuild trust? What is the prospect for the global economy in 2024? What role can China play in the global economic recovery? Global Times (GT) reporter Xu Hailin discussed these issues with the Managing Director at the WEF, Saadia Zahidi (Zahidi).

GT: What do you think are the best ways to rebuild trust in this background for the global economy? What role could China play in this process or in which fields can China contribute more to the global recovery?

Zahidi: We're entering this new phase in which we potentially don't have the same level of growth rates that we've had in the past. I think both for developing economies and for developed economies there's a slowdown in growth. This year's projection from the International Monetary Fund for now is 2.9 percent, slightly less than last year. Overall, the long-term growth rates for developing and developed economies have slowed down.

I think there needs to be a rethinking around fundamentally what that model for growth is for developed and developing economies. Where should the investment go? Is it in human capital? Is it in building out more artificial intelligence and more support for things to be more efficient across our economies? Is it about the green transition? Is that part of the focus? And I would say the answer is all of the above. It's about investing in human capital. It is about investing in artificial intelligence and new technologies. And it's also about supporting an energy transition, which could lead, in the long term, to a lot of localized energy sources, and can be very good for economies, for local economies, and for lowering the prices of energy over time.

So those are the things that need to get done. And when it comes to China, the country has a leading role in that energy transition. I think it is very important that the green technologies that are developed in China are then available and shared with the rest of the world, with China being the leader in that space, similarly for artificial intelligence. I think that's where greater cooperation between different countries on artificial intelligence is also needed so that we can continue to have joint systems, risks and opportunities that can be met and managed together. What is also needed includes digital trade, infrastructure, and all kinds of manufacturing to continue to be a big strength in China.

GT: You have mentioned in other interviews that this year would be crucial for the whole world to recover. Why? And what is the economic outlook for 2024?

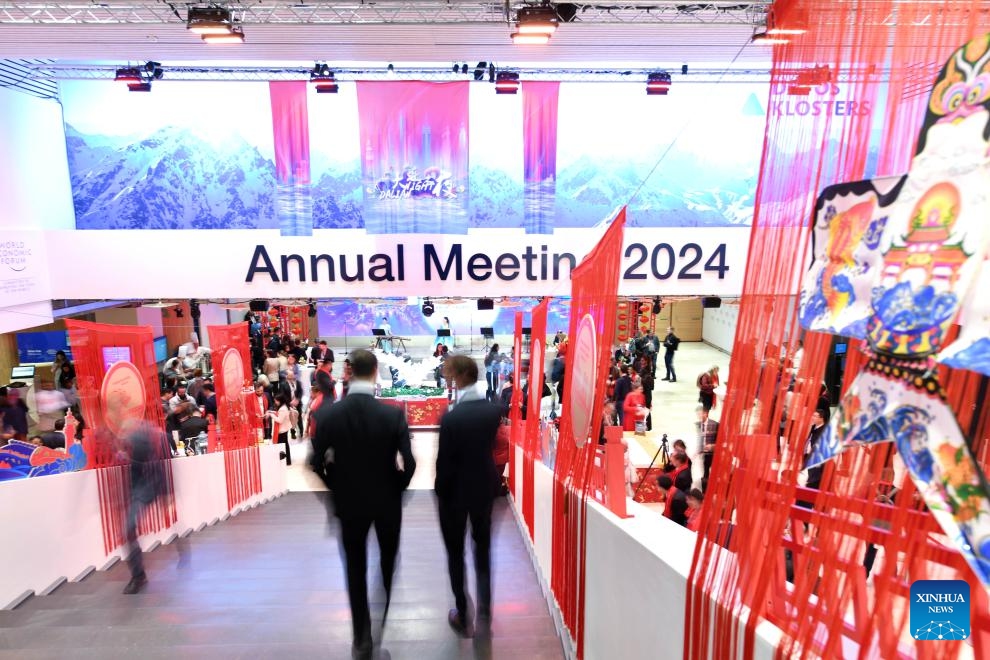

People attend a reception held by China's Dalian City during the World Economic Forum (WEF) Annual Meeting 2024 in Davos, Switzerland, Jan. 16, 2024. Dalian, the host city of the Annual Meeting of the New Champions 2024, held a reception on Tuesday evening in Davos. The event featured a cultural performance and local gourmet cuisine to celebrate the Chinese Lunar New Year in snowy Davos.(Photo: Xinhua)

Zahidi: There's quite a mixed picture and I would say a slight majority has a positive outlook for the global economy. About 56 percent roughly of the chief economists surveyed are expecting a positive outlook, but 43 percent are not. They're concerned about an economic downturn.

