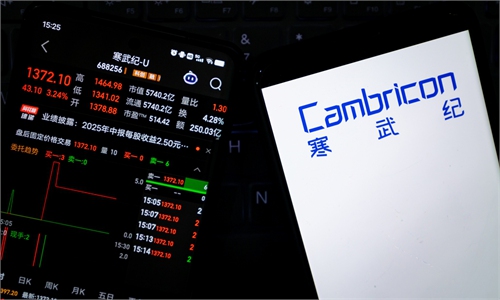

China AI chipmaker Cambricon announces risk of its stock price deviating from current fundamentals, after stock price hits new high

Photo: VCG

China's artificial intelligence (AI) chip provider Cambricon announced on Thursday that the company's stock price carries a risk of deviating from current fundamentals, and investors participating in trading may face significant risks, after its stock price hit a new high on Thursday.

Shares of Cambricon on Thursday surpassed those of Kweichow Moutai at the close for the first time, becoming the highest-priced stock in the A-share market, after its shares briefly surpassed those of Kweichow Moutai in intraday trading on Wednesday but fell back at the close.

According to Thursday's announcement released on the Shanghai Stock Exchange, the company's closing price on Thursday rose by 133.86 percent compared to that on July 28, with its stock price increase surpassing that of most peer companies and significantly exceeding the gains of relevant indices such as the STAR Composite Index, STAR 50 Index, and Shanghai Composite Index.

The company urged all investors to fully understand the risks of secondary market trading, enhance risk awareness, invest rationally, and pay attention to investment risks.

Cambricon said in the announcement that it has noted recent market predictions regarding its operations. Based on its actual situation, the company preliminarily estimates its full-year revenue for 2025 to be between 5 billion and 7 billion yuan. The aforementioned operational forecasts and other forward-looking statements represent preliminary estimates by the company's management and do not constitute a substantive commitment to any investors.

Investors and related parties should maintain sufficient awareness of the risks, understand the differences between plans, forecasts, and commitments, and pay attention to investment risks, it said.

The company has no plans to release new products. Recent online information about the company's new products is false and misleading to the market. Investors are urged to make rational decisions and pay attention to investment risks, according to the announcement.

Additionally, Cambricon noted the supply chain-related risks, stating that the company operates under a Fabless model, with suppliers including IP licensing vendors, server manufacturers, wafer foundries, and packaging and testing plants. Due to the highly specialized division of labor and high technical barriers in the integrated circuit industry, combined with the fact that the company and some of its subsidiaries have been included on the "Entity List," there is a certain risk to the stability of the company's supply chain, which may adversely affect its operating performance.

On Thursday, the stock of the company surged nearly 16 percent, with its stock price hitting a new high of 1,587.91 yuan per share and its total market value exceeding 660 billion yuan, the Securities Times reported.

The company's stock performance came after it released the earnings report in the first half of this year on Tuesday night. According to the report showed on the website of the Shanghai Stock Exchange, the company saw operating revenue increase to 2.88 billion yuan compared to the same period last year, a year-on-year growth of 4,347.82 percent.

The net profit attributable to the parent company reached 1.038 billion yuan, and the net profit after deduction of extraordinary items was about 913 million yuan, both achieving a turnaround from losses to profits, the report showed.

Global Times