The political atmosphere is increasingly tense as the 2024 US presidential election approaches. Recent polls indicate a decline in support for the incumbent President Joe Biden, with former President Donald Trump seeing a rise in support. According to a survey published on Monday by The New York Times and Siena College, Donald Trump is leading Joe Biden among potential voters in all swing states except Michigan.

Trump appears to have a higher trust rating on economic issues than Biden, especially against the backdrop of escalating inflation concerns. A survey conducted by the Financial Times and the University of Michigan's Ross School indicates that fears of inflation among US voters have intensified yet again. Additionally, the survey shows that Donald Trump's economic approval ratings remain higher than those of Biden.

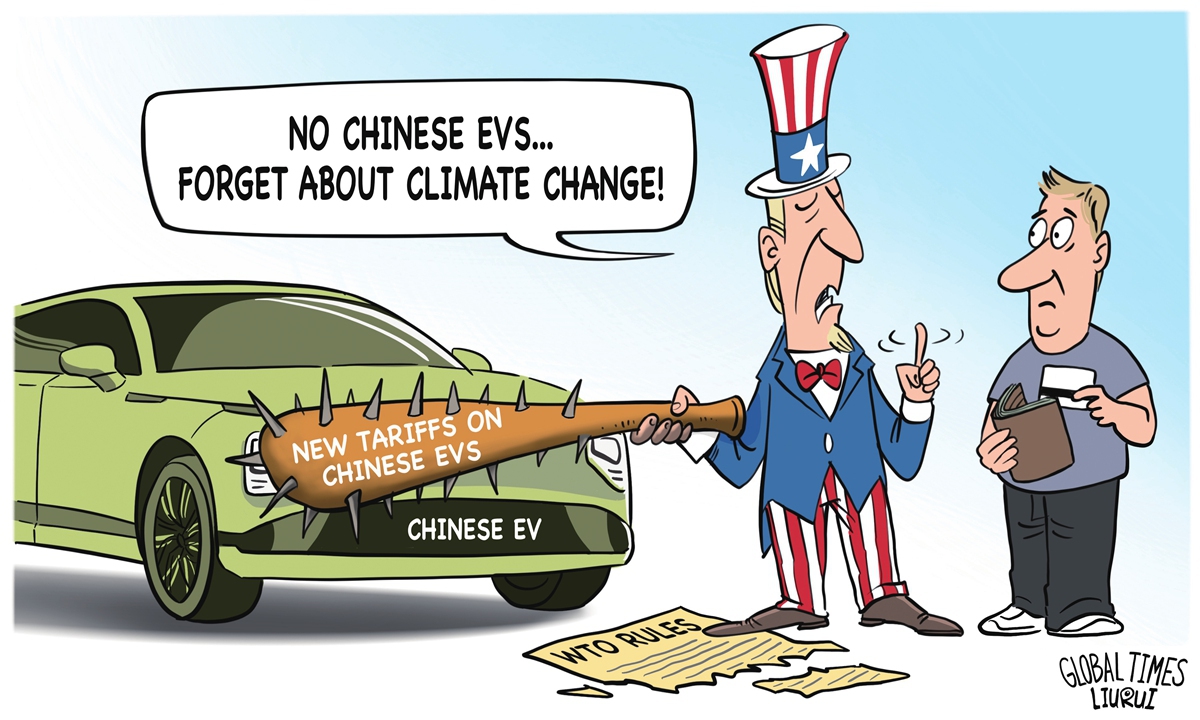

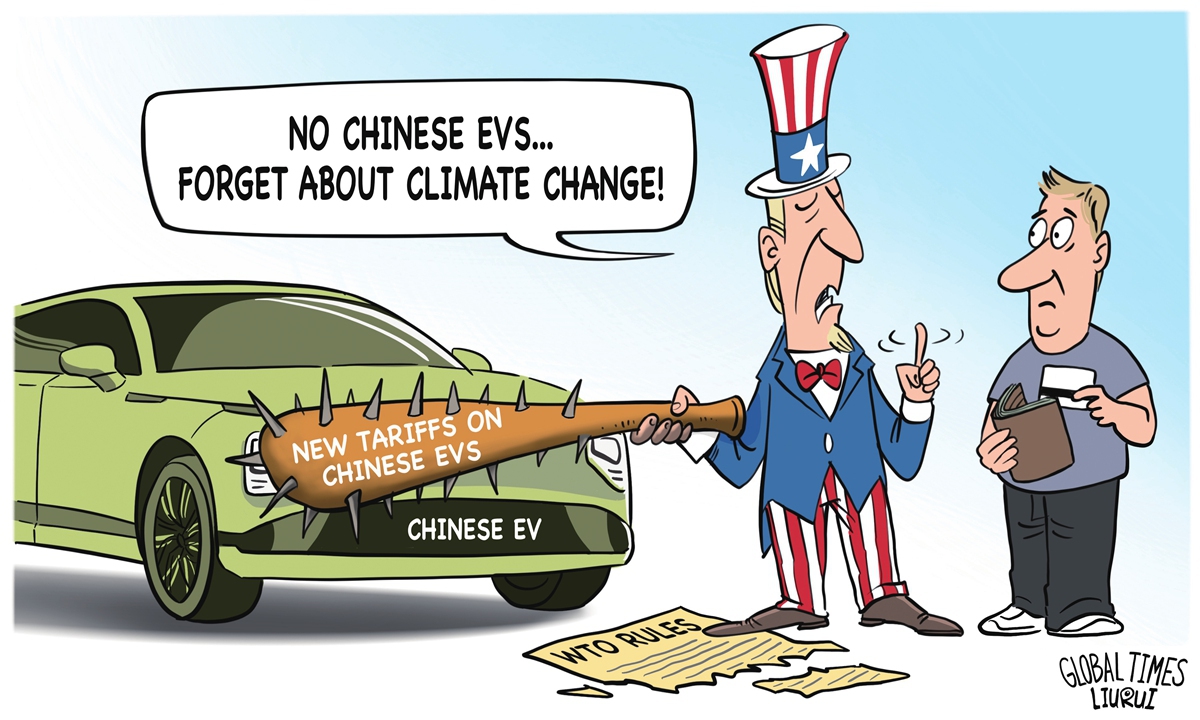

In this context, the Biden administration has recently decided to impose new tariffs on imports from China, including electric vehicles, solar cells, steel, and aluminum products. This move is widely interpreted as a policy action to show support for key labor unions, particularly the United Auto Workers (UAW), the United Steelworkers (USW) and the International Brotherhood of Electrical Workers (IBEW), which are closely associated with these products. These three major unions, which traditionally are significant supporters of the Democratic Party, have millions of members.

Biden's decision may politically cater to unions and protect domestic industries, but it has sparked widespread criticism. Many industrial groups representing US importers oppose this policy, arguing that the increased tariffs will raise supply chain costs and lead to higher prices for American consumers—a particularly sensitive issue when inflation is already a major concern.

The current inflation hike in the US partly stems from global supply chain disruptions and an uneven economic recovery in the post-pandemic era. Under these circumstances, imposing tariffs could further increase prices and exacerbate inflationary pressures. Although such policies might gain short-term support from unions and specific industrial sectors, they could harm a broader range of US consumers and economic health in the long run.

From a broader perspective, Biden's policy toward China appears to be driven by short-term political considerations. However, this approach could not only strain US-China relations but also create global economic shocks, potentially impacting America's relationships with other major economies.

Over the past three to four decades, the US economy has thrived on low inflation rates primarily due to cost-effective manufacturing in China. However, since initiating the trade war with China in 2018, the US has failed to keep inflation rate at a low level. In the long term, imposing high tariffs to curb Chinese exports to the US may not effectively address America's inflation issues, but rather potentially making inflation a persistent challenge for the US economy.

At the intersection of politics and economics, the Biden administration's decision reflects a persistent problem in American politics: electoral votes often take precedence over long-term national interests or economic health. Although this may help Biden gain short-term benefits in the elections, it is a gamble for the long-term welfare of the American people and the economy.

The author is a senior editor with People's Daily, and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn. Follow him on X @dinggangchina

Abusing tariffs. Illustration: Liu Rui/GT

US President Joe Biden's announcement to slap major new tariffs on Chinese electric vehicles, advanced batteries, solar cells, steel, aluminum and medical equipment on Tuesday has clear election considerations.The political atmosphere is increasingly tense as the 2024 US presidential election approaches. Recent polls indicate a decline in support for the incumbent President Joe Biden, with former President Donald Trump seeing a rise in support. According to a survey published on Monday by The New York Times and Siena College, Donald Trump is leading Joe Biden among potential voters in all swing states except Michigan.

Trump appears to have a higher trust rating on economic issues than Biden, especially against the backdrop of escalating inflation concerns. A survey conducted by the Financial Times and the University of Michigan's Ross School indicates that fears of inflation among US voters have intensified yet again. Additionally, the survey shows that Donald Trump's economic approval ratings remain higher than those of Biden.

In this context, the Biden administration has recently decided to impose new tariffs on imports from China, including electric vehicles, solar cells, steel, and aluminum products. This move is widely interpreted as a policy action to show support for key labor unions, particularly the United Auto Workers (UAW), the United Steelworkers (USW) and the International Brotherhood of Electrical Workers (IBEW), which are closely associated with these products. These three major unions, which traditionally are significant supporters of the Democratic Party, have millions of members.

Biden's decision may politically cater to unions and protect domestic industries, but it has sparked widespread criticism. Many industrial groups representing US importers oppose this policy, arguing that the increased tariffs will raise supply chain costs and lead to higher prices for American consumers—a particularly sensitive issue when inflation is already a major concern.

The current inflation hike in the US partly stems from global supply chain disruptions and an uneven economic recovery in the post-pandemic era. Under these circumstances, imposing tariffs could further increase prices and exacerbate inflationary pressures. Although such policies might gain short-term support from unions and specific industrial sectors, they could harm a broader range of US consumers and economic health in the long run.

From a broader perspective, Biden's policy toward China appears to be driven by short-term political considerations. However, this approach could not only strain US-China relations but also create global economic shocks, potentially impacting America's relationships with other major economies.

Over the past three to four decades, the US economy has thrived on low inflation rates primarily due to cost-effective manufacturing in China. However, since initiating the trade war with China in 2018, the US has failed to keep inflation rate at a low level. In the long term, imposing high tariffs to curb Chinese exports to the US may not effectively address America's inflation issues, but rather potentially making inflation a persistent challenge for the US economy.

At the intersection of politics and economics, the Biden administration's decision reflects a persistent problem in American politics: electoral votes often take precedence over long-term national interests or economic health. Although this may help Biden gain short-term benefits in the elections, it is a gamble for the long-term welfare of the American people and the economy.

The author is a senior editor with People's Daily, and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn. Follow him on X @dinggangchina