Morrison blame game taking China-Australia ties into abyss

China moves to reduce economic reliance on Australia

