Gold, silver plunge by 'France+UK GDP' after Fed chair pick; panic selling, short-term pullback won't change long-term up trend: analysts

Photo: VCG

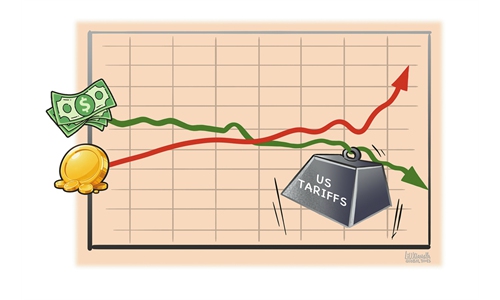

Gold and silver prices plunged drastically on Friday US time, with the scale equivalent to the combined GDP of the UK and France in 2025, ending the rapid gains seen in the recent weeks, which several major US financial media outlets linked to the announcement of a new hawkish nominee for Federal Reserve chair. Analysts said the selloff reflects a short-term pullback driven by investor profit-taking after the recent strong rally, while the long-term upward trend for precious metal prices is expected to be remained.The speed and scale of Friday's wipeout in gold and silver was unnerving. The sharp pullback in gold and silver erased an estimated $7.4 trillion in combined market value, based on above-ground supply and prevailing spot prices, according to a MarketWatch analysis. The amount is equivalent to the combined GDP of the UK and France in 2025. According to official IMF data, France's GDP was $3.36 trillion and the UK's GDP was $3.96 trillion in 2025.

Spot silver was down 28 percent at $83.45 an ounce, trading near its lows of the day. Silver futures plummeted 31.4 percent to settle at $78.53, marking their worst since March 1980. Spot gold fell around 9 percent to $4,895.22 an ounce. Gold futures dropped 11.4 percent to settle at $4,745.10, CNBC reported.

Several major US financial media outlets, including The Wall Street Journal, CNBC, Bloomberg and Forbes, linked this drop to the announcement of a new hawkish nominee for Federal Reserve chair.

Friday's panic selling was triggered by a rebound in the US dollar after a report the Trump administration was preparing to nominate Kevin Warsh for Fed chair, a move later confirmed, Bloomberg reported.

After US President Donald Trump confirmed Warsh's pick on Friday morning, the US dollar posted its strongest day, and gold and silver experienced a violent selloff. Gold futures suffered their largest one-day decline on record, marking the worst day for both gold and silver since 1980, according to The Wall Street Journal.

Historically, Warsh has been more concerned with higher inflation than slower growth, according to The Wall Street Journal. His potential tenure in office may curb investors' recent pursuit of precious metals as a safe haven amid high US inflation, per media analysis.

As Federal Reserve policy and the US economy have not yet reached an inflection point, the gold bull market may not be over, China Business Journal reported on Saturday, citing analysis from China International Capital Corporation Limited (CICC).

"Given the significant rise in gold prices in recent weeks, the market already needed a pullback, while this sell-off is the result of multiple factors combined," said Yang Delong, chief economist at First Seafront Fund. He said the recent strong rally had accumulated substantial profit-taking positions, driving Friday's sharp decline.

Even accounting for Friday's losses, silver remains up more than 150 percent from a year earlier. Gold has also made remarkable gains over the past year, as investors flocked to "safe haven" assets like precious metals as a hedge against uncertainty in financial markets and the global economy. After Friday's sharp decline, gold was still up more than 70 percent over the past year, according to NBC.

In the short term, the gold price had surged sharply, consecutively breaking through the $5,000 and $5,500 levels, indicating a clear short-term overheating and correction. In the long term, given the continuous increase in the US dollar supply and the mounting US government debt, the market is expected to support a long-term upward trend in gold prices, Yang said.

Gold remains an important investment tool. Historical trends show that after rapid short-term rises, prices often consolidate or pull back. Most speculative activity is driven by major international investment institutions, while central bank reserve accumulation and retail purchases are largely routine, Dong Shaopeng, senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times.