China-Germany consumer tech cooperation deepens as IFA unveils 2026 innovation blueprint

IFA (Internationale Funkausstellung Berlin), one of the world’s largest consumer tech events, unveils key elements of its 2026 strategy at a briefing in Beijing on November 22, 2025. Photo: Zhang Yiyi/GT

IFA (Internationale Funkausstellung Berlin) Berlin, one of the world's largest consumer tech events, unveiled key elements of its 2026 strategy in Beijing on Friday, underscoring the growing importance of Chinese partners in shaping global technology trends. As the world's largest home and consumer electronics show, IFA emphasized that China remains one of its most important partners, both for the scale of its manufacturing ecosystem and for its accelerating technological breakthroughs Leif Lindner, CEO of IFA Management GmbH said.

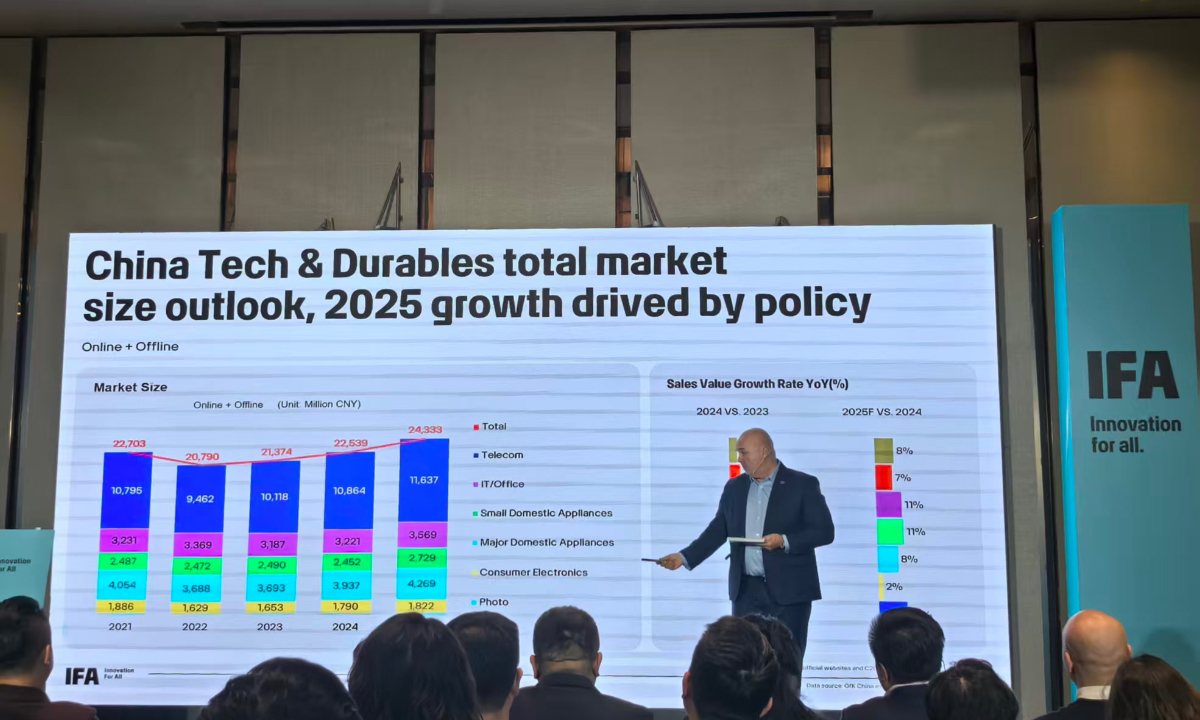

Lindner said that China is entering a stable growth phase fueled by export momentum and targeted fiscal policies, with consumer-tech demand remaining resilient. China will remain one of the most dynamic and innovative markets worldwide in 2026—making it a natural anchor for stronger China-Europe industrial cooperation.

Lindner told the Global Times during an interview that China continues to represent "technological precision, innovative spirit and quality like no other country," adding that IFA serves as a bridge connecting Asia and Europe and offering Chinese innovators a global stage. For Chinese companies, IFA 2026 will provide international exposure, access to retailers and consumers, and insight into European market trends, while creating opportunities to engage investors and strategic partners across the world.

Lindner told the Global Times that he has visited China twice in the past month to strengthen communication with exhibitors, noting that one-third of IFA's exhibitors already come from China. He described IFA as a place where global retailers and innovators meet, and emphasized that cooperation—not fear—should define China-Europe engagement. The briefing also brought together leaders from several Chinese tech companies.

Chinese robotics companies are also expanding their global footprint through major international exhibitions. Wang Qingwei, Head of European Business, ROBOTERA told the Global Times that his company attends shows across North America and Europe—including CES, Hannover Messe and academic robotics conferences—and hopes to join IFA 2026. He added that exhibitions remain a key channel for Chinese robotics brands to enter overseas markets.

Wang noted that the company's overseas revenue has reached roughly 50 percent this year, with clients spanning Europe, the US and Asia-Pacific. Most customers are in the US, including nine of the world's top ten tech giants. Their robots have already been deployed in North American supermarkets and hospitals for navigation, delivery and medical assistance.

Wang Yang, VP of Tec- Do 2.0, Founder of SparkFly, said Chinese brands have undergone a fundamental shift compared with five or ten years ago. "We are now exporting value driven by deep tech innovation. In many categories—from EVs to robotics—Chinese brands have evolved from followers into global leaders." He added that marketing strategies have shifted from single-channel online advertising to more multidimensional approaches including international exhibitions, local engagement and AI-driven marketing tools. Rapid advances in AI, he noted, are helping Chinese companies flatten experience gaps and accelerate global expansion.

IDC Global and China Vice President Wang Jiping said Chinese consumer-electronics brands are strengthening their global influence by embracing deeper localization, from sports sponsorships to products tailored to cultural needs in overseas markets. He noted that Chinese brands have moved beyond competing on specifications or pricing to understanding how people live, what they value and how technology should adapt to local customs.

He added that China is gaining strength in fragmented categories—including wearables, cleaning devices and service robots—rather than relying solely on competitive but crowded sectors like smartphones. As global tech ecosystems increasingly operate under a "dual-track" environment between China and the West, he said Chinese brands are becoming more adept at navigating both systems.

Industry insiders say China-Germany cooperation in AI and consumer technology is set to become an increasingly important driver of innovation, as both sides deepen collaboration across supply chains, R&D and market expansion.

Wang noted that the company's overseas revenue has reached roughly 50 percent this year, with clients spanning Europe, the US and Asia-Pacific. Most customers are in the US, including nine of the world's top ten tech giants. Their robots have already been deployed in North American supermarkets and hospitals for navigation, delivery and medical assistance.

Wang Yang, VP of Tec- Do 2.0, Founder of SparkFly, said Chinese brands have undergone a fundamental shift compared with five or ten years ago. "We are now exporting value driven by deep tech innovation. In many categories—from EVs to robotics—Chinese brands have evolved from followers into global leaders." He added that marketing strategies have shifted from single-channel online advertising to more multidimensional approaches including international exhibitions, local engagement and AI-driven marketing tools. Rapid advances in AI, he noted, are helping Chinese companies flatten experience gaps and accelerate global expansion.

IDC Global and China Vice President Wang Jiping said Chinese consumer-electronics brands are strengthening their global influence by embracing deeper localization, from sports sponsorships to products tailored to cultural needs in overseas markets. He noted that Chinese brands have moved beyond competing on specifications or pricing to understanding how people live, what they value and how technology should adapt to local customs.

He added that China is gaining strength in fragmented categories—including wearables, cleaning devices and service robots—rather than relying solely on competitive but crowded sectors like smartphones. As global tech ecosystems increasingly operate under a "dual-track" environment between China and the West, he said Chinese brands are becoming more adept at navigating both systems.

Industry insiders say China-Germany cooperation in AI and consumer technology is set to become an increasingly important driver of innovation, as both sides deepen collaboration across supply chains, R&D and market expansion.