FM reiterates firm position on critical minerals after G7 meeting

Stabilizing supplies requires ‘genuine’ cooperation, not bloc politics

rare earth Photo:VCG

China's Foreign Ministry on Tuesday reiterated its firm position on keeping global industrial and supply chains of critical minerals safe and stable, and stressed that all parties also have the responsibility to maintain security and stability, in response to a reported agreement among G7 countries to reduce rare-earth reliance on China.

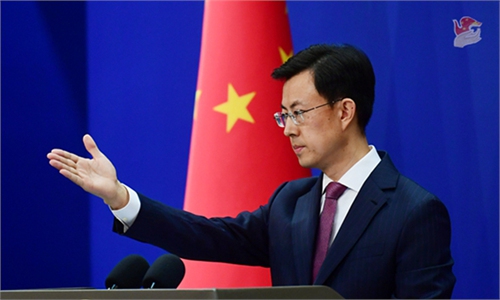

Asked to comment on a report claiming that finance ministers from G7 countries agreed yesterday to accelerate the reduction of rare earth imports from China, since they are relying too much on China, Mao Ning, a spokesperson for the ministry, said that "on keeping the global industrial and supply chains of critical minerals safe and stable, China's position has not changed. All parties have the responsibility to do so."

Notably, while media reports linked the meeting convened by US Secretary of the Treasury Scott Bessent to rare-earth imports from China, a press release from the US Treasury Department regarding the meeting did not mention China by name.

"Throughout the course of discussions, attendees expressed a strong, shared desire to quickly address key vulnerabilities in critical minerals supply chains. The United States highlighted actions and investments it has already undertaken, as well as planned steps to create resilient, secure, and diversified critical minerals supply chains," read the press release.

Crucially, the press release did not mention any "agreement" among G7 countries to reduce reliance on China.

A Reuters report on Tuesday claimed that the finance ministers from the G7 and other major economies met in Washington to discuss ways to reduce dependence on rare earths from China, including setting a price floor and new partnerships to build up alternative supplies, ministers said.

Chinese experts said that the reported meeting showed the deep concern and anxiety of the US and some other countries over China's advantages in the rare-earth industry, noting that addressing structural issues in the supply chain requires genuine cooperation among all parties, rather than bloc politics.

Gao Lingyun, a researcher at the Chinese Academy of Social Sciences, told the Global Times on Tuesday that Washington's attempt to ensure the security of its so-called critical materials supply chains through a bloc-oriented approach is highly improbable and largely unfeasible, as the rare-earth industry goes far beyond simple extraction, processing and end use, involving multiple complex links across the value chain.

"Addressing structural issues in the supply chain requires genuine cooperation among all parties, rather than attempts to act within a limited geographic or political framework," Gao added.

According to media reports, there were also differences among different attendees at the meeting. In the press release, "Bessent expressed his optimism that nations will pursue prudent derisking over decoupling, and that they understand well the need to remedy current deficiencies in critical minerals supply chains."

German Finance Minister Lars Klingbeil told reporters after the meeting that "I think it is right that the Americans are putting so much pressure on this issue," adding that "this is not an exclusive club," according to Bloomberg. Klingbeil also warned against an anti-China coalition, stressing that Europe needs to move faster on its own to develop supplies of important raw materials, Reuters reported.

There are significant differences among countries in terms of resource endowments, fiscal capabilities, and demand structures, which make the so-called cooperation extremely complex when it comes to actual implementation, Jian Junbo, director of the Center for China-Europe Relations at Fudan University's Institute of International Studies, told the Global Times on Tuesday.

On the one hand, these countries remain heavily dependent on China's rare-earth supply; on the other hand, they have deep concern and anxiety over China's advantages in the industry, Jian said, adding relevant attempt also reflects the same old "de-risking" mindset toward China.

Even as Germany's Finance Minister noted the talks had just begun with many unresolved issues, Japanese Finance Minister Satsuki Katayama claimed that there was "broad agreement on the need to swiftly reduce reliance on China for rare earths," according to Reuters.

The claim came after China has strengthened export controls over dual-use items toward Japan. Chinese officials have repeatedly stressed that the move is justified and lawful.

In responding to a question related to the export controls on Monday, Mao, the spokesperson for the Chinese Foreign Ministry, stressed that "China's measures, which were taken in accordance with the laws and regulations, are fully legitimate, justified and lawful."

Jian also noted that China's export control measures on rare earths are taken in accordance with laws and regulations, and fully comply with WTO rules.

China conducted a thorough assessment in advance of the potential impacts that these measures may have on production and supply chains, and is confident that the relevant impacts are very limited. China's export controls do not constitute a prohibition on exports. As long as the applications are for legitimate civilian uses and comply with regulations, they can be approved, a spokesperson for China's Ministry of Commerce said in October.