A teller counts U.S. dollar bills at a bank in Qionghai, south China's Hainan Province.Photo:Xinhua

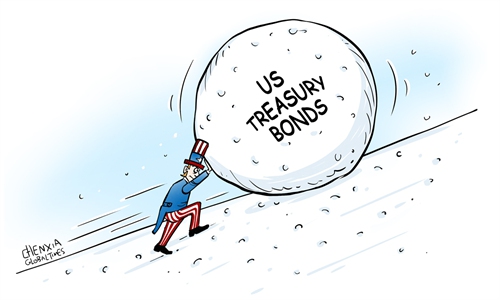

China's holdings of US Treasury debt fell to $797.7 billion in January, ending a two-month increase, according to data released by the US Department of the Treasury on Tuesday.

As the second largest-holder of US government debt, China's holdings in January fell by $18.6 billion from December. Since April 2022, China's holdings of US Treasury debt have remained below $1 trillion.

During the full year of 2023, China's US debt holdings decreased by a net $50.8 billion.

"China's increase or decrease in its holdings of US debt is mainly based on the country's balance of external payments. In addition, the profits on US bonds may have some impact," Xi Junyang, a professor at the Shanghai University of Finance and Economics, told the Global Times on Wednesday.

Xi noted that short-term fluctuations in China's holdings of US Treasury debt are normal. Considering the need to reduce its dependence on US debt, gradually cutting its holdings will become a trend for China, he said.

Among the top three foreign government investors, the UK, as the third-largest holder, also chose to reduce its holdings of US government debt in January. The holdings of the UK stood at $753.5 billion, down $200 million from a month earlier, falling from a record high set in December and the first decline in four months.

Japan has been the largest overseas holder of US Treasury debt since June 2019, when it surpassed China. In January, Japan's holdings exceeded $1.15 trillion, hitting a new high since August 2022 for a second month and increasing by $14.9 billion from December last year.

China's State Administration of Foreign Exchange (SAFE) announced last month that as of end-January, China's foreign exchange reserves stood at $3.219 trillion, down $18.7 billion from a month earlier.

The SAFE reiterated that the scale of foreign reserves was affected by the combined effect of exchange rate translation and changes in asset prices, pointing out that the US Dollar Index rose in January, and global financial asset prices were mixed.

The basic trend of China's economic recovery and long-term improvement has not changed, which is conducive to maintaining stability in the scale of foreign reserves, the SAFE said.

Analysts noted that in the medium to long term, the willingness of overseas capital holders to invest in US Treasury bonds will continue to diverge.

On the one hand, some private capital is betting on profits from US debt holdings due to this year's Fed interest rate cuts.

On the other hand, overseas central banks are still steadily promoting the diversification of their foreign reserves.

More are considering the allocation of gold as an alternative to US Treasury debt due to inflation, geopolitical risks and greater diversification in the global reserve currency system.

Global Times