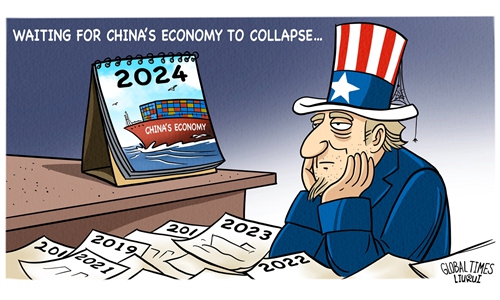

The hopeless fault-finder Illustration: Liu Rui/GT

Putting all the blame on China for economic problems in the US seems like an easy way for the Biden administration to pass the buck. However, the more that people in the US blame China, the fewer are actually working on a real solution. This is why the growing US tendency to shift blame onto Chinese manufacturing is a concerning sign.US Treasury Secretary Janet Yellen said on Wednesday that when she next visits China, she would raise concerns that China's excess production capacity may distort global markets and hurt jobs in other industrial and developing economies, Reuters reported.

Yellen is one of the Biden administration officials who have recently expressed concern about China's overcapacity "flooding the market with cheap goods."

But ironically, while she talked about the negative impact of excess capacity in China, a new study by the Federal Reserve Bank of New York suggested that China's efforts to boost manufacturing and shore up the economy could put "meaningful upward pressure" on US inflation and push back the start of monetary easing, Bloomberg reported on Tuesday.

How could low-priced products from China's "excess capacity" contribute to inflationary pressure in the US? If anything, this is a typical example of how the "blaming Chinese manufacturing" rhetoric of US officials and economic agencies is often contradictory and nonsense for anyone with basic economic understanding.

The illogical accusation against Chinese manufacturing shows that the US is quick to blame China for its own economic woes, while failing to acknowledge its own role in the matter.

The scapegoating only serves to divert attention from America's own issues, and often leads to misconceived economic and trade policies, such as trade barriers and protectionism. This deters Washington from addressing the problems, while exacerbating inflation and market distortion.

Take the US inflation dilemma as an example. It is no secret that inflation has not yet reached a level where the Fed can be certain about cutting rates. It is not China's fault, but America's economic policy that is to blame for the problem. There is also no chance that the inflation problem can be addressed by suppressing China-made goods.

The Fed's helicopter monetary policy during the pandemic and subsequent interest rate hikes have had serious consequences for the US economy, which have been directly reflected in the recent crises in the commercial real estate sector and US regional banks.

Moreover, trade-distorting practices with China are a significant factor contributing to high inflation in the US. The US initiated a trade war with China by imposing additional tariffs on imports of Chinese goods, leading to increased prices for low- and medium-end products. A 2021 report by Moody's stated that US importers absorbed more than 90 percent of the additional costs caused by the increased US tariffs on Chinese goods.

Also, the US has promoted the concept of "decoupling" and "breaking the chain," compelling companies to relocate their outsourcing operations, which only leads to higher costs of production, purchasing and operating.

Washington has shown growing protectionism to keep its domestic markets and protect jobs, which, however, has not improved industrial competitiveness but led to a spiral of workers' wages and rising prices. The United Auto Workers strike is a prime example.

Fundamentally speaking, the root cause of the China-US trade imbalance is not that Chinese products are cheaper. There is nothing wrong in US demand for Chinese products, and the US can balance the trade account by exporting more high-end products to China and participating more actively in China's economic development.

However, its trade policy toward China is aimed at severing this complementary relationship, which is detrimental to both sides.

A recent poll by the AP showed that 57 percent of Americans think the national economy is somewhat or much worse off than before Biden took office in 2021. This actually calls for policymakers to reflect on their economic and trade policy choices. Cracking down on China won't make America's economic problems disappear, but only lead to misguided policies that could exacerbate them.

Violations of the law of the market for political purposes will eventually be punished by the law of the economy.