US' 50% copper tariff sparks market turmoil; imports meet half of its domestic demand

A worker sorts copper production at El Teniente mine, the world's largest underground copper mine in Machali, Chile, on April 2, 2025. Chile is the world's largest copper producer, accounting for approximately 25 percent of global copper ore production. Photo: VCG

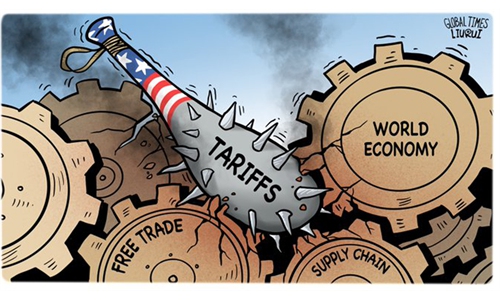

The US announced a 50 percent tariff on copper imports on Wednesday, which will go into effect on August 1. Many analysis reports pointed out that the US still relies on copper imports and it takes a long time to build up copper production capacity at home. Meanwhile, the tariff announcement resulted in a record spike in New York futures and a drop in the global benchmark.

Copper imports accounted for about half of the US domestic demand. Chile was the largest copper supplier to the US, according to data from the US Geological Survey.

Chile's Foreign Minister Alberto van Klaveren on Thursday said the US would not be able to replace the copper it was importing from the Latin American nation or other countries that supplied it, the Financial Times reported.

"Chile will obviously continue to find a market for its copper, there's no doubt about it. The world needs copper because copper is essential for the energy transition that is taking place around the world," van Klaveren said at a press conference on Wednesday.

Maximo Pacheco, chairman of Codelco, Chile's top copper miner, said the company wanted to know which copper products would be included and if the tariff would hit all countries, according to Reuters.

Pierre Gratton, president of the Mining Association of Canada, said the tariff is concerning for copper smelters such as Glencore's Horne facility in Quebec, Reuters reported.

The countries that would be most affected by the new copper tariffs will be Chile, Canada and Mexico, which were the largest suppliers of refined copper, copper alloys and copper products to the US in 2024, according to US Census Bureau data.

Chile is US' biggest copper supplier at 41 percent, followed by Canada at 27 percent. The US imported around 850,000 tons of copper (excluding scrap) in 2024, accounting for around 50 percent of its domestic consumption, according to an analysis report published on Wednesday by ING Think, a research institute of over 40 global economists.

According to Reuters, the tariff on imported copper aims at boosting US production of a metal critical to electric vehicles, military hardware, the power grid and many consumer goods.

However, many analysis reports pointed out that the US is highly reliant on copper imports and it takes a long time to build up copper capacity in the US.

Jefferies LLC analysts wrote in a note that "the US does not have nearly enough mine/smelter/refinery capacity to be self-sufficient in copper," and that "as a result, import tariffs are likely to lead to continued significant price premiums in the US relative to other regions."

"A 50 percent tariff on copper imports would hit US companies that use the metal because the country is years away from meeting its needs," said Ole Hansen, head of commodity strategy at Saxo Bank.

Citigroup Inc called it a watershed moment for copper, closing the window for significant shipments into the US market.

Bloomberg also noted that if the tariff takes hold, it will inflict higher costs across a broad section of the US economy due to the myriad of industries and applications that rely on copper.

The analysis report by ING Think said that "the US produces only about 5 percent of the world's copper and has seen a 20 percent decline in production over the last decade. Building new mines in the US can take up to 29 years due to lengthy permitting processes."

Earlier on Tuesday, US Commerce Secretary Howard Lutnick told CNBC that the Trump administration wants to bring "copper production home." He noted that Trump's move will bring copper tariffs in line with US duties on imports of steel and aluminum, which Trump doubled to 50 percent in early June.

According to ING Think, the US' previous tariffs on steel and aluminum did not lead to increased domestic production of the two metals. In 2024, the output of the US steel industry was 1 percent lower than it had been in 2017 before the introduction of the first round of tariffs by Trump, while the aluminum industry produced almost 10 percent less.

The tariff announcement also caused turmoil in the financial market.

The three-month benchmark copper futures on the London Metal Exchange were down 1.63 percent at $9630.50 a ton as of 9:20 am Singapore time on Thursday, a reflection of the unusually wide premium that's developing between US copper and the metal elsewhere, according to CNBC.

Copper futures climbed as much as 17 percent in New York on Tuesday, a record one-day spike to an all-time high, before falling more than 4 percent in early trading on Wednesday, Bloomberg reported.

Global Times