I think that's understandable because first, there's the uncertainty around inflation. Now we're starting to have inflation come down, but it doesn't mean that consumers are not facing elevated prices compared to a year ago. The basket of goods that most consumers are buying is more expensive than it was a year ago or two years ago. So that is continuing to impact people's daily lives and that concern around economic distress and economic hardship continues. A second element is the policy decisions from central banks to deal with inflation in Europe, the US and several other parts of the world. Now, there's always a risk of moving too fast or moving too slow. That's something that central banks have been very cautious about. They have made it very clear that there shouldn't be an expectation from markets and there is going to be an immediate easing of operations.

And then finally, I think the third element is, we're seeing new shocks. There is likely a possibility of new supply shocks. We're seeing what's happening in the Red Sea that can disrupt shipping routes and the supply of food, energy and other goods and services, which can again lead to increased prices. I think overall, all of that together, the shock of the pandemic, the shock of the war in Europe and the shock of the war in the Middle East are adding risks to the global economy.

Now that said, I definitely don't want to be doom and gloom about this, because I think if we also look at part of what the chief economist report tells us, there are bright spots around the world. Their view is that two-thirds of them still expect moderate growth from China, so they do expect that a recovery will continue, perhaps slower than was expected last year, but that a recovery will continue. South Asia is another bright spot, so there are fairly high growth rates expected for India. There are high or relatively positive growth rates expected for Latin America as well. So I think there are silver linings around the world.

When it comes to the medium to long term, there are opportunities about what artificial intelligence will do to productivity, and how it will make so many more things more efficient and easier and potentially provide an opportunity for workers to be augmented. It doesn't come without risks. It also means that there are some roles and tasks that could be automated over time. There's also the risk of misinformation and disinformation when it comes to artificial intelligence. So those risks need to be managed. But in the longer term, there may be a gain in productivity.

GT: Speaking about the positive perspectives about the developing countries, what is the role of the developing countries in this process?

Zahidi: I think there has to be a sort of stocktaking of what is the path to development for developing economies. And in the past, there has been a focus on competing on the basis of wages, cheap manufacturing and cheap labor, and relying on that as the pathway to growth in a highly globalized world that was looking for very ultra-efficient supply chains. I think that is something that developing economies will have to rethink.

Now, a lot of, for example, multinationals are looking to invest in a way that is going to make them more resilient, not necessarily going only for efficiency. And it means that developing economies have to start thinking a bit more about investing in security, investing in infrastructure, investing in their people and ensuring that there's very skilled labor that is available.

A second opportunity is being part of digital trade and digital supply chains. Pockets of highly talented, highly skilled people and efforts by developing economies are part of those digital value chains. I think this is another massive opportunity for growth. And then different developing economies have different strengths, but there are ways in which they can be playing to those trends at this particular moment. For example, countries that have a lot of raw materials in terms of green metals and minerals have a big opportunity at present as well.

GT: How can the opportunities brought by China's further opening-up be perceived?

Zahidi: I think it's very clear that the affairs of China, one of the two largest economies in the world, can impact the rest of the world, and how China's internal market functions and how China trades and connects with the rest of the world has a big impact on the global economy. I think that's incredibly obvious. As China's recovery gets stronger and stronger over the course of this year, which is the expectation from two-thirds of our chief economists, there will be a big opportunity to provide a boost to the rest of the world.

GT: You have been working with WEF for over 20 years, so you must know that China has always had a long-term relationship with the forum. Chinese state leaders have always passionately participated in the forum. What are your expectations for and how do you evaluate China's participation this year to help the recovery of the global economy?

Zahidi: First, we're absolutely delighted to have the Chinese premier joining us here at the annual meeting to open up the meeting on Tuesday. And I think it's been over a decade that we've been holding our annual meeting of the New Champions in China. Before that, for a long time, we had a lot of "bringing China to the world and the world to China" through world economic forum activities there. With our ongoing presence and our office in China, we continue to do a lot of work initiatives that are focused locally as well. So I think overall for us, it's a very important partnership and collaboration, and we look forward to continuing it.