US future economic warfare with China will only deepen Australia’s rift with Washington: former Australian FM

Central Business District of Beijing, China (left) and Canberra, capital city of Australia. Photos: VCG

Editor's Note:

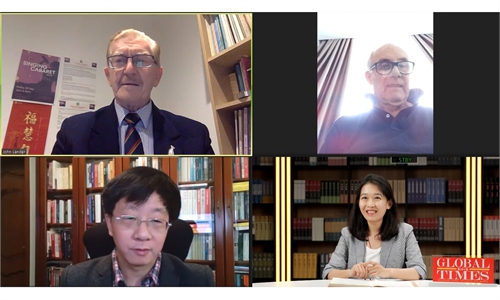

Optimism can be maintained when envisioning the future trajectory of China-Australia relations, which has encountered a number of challenges over the past years - this is the message Global Times (GT) captured in an exclusive interview with Bob Carr (Carr), former Australian foreign minister, during the 2024 Understanding China Conference (Guangzhou) recently. Why does Carr believe so? Will the next US administration bring more opportunities or more risks for China-Australia ties? Carr shared his views with GT reporter Li Aixin.

GT: How would you describe the current dynamic of China-Australia relations?

Carr: The relationship between Australia and China is sound. The consensus view in Australian politics, shared by both the opposition and the government, is that the relationship with China is important and should be improved, with trade being enhanced. It's very interesting that both sides of Australian politics say that, considering that the conservatives in the opposition - when they were in government nearly three years ago - were saying harsh and hard things about China.

But they now recognize that that's not acceptable to Australian voters, who want the government to look after not only Australian security but also Australian prosperity by maintaining and expanding trade with China, which is Australia's biggest market by a long way. There is no replacement.

It's now absolutely clear that for Australian exporters, India will not be a "new China." Australian trade with China is growing, and the idea of shifting to other markets in Asia has not been realized, because it is not possible. China and Australia are natural trading partners.

GT: Is trade the cornerstone of the relationship?

Carr: Yes. It's the biggest factor. Our countries are very different. Australia is part of the Western world and looks to the US for security. The political systems are very different. There are civilizational differences, but trade is the area where these two very different countries can do business to mutual advantage.

GT: Are you optimistic that China-Australia relations will not turn back?

Carr: I am optimistic. I think that if the Trump administration attempts to contain China or engage in economic warfare with China, it will simply see Australia further explicitly at odds with Washington.

For example, like China, Australia is committed to the regional trade pact, and both Australia and China support the continued work of the WTO. The US, however, remains hostile - even under Biden, the US has withdrawn and reduced its support.

Australia and China have even pursued trade in critical minerals where it's been in Australia's interest. We've concluded that it is safe to export these products to China.

In strategic documents, Australia has stated that the era of American primacy in Asia is over - that is, America is no longer able to have its way on every aspect of strategy in Asia. This is particularly interesting, given that Australia is such a strong American ally.

GT: You once said, "No need to see China's rise as a threat; the rise of China is good for China, good for the region, and good for the world." Could you elaborate on this?

Carr: I think that's the consensus in Australia. We want the Chinese economy to recover and resume its growth path. If it does, China will import more from Australia, which is good for Australian farmers, exporting seafood, exotic fruits or wine to Chinese supermarkets. It's also good for exporters of iron ore. If their sales to China increase, that means more revenue through taxation, which flows into the Australian government's budget. This enables us to do more for health, disability, defense and education.

The iron ore price, which reflects Chinese demand and the Chinese economy, determines whether the Australian budget is in surplus or not. So, we are absolutely a beneficiary of China's economic success.

That's why, even though we are a strategic partner and an ally of the US, we are not aligned with Washington in its commitment to contain China, to economically separate from China or to engage in damaging economic actions directed at China. That is absolutely not in Australia's interest.

The only way to lift world economic growth and to roll back extreme poverty is through more trade and more openness, as has been demonstrated again and again. When the US looks at using tariffs as an instrument of diplomacy, it would be doing so at the cost of American living standards. America's middle class needs cheap, competitively priced imports from China. It's the most obvious way to lift their living standards.

GT: You have consistently expressed opposition toward AUKUS. How do you assess the sustainability of it? Are there major challenges and risks AUKUS will face in the future?

Carr: I think the US will decide not to give Virginia-class submarines to Australia. The US is engaged in competition with China in terms of the number of nuclear-powered submarines, and it is falling behind, failing to reach its targets because its shipyards are so strained and it has acute shortages of skilled labor. These are problems that cannot be easily fixed. Extra money is not the simple answer here.

I think in a few years, an American defense secretary - whoever that is at the time - and an American president, most likely the president after Donald Trump, will say that we can't sell these Virginia-class submarines to Australia. Instead, they will tell the Australians that they've got an alternative: simply base American nuclear-powered submarines in Australian ports. They will say that some Australian sailors will be on board to learn how to crew nuclear-powered subs, and that's how things will end up.

For Australia, this means losing its sovereign submarine capacity, as the older submarines are retired, and we won't be getting Virginia-class subs from American shipyards. There will be a gap before the British-built submarines arrive, perhaps in the 2050s. People will reflect that it would have been a much better deal for Australia if we had acquired the French submarines, as former prime minister Malcolm Turnbull had committed us. These would have been conventionally powered submarines, protecting Australia's waterways, arriving by the end of the 2020s. But now, we are not going to have them.

GT: Is it possible that AUKUS will one day be abandoned?

Carr: I think it's too embarrassing for the politicians who signed up for it. They'll persist with this and allow the next generation of political leadership to deal with this failure.

GT: Will the next US administration bring more opportunities or more risks for China-Australia relations?

Carr: I think the economic nationalism of Trump and the resort to trade war will lead to Australia and China saying similar things about the need to avoid economic warfare and the need to emphasize market access and trade agreements.

I believe there will be a strategic difference between Australia and the US on this issue - specifically, the benefits of international economic engagement and the institutional architecture that supports it, specifically the WTO and its instruments.

Australia and China, along with other WTO members, have worked to set up a dispute resolution arrangement after the US abandoned its support for the appeals body under the WTO. I think we're going to see more of that cooperation.

Our trade minister, Don Farrell, described the export controls imposed by the Biden administration on China as draconian. So, even before Trump, Australia had been taking a critical view of American containment measures directed at China.

GT: When it comes to the topic of "understanding China," what do you think is the most important thing that needs to be understood about China?

Carr: Here's my challenge for China: China needs to demonstrate that it is not uninvestable. I think China should work with foreign investors from Europe, America and Australia to create a range of narratives showing how firms can make profits by investing their shareholders' money in China.

I think the astonishing thing about China is its urbanism, its urban planning and its grand concepts for larger communities serviced by outstanding infrastructure, high-speed rail, good architecture, quality housing and clean air.

When I came to China 30 years ago, there was a very high level of pollution. The air was thick. This is common in developing countries industrializing and mechanizing very fast. So, China has determined and demonstrated that environmental protection can be a very high-level objective, a serious goal that is compatible with, indeed necessary for, economic growth. That's a great advertisement for China.

A big part of the success story in Beijing is in the western areas, where I saw tree planting, the restoration of an old canal and new parklands. It's a very impressive story. Without China's investment in solar panels and EVs, the world wouldn't have a renewable sector. It's Chinese investment that has driven it and will continue to drive it.