Shenzhen bourse index reshuffle to boost financing for strategic sectors such as AI, chips

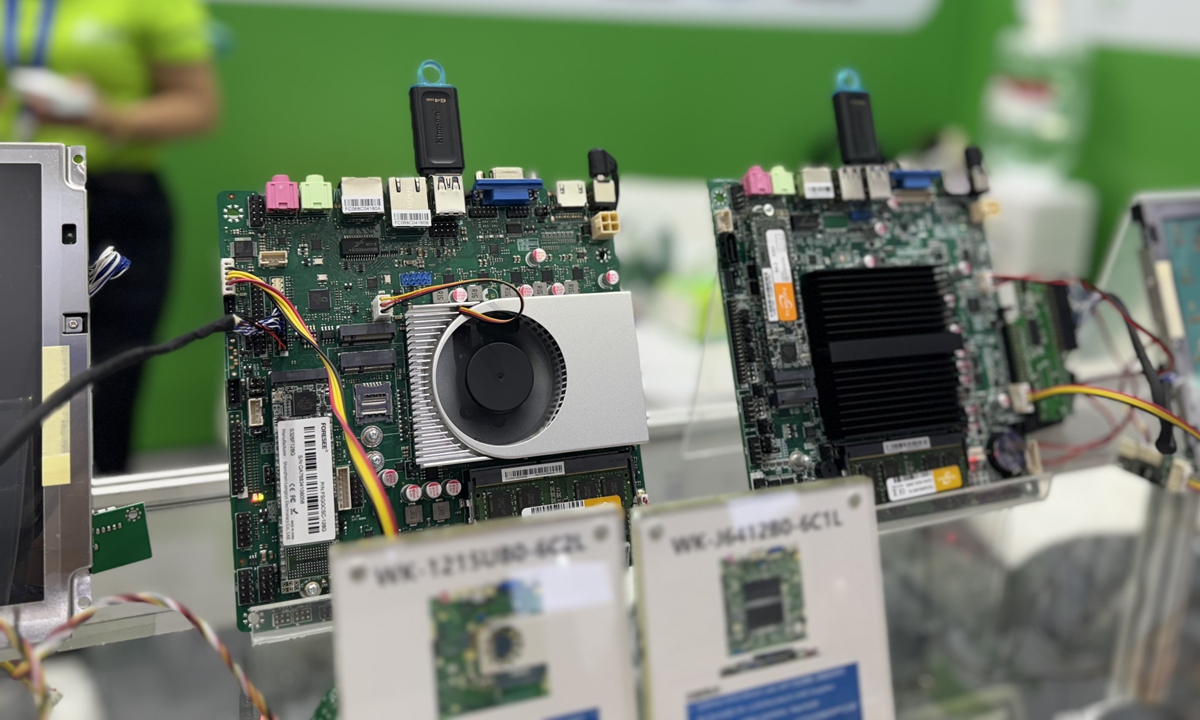

Shenzhen-based N&S Electronic shows their chips at the 14th Beijing International Robot Exhibition in Beijing on May 21, 2025. Photo: Liu Caiyu/GT

The Shenzhen Stock Exchange (SZSE) on Monday began its regular constituent adjustments for several major indices, including the Shenzhen Component Index, the ChiNext Index, the Shenzhen 100 and the ChiNext 50.

An analyst said that the move will further support easier financing for technology-oriented companies, particularly those in emerging strategic sectors such as artificial intelligence (AI) and chips.

The Shenzhen Component Index will replace 17 constituent stocks, adding seven companies from the main board and 10 from the ChiNext board, according to a notice.

The ChiNext Index will see eight constituent stocks replaced. The Shenzhen 100 Index will adjust seven constituents, with four companies from the main board and three from the ChiNext board added. The ChiNext 50 Index will replace five constituent stocks.

According to the SZSE, strategic emerging industries account for 93 percent of the ChiNext Index after the latest adjustments. The newly included constituent companies reported a 13 percent year-on-year increase in research and development (R&D) spending in the first three quarters, with R&D expenses accounting for 5 percent of their operating revenue, and 30 companies showing an R&D intensity of more than 10 percent.

The Shenzhen 100 Index is becoming more prominent as a "new-quality blue chip" benchmark, with the weight of strategic emerging industries rising to 81 percent. Key sectors such as advanced manufacturing, the digital economy, and green low-carbon industries now account for 79 percent of the index.

For the ChiNext 50 Index, strategic emerging industries make up 98 percent of the total, with next-generation information technology sectors represented by AI, chips, and optical modules contributing 45 percent.

The move by the SZSE strengthens financing support for booming strategic emerging industries, Hu Qimu, deputy secretary-general of the Forum 50 for Digital-Real Economies Integration, told the Global Times on Monday.

"Strategic emerging industries carry inherent risks, which can make investors hesitant. Including such companies in an index directs resources to them, signals to long-term capital that their growth is relatively reliable, and ensures that funds tracking the index allocate accordingly," Hu said.

He added that this provides more predictable, low-cost equity financing, allowing companies to focus on R&D, advance technologies, and develop applications, ultimately supporting industrialization.

"It also helps create a stable technology investment outlook, enabling innovations to turn into productive capabilities more quickly," Hu said, predicting that index-based support will become a trend for financing businesses in strategic emerging sectors as the nation promotes the development of new quality productive forces.

Global Times