Chinese upstream & downstream firms explore new chances in the global gold, silver rally

Customers inside the Laopu Gold Co store at IFC Mall in Hong Kong on December 25, 2025 Photo: VCG

As the year 2025 approaches its end, the prices of precious metals such as gold and silver continue to set new record highs.

In this eventful market rally, the upstream and downstream precious metal industry in China is exploring new opportunities to reposition themselves and promoting the high-quality development of the precious metal industry.

Latest data showed that the London gold spot price set a new record high of $4,500 per ounce on Saturday, while the spot silver price broke through $79 per ounce. According to the information from Chinese financial services provider Hithink RoyalFlush Information Network Co, the year-to-date gain in the London spot gold prices has exceeded 70 percent, while the silver spot prices have risen by more than 140 percent year-to-date and the platinum spot prices by more than 160 percent year-to-date, as of December 24.

Amid the continued rises in international gold prices, the retail prices of pure gold jewelry from major domestic brands including Chow Sang Sang, Lao Feng Xiang, and Chow Tai Fook have collectively surpassed 1,400 yuan ($199.8) per gram for the first time recently.

On Sunday, several consumers were seen lingering at a Chow Tai Fook in a shopping mall in Beijing's Chaoyang district. A consumer surnamed Liu told the Global Times that she was only browsing and remained hesitant about whether to buy more gold jewelry at such high prices.

A salesperson of the brand told the Global Times that the surging gold prices have not much impact on its sales so far because most of the jewelry products are sold at fixed price that not fluctuates according to international gold prices. "Compared with previous several months this year, our gold recovery business posted notable increases recently as more investors tend to monetize the gold," she said.

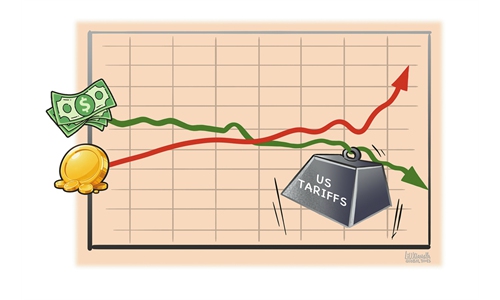

The price surge of gold underscores its nature as a safe-haven asset amid rising global uncertainties. The broader rally in precious metals have similar drivers - increasing demand of strategic minerals amid the fast development of sectors like artificial intelligence, new energy and high-end manufacturing, Wu Chenhui, an independent analyst who closely follows the metals industry, told the Global Times on Sunday.

High-quality development

As precious metals prices shine in both global and domestic markets, upstream A-share mining companies in the precious metals industry have also achieved brilliant performance. In the first three quarters of 2025, 11 mining companies in the A-share precious metals index posted double-digit or even triple-digit growth in both revenue and profits, according to a report published by the Shanghai Securities News on Thursday.

Faced with tremendous price rises in precious metals, especially gold and silver, Wu said various links of the whole industrial chain should reposition themselves to contribute to the high-quality development of the precious metals industry.

Domestic enterprises should enhance their capacity to explore precious metals such as gold and adjust their supply capacity in line with market demand, while more futures varieties will help enhance China's capacity in price setting of precious metals, Wu said.

Currently, China's domestic industrial sector is moving toward high-quality development centered on "security" and "development." In June, the Ministry of Industry and Information Technology and eight other government departments, including the National Development and Reform Commission, the Ministry of Commerce and the Ministry of Natural Resources, issued an action plan for the high-quality development of the gold industry from 2025 to 2027.

The country's gold resources will increase by 5 percent to 10 percent during the period, and its outputs of gold and silver will grow by more than 5 percent, according to the document.

The Chinese mainland mining companies such as Chifeng Gold, Zijin Mining, and Shandong Gold International have been actively carrying out financing and merger and acquisition activities to enhance their overall strength.

In March, Chifeng Gold was listed on the Hong Kong Stock Exchange (HKEX). In September, Zijin Gold International, formed by the asset restructuring of eight overseas gold mines of Zijin Mining, was listed on the HKEX. In December, Shandong Gold International stated that it would complete its H-share issuance and listing within the validity period of the resolution of the shareholders' meeting.

In November, the Guangzhou Futures Exchange started trading the platinum and palladium futures and options, which is expected to enhance China's influence in the pricing of platinum-group metals (PGMs).

Mixed forecasts

Heraeus Precious Metals, a leading global precious metals company, projected that the global prices of gold, silver, and PGMs are likely to show a downward trend in the first half of 2026, according to a note the company sent to the Global Times on December 9.

After such a significant price increase, the prices of precious metals are likely to need repositioning and consolidation, said Henrik Marx, head of the precious metals trading with Heraeus.

"Thanks to strong central bank demand and a favorable macroeconomic environment, gold is expected to remain the most solidly supported. Silver's performance may be more volatile due to industrial headwinds. The platinum market appears to remain tight, but the deficit may narrow. Meanwhile, palladium could face an expanding surplus as the market share of electric vehicles increases," Marx noted.

Gold prices, according to the forecast, could rise to $3,750-$5,000 per ounce while silver will trade between $43 and $62 an ounce. "While this rally in gold has not, and will not, be linear, we believe the trends driving this rebasing higher in gold prices are not exhausted," said Natasha Kaneva, head of the Global Commodities Strategy at J.P. Morgan, in a note dates December 16.

"The long-term trend of official reserve and investor diversification into gold has further to run. We expect gold demand to push prices toward $5,000 per ounce by year-end 2026," Kaneva projected.

Yang Delong, chief economist at Shenzhen-based First Seafront Fund, told the Global Times on Sunday that he had expressed optimism about the long-term trends of precious metals against the backdrop of growing demand for safe-haven assets. "Silver may exhibit greater volatility than gold, due to its lower absolute price," he said.