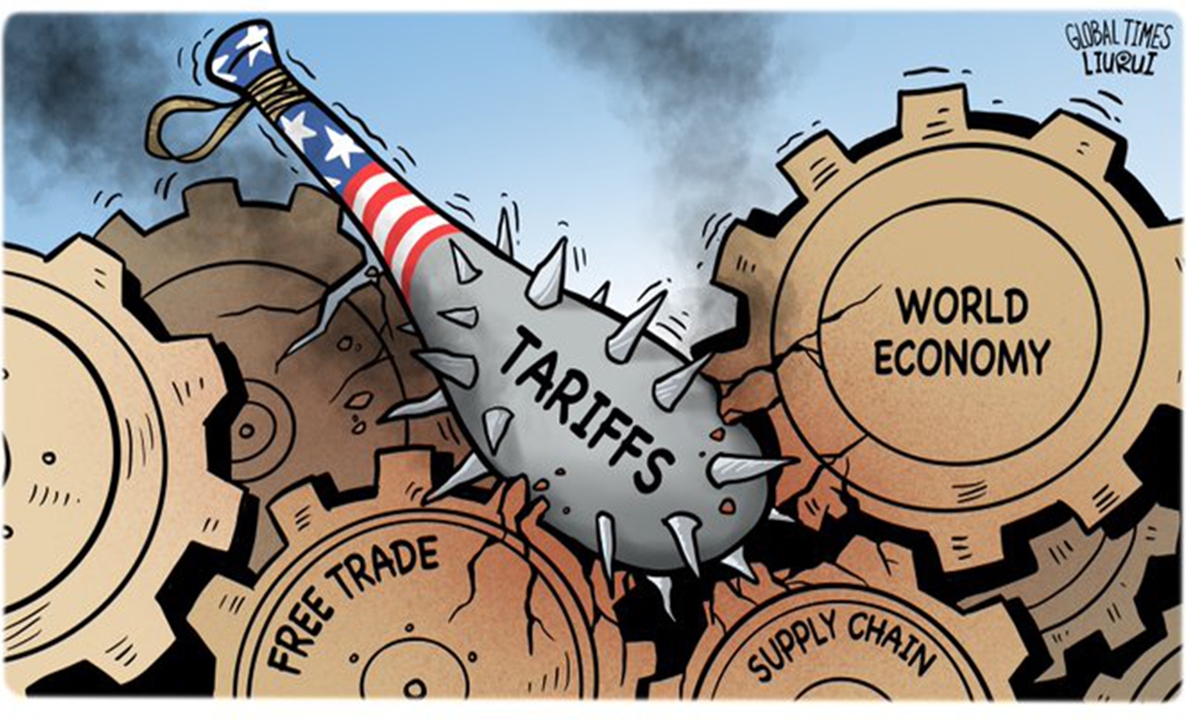

Illustration: Liu Rui/GT

According to the White House, US President Donald Trump on Wednesday signed an executive order to increase Brazil's tariff by 40 percentage points, raising the total rate to 50 percent - with the tariff set to take effect on August 1.However, the inconvenient fact is that Brazil is not a source of trade imbalance. Over the past decade, the US has consistently maintained a trade surplus with Brazil. In 2024 alone, the US recorded a goods trade surplus of $7.4 billion with Brazil.

The real logic behind the US tariff policy lies not in the bilateral trade structure, but rather in the interplay between political alliances and electoral cycles. Many observers believe the US actions are connected to the political ties between President Trump and Brazil's former president Jair Bolsonaro. Against this backdrop, the economic pressure exerted on Brazil by the US carries both a symbolic "election‑stage" posture and a message of "defending alliances." While Brazil has taken multiple measures to respond, reaching a quick technical deal appears slim.

The US-Brazil trade friction not only reflects the current high uncertainty in international affairs, but also reveals deeper structural shifts in global geopolitics. In this context, it is worth adopting a third‑party perspective and asking: does the friction between the two largest economies in the Americas open up new strategic coupling space for China?

As Brazil and China explore new development paths, opportunities in energy, agriculture, infrastructure, finance and technology could gradually take shape, provided there is shared political will and a spirit of constructive engagement.

In the energy sector, Chinese energy firms could seize the moment to lock in long term supply agreements with Brazilian firms. As Brazilian crude loses price competitiveness in the US market, Chinese demand could stabilize volumes at favorable pricing.

Steel presents a similar opportunity. Chinese producers can coordinate with Brazilian mining companies like Vale and domestic steel firms to optimize procurement networks. Such integration would allow Chinese firms to enhance quality control and efficiency while diversifying sourcing beyond the Middle East and Africa.

Agriculture also offers strategic potential. Chinese grain enterprise could expand forward contracts and prepayments with Brazilian suppliers, gaining greater control over pricing, delivery and risk. As US market access narrows, Chinese demand could stabilize farm incomes in Brazil, reinforcing China's role in global food pricing. High-value exports such as coffee, nuts, honey and orange juice align with evolving consumer trends in China and support national priorities like food security and the Healthy China action plan.

Infrastructure is another area of strategic relevance. Brazil's northern and northeastern regions face logistics bottlenecks just as their export potential is set to grow. Chinese firms could support large-scale upgrades in ports and railways, backed by financing from institutions like China Development Bank or the Export-Import Bank of China, thereby advancing infrastructure diplomacy under the jointly pursued Belt and Road Initiative.

In the digital and technological domain, should American tech companies face increased scrutiny in Brazil, Chinese cloud and payment platforms could step in. If trust in US providers erodes, Chinese firms may find room to grow by partnering with local telecommunications, government services and financial institutions. This would allow China to move beyond digital service delivery into deeper ecosystem collaboration, influencing regulatory and operational frameworks.

China can also reinforce its image as a responsible major country committed to stability and mutually beneficial cooperation. Within BRICS, China can support efforts to stabilize trade and investment channels disrupted by unilateral US actions. On multilateral platforms such as the World Trade Organization and the G20, Beijing can continue to advocate for inclusive, rules-based frameworks and oppose trade unilateralism. This not only enhances China's credibility among developing nations but also builds momentum for greater South-South collaboration.

It remains to be seen how long the rift between the US and Brazil will persist. What is clear is that this shift has opened space for new forms of cooperation. As supply chains, financial arrangements, and digital ecosystems adjust, opportunities for mutually beneficial engagement are emerging. From Brazil's perspective, China - not seeking confrontation or dominance - offers opportunities for stable, long‑term partnerships cultivated in the spirit of win‑win cooperation and shared development.

The author is a scholar of international relations at Brazil's Federal University of ABC. opinion@globaltimes.com.cn