US sets to vote on controversial bill curbing China biotech investment; move will undermine global tech cooperation, hurt US firms: analysts

US congress Photo:VCG

The US Congress is set to vote, could happen this week, on the 2025 National Defense Authorization Act (NDAA), a "must-pass" annual defense bill that would restrict US outbound investment to China in sensitive sectors as well as federal government contracting with Chinese biotechnology companies, two controversial measures that were left out of similar legislation last year, according to media reports.

"These two measures were actually proposed years ago but failed to pass last year. This time, they've been stuffed back into the 'must-pass' annual NDAA, signaling an intensification of US strategic competition with China," Zhang Xiaorong, director of the Beijing-based Cutting-Edge Technology Research Institute, told the Global Times on Tuesday.

"While framed as protecting 'national security,' such overreach will also hurt American companies' interests, undermine global tech cooperation, accelerate decoupling," Zhang noted.

US lawmakers have sought for years to pass versions of the Biosecure Act as well as the Foreign Investment Guardrails to Help Thwart (FIGHT) China Act.

The Biosecure Act targeting Chinese biotech as well as the FIGHT China Act targeting US investments in technologies with military applications were both included in the latest version of the NDAA agreed to by House and Senate negotiators over the weekend, said Bloomberg in a report on late Monday.

The Biosecure Act was blocked in the Congress in 2024 when some lawmakers objected to the naming of specific companies, some of which have US factories and contracts with American labs, said Bloomberg.

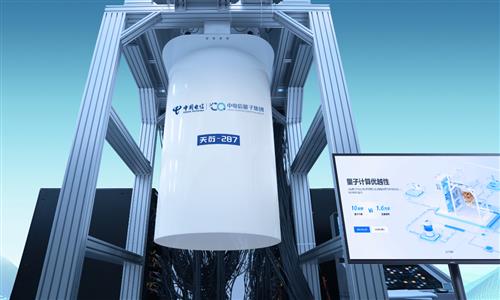

The FIGHT China Act, meanwhile, authorizes the Treasury secretary to prohibit or require notification of US investments in sensitive technologies in China, including in the fields of AI, semiconductors, quantum computing and hypersonics. US lawmakers see those technologies as having military applications, according to Bloomberg.

The act was opposed by then-chair of House Financial Services Patrick McHenry in November last year, saying that such legislation would limit the influence of Western firms in China, according to Politico.

The new version of the NDAA bill requires to create a list of biotech companies that would be blocked from federal contracts, grants or loans within a year, and give companies a chance to appeal. Companies on a Department of Defense list of "Chinese military companies (CMC)" would be among those targeted, though others could be added, according to the report.

"The bill explicitly references the Pentagon's existing list of so-called 'CMC.' Yet that list has long been criticized for vague criteria and lack of transparent evidence - it is essentially a political tool. Using it as the legal basis for legislation can hardly be called fair or legitimate," said Zhang.

Chinese companies, including drone maker DJI, lidar manufacturer Hesai Technology Co and semiconductor company Advanced Micro-Fabrication Equipment Inc. China, sued the US Department of Defense for being included in the so-called CMC blacklist.

The "must-pass" NDAA has faced opposition from US senators in October, before it was received by the House in November, according to public information published on the US Congress' website.

The vote result of the bill on October 9 showed that out of the 100 votes, 20 members voted against and 3 abstained, meaning one-fifth of lawmakers opposed the bill.

"The real US goal behind these investment restrictions is simple: Washington believes American capital flowing into China has been a key driver of China's rapid technological rise in sensitive sectors, so it wants to choke that flow to slow China down and preserve US dominance, especially in biotechnology. That logic is flawed," Zhou Mi, a senior researcher at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times on Tuesday.

"China's progress in these fields is primarily driven by its massive domestic market, rapid real-world iteration, and the innovation capacity of Chinese companies - not by US investment, which is only a supporting factor. Blocking it won't stop China's advance; it will only sideline American investors and companies from the world's largest growth market, putting them at a competitive disadvantage while hurting their own interests," said Zhou.

Zhou also noted that the bill, if passed, will also disrupt global supply chains, reduce options for everyone, slow down response times, and raise innovation costs.