$24.1b online shopping spree indicates US is engaged in a symbiotic dance with China

Illustration: Chen Xia/GT

The dust has settled on the 2025 Summer Black Friday, and the numbers are staggering: In just four days, US online spending hit $24.1 billion. Retailers recorded online sales growth of 30.3 percent. Reuters reported that 53.2 percent of orders came from mobile devices, with discounts averaging over 20 percent.

What's clear is this: America's consumer market is in the throes of a seismic shift. The e-commerce surge isn't just a symptom - it's the engine driving this transformation.

Beyond a mere pivot from brick-and-mortar to online, this represents a wholesale rewiring of consumer behavior, supply chains, retail models, and global trade dynamics. And at the heart of it? An ever-deepening connection with Chinese manufacturing.

Dig into the data, and "Made in China" emerges as the backbone of this boom. On Amazon, 70 percent of goods are Chinese-made. Walmart clocks in at 60 percent, while Target and Best Buy hover around 30 percent and 30-35 percent, respectively. From electronics to apparel to kitchen gadgets, the low-cost, high-quality output of Chinese factories is the linchpin of US retail giants' supply chains.

This isn't just about numbers - it's about an intricate web of interdependence. Despite corporate buzzwords like "diversification," the reality is stark: China's role on critical product categories is unshakable. High-value, high-volume SKUs - think consumer electronics, clothing, and small appliances - are built on China's unmatched cost efficiency and production flexibility. Alternatives like US or Mexican manufacturing can't match the scale, speed, or price.

The consumer side tells the same story. America's trillion-dollar retail market, supercharged by post-pandemic online adoption, leans heavily on China's ability to churn out goods at breakneck speed to meet the demands of high-stakes sales events. Without China's manufacturing capability, retailers would buckle under the pressure of surging orders, competitive pricing, and tight logistics.

The US faces a stark choice: double down on a lose-lose trade war or preserve a mutually beneficial partnership, thereby advancing the transformation of American consumption. The time for decision is now, and the consequences of inaction could be dire.

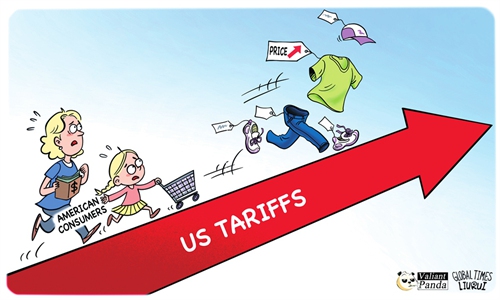

If Trump-era tariffs make a comeback, the fallout will be brutal. First, inflation - already a sore spot - will spike, hammering a consumer market mid-transformation and dragging down the broader economy. Second, supply chains will fracture. Retailers have dabbled in sourcing from third countries, but the data doesn't lie: New products and restocks still hinge on Chinese factories, ports, and logistics networks. Shifting to other countries or domestic production isn't a quick fix - it's a three-to-five-year slog, at minimum. Third, as observers noted, tariffs will erode industry revenue and choke investment.

July's e-commerce explosion underscores a simple truth: The US and China are locked in a symbiotic dance. The world's biggest consumer market and its largest manufacturer aren't just linked - they're fused in a complex, interdependent relationship. Tariffs won't "decouple" this dynamic - they'll just unleash chaos in the short term and significant losses in the long term. The potential economic fallout is not to be underestimated.

History has shown that tariff wars are reckless, unpopular, and unsustainable. China's position is clear and firm: We do not want a trade war, but we are not afraid of one. Rational negotiation and a commitment to mutual gain are the only path forward. Washington should continue its efforts to translate the high-level agreement into concrete policies that sustain this e-commerce miracle. The importance of these negotiations and the achievement of win-win outcomes through them cannot be overemphasized.