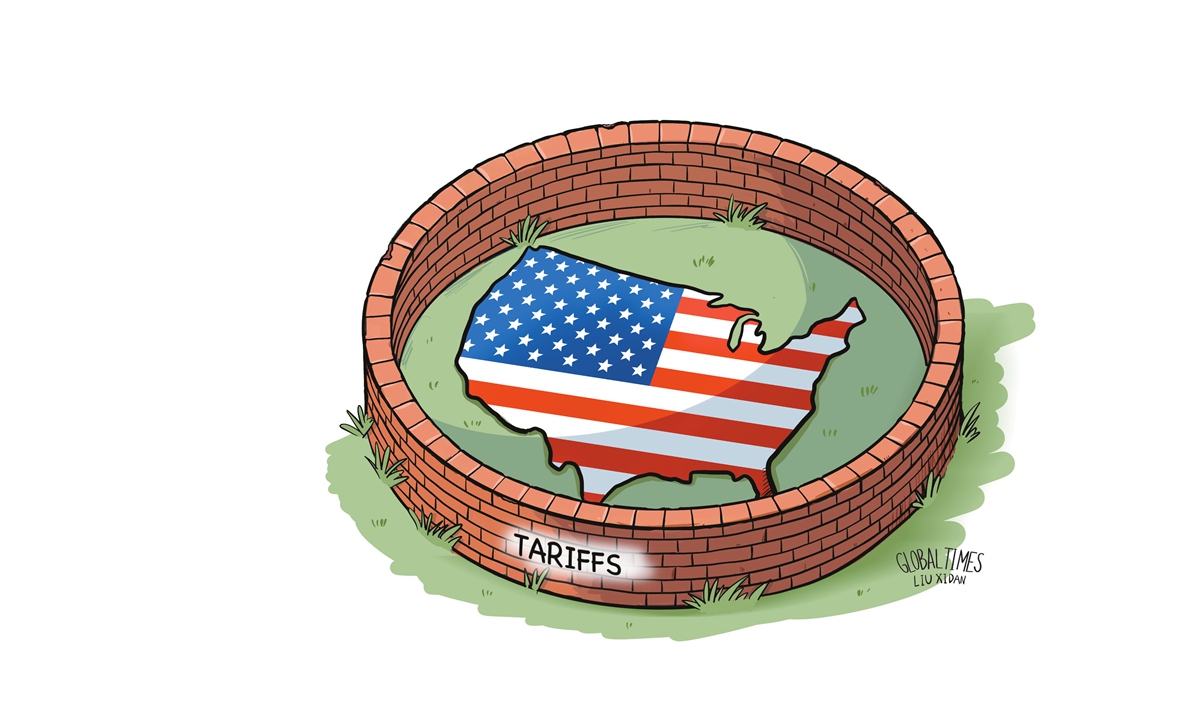

Illustration: Liu Xidan/GT

For much of the 20th century, the US persuaded the world that open, rules-based trade was good. Yet today Washington invokes a catch-all claim of "national security" to justify tariffs, export bans, and sanctions that make commerce resemble trench warfare.Supply chains are splintering, allies are hedging, and American firms are losing the very global scale that once underpinned their dominance. If this weaponized trade posture endures, the US will not merely weaken its competitors; it will bankrupt its own future while accelerating a poorer, more divided world. Economic power has never been sustained by crippling others but by outperforming them.

Two strategic blunders set the stage. First, policymakers elevated a strong-dollar doctrine that delights bond markets but prices US factories out of global bids. Second, the 2017 tax overhaul slashed rates for the wealthy while gutting full research-and-development deductions, steering capital away from labs and toward short-term financial engineering. Add to that the 20 years of trillion-dollar overseas wars that left domestic infrastructure to decay. As a result, the US entered the 2020s with eroded supply chains, swelling debt and flagging productivity. Confronting these self-inflicted wounds would require patience and investment. Unfortunately, scapegoating foreigners proved politically cheaper.

That scapegoating now dominates policy. Tariffs were sold as a jobs bonanza. Instead, manufacturers rerouted components through third countries, passed costs to consumers, or relocated to Vietnam and Mexico. Semiconductor export controls aimed at kneecapping China backfired when Huawei and SMIC unveiled a domestically designed five-nanometer chip, proving that restrictions can catalyze the innovation they hope to stall. Sanctions, once a precise instrument against "rogue regimes," now blanket entire industries over routine commercial disputes, inspiring nations to build payment conduits that bypass the dollar altogether. Each blow wins a headline, while eroding the very advantage it claims to defend.

The economic wreckage is measurable. Global automakers live in uncertainty, never knowing which border will sprout a tariff next quarter. US chip designers stare at R&D budgets that depend on Chinese revenue they can no longer book. Tourism, a soft-power jewel, has plummeted as snarled visa lines and hostile rhetoric deter visitors, costing tens of billions in lost spending. Most ominous is the quiet exodus of trust: Europe and Asia are stitching together regional trade pacts that omit the US, while commodity exporters price contracts in euros, yuan, or rupees to dodge sanction risk. Confidence, once fractured, rarely snaps back.

Yet the gravest cost is intangible - the slow rot of intellectual leadership. US universities, cradle of the transistor, the internet and mRNA vaccines, are vilified as partisan ivory towers. Real federal science funding is shrinking while states are fighting culture wars over textbooks and tenure. A nation that disinvests in curiosity will soon discover that others have seized the commanding heights of quantum, biotech and clean energy. No tariff can redeem such a loss.

Nevertheless, Washington can still change course, but the window is narrowing. To do that though, four shifts are essential: First, compete, don't contain. Superpowers endure by raising productivity, not barricades. Launch a 20-year moonshot in advanced manufacturing, AI and climate tech; subsidize the risky first plants, then let firms chase global customers at scale. A rule of thumb: if a policy cuts off US companies from the world's fastest-growing markets, it is self-defeating.

Second, re-empower the knowledge base. Restore full R&D tax credits, triple the National Science Foundation budget, and issue green cards with every STEM doctorate. Immigration is not a concession; it is a weapon. The US greatest comparative advantage is its ability to attract talent - squandering it is economic suicide.

Third, recommit to multilateral rules. The World Trade Organization needs reform: stricter limits on industrial subsidies, clear norms for data flows and fast-track arbitration.

Fourth, rebalance guns and girders. A republic cannot indefinitely police three oceans while its bridges collapse. Retrench redundant deployments and redirect the savings to ports, grids and broadband - the arteries that decide whether factories stay or flee. Security rooted in domestic strength is harder to threaten and cheaper to sustain.

Disregard the skeptics: US prosperity sprang from openness - welcoming immigrants, exporting to rivals, and trusting that new industries would outrun vanishing ones. The surest route to real insecurity is to wall off ideas and markets, forcing allies to drift and adversaries to improvise.

Every tariff hike, every blanket sanction, nudges another government to question the dollar's dominance. Confidence is a fragile currency; once squandered, it trades at a painful discount. Yet confidence can be restored if the US reembraces a foreign-economic strategy grounded not in fear but in relentless self-improvement. The US wrote the original rulebook on open markets because open markets amplified US prosperity.

The choice is stark but simple. Down one road lies isolation, duplication and irreversible decline. Down the other lies renewed prosperity built on persuasion, cooperation and innovation. The US must choose quickly and wisely - for its own sake and for everyone else's.

The author is a senior fellow of Taihe Institute and chairman of Asia Narratives. opinion@globaltimes.com.cn