GT Voice: Foreign firms’ steady share of China’s trade shows predictable, stable market

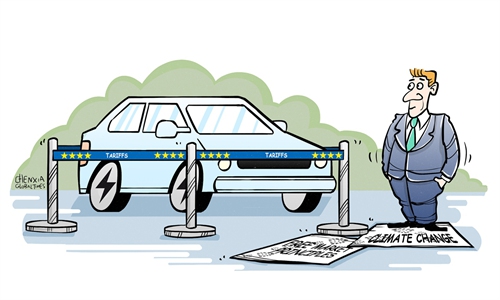

Illustration: Chen Xia/GT

Despite the complex and volatile global trade landscape, China's advantages, coupled with its proactive efforts to stabilize and attract foreign investment, continue to play a significant role in building a more predictable and stable environment for foreign businesses.The total import and export value of foreign-funded enterprises operating in China reached 6.32 trillion yuan ($881.4 billion) in the first half of this year, up 2.4 percent year-on-year, maintaining growth for five consecutive quarters, Wang Lingjun, deputy head of the General Administration of Customs, told a press conference in Beijing on Monday.

The figure is particularly noteworthy given the dramatic changes in global trade and industrial chains, reflecting the firm commitment of multinational enterprises to the Chinese market.

Foreign-funded enterprises have always played a vital role in China's imports and exports. Over the past five years, the cumulative trade of foreign-invested enterprises has comprised approximately one-third of China's total foreign trade. This phenomenon not only underscores the enduring attractiveness of the Chinese market to foreign investors but also reflects the results of China's initiatives to stabilize foreign investment.

With a vast consumer base of more than 1.4 billion people, the Chinese market offers foreign-funded enterprises broad development space. This allows them to fully unleash their production capacity, achieve economies of scale, reduce production costs, and enhance market competitiveness. For instance, numerous international automotive giants have established production bases in China, meeting domestic market demand while also exporting products globally.

Equally important is China's comprehensive industrial ecosystem, offering complete supply chains from raw materials to finished products across most manufacturing sectors. This ecosystem significantly reduces production costs and enhances operational efficiency for foreign-funded enterprises.

Moreover, the continuously improved business environment has injected certainty into foreign investment expectations. To this end, in recent years, China has been steadily shortening the market access negative list. Initially issued in 2018, the market access negative list underwent four major revisions in 2019, 2020, 2022 and 2025. The number of listed items has decreased from 151 in 2018 to the current 106, a reduction of about 30 percent, according to the Xinhua News Agency.

This is not to say that the effort to attract foreign investment has been smooth sailing. The recovery of global cross-border direct investment has been slow, with unilateralism and protectionism on the rise. Also, as China's industries accelerate their transformation and upgrading, multinational companies are adjusting their layouts, leading to a period of adjustment in the scale and structure of foreign investment attraction.

Faced with these changes, China has adopted more precise and effective measures to stabilize and attract foreign investment.

First, China continues to adhere to the concept of open cooperation and integrate into the global economy with a higher level of openness. In recent decades, China has continuously improved the foreign investment service system by establishing open platforms such as special economic zones and pilot free trade zones. These valuable experiences will continue and be carried forward.

Second, China continues to make policy adjustments in line with the times, to continuously boost the confidence of foreign companies in investing in China. For example, in response to the widespread concern of foreign-funded enterprises regarding government procurement, China has proposed clarifying the standards for government procurement of domestic products to ensure that products produced by enterprises of different ownership types within China's territory can participate equally in government procurement activities.

Foreign investment is undergoing a transformation from "manufacturing-oriented" to "innovation-oriented." Faced with this trend, China aims to seize the opportunity by focusing on industrial transformation and upgrading and targeting high-end manufacturing, biopharmaceuticals, digital technology, and other fields. This will create more cooperation opportunities and enable China to become not only a production base for foreign investment but also an important global innovation hub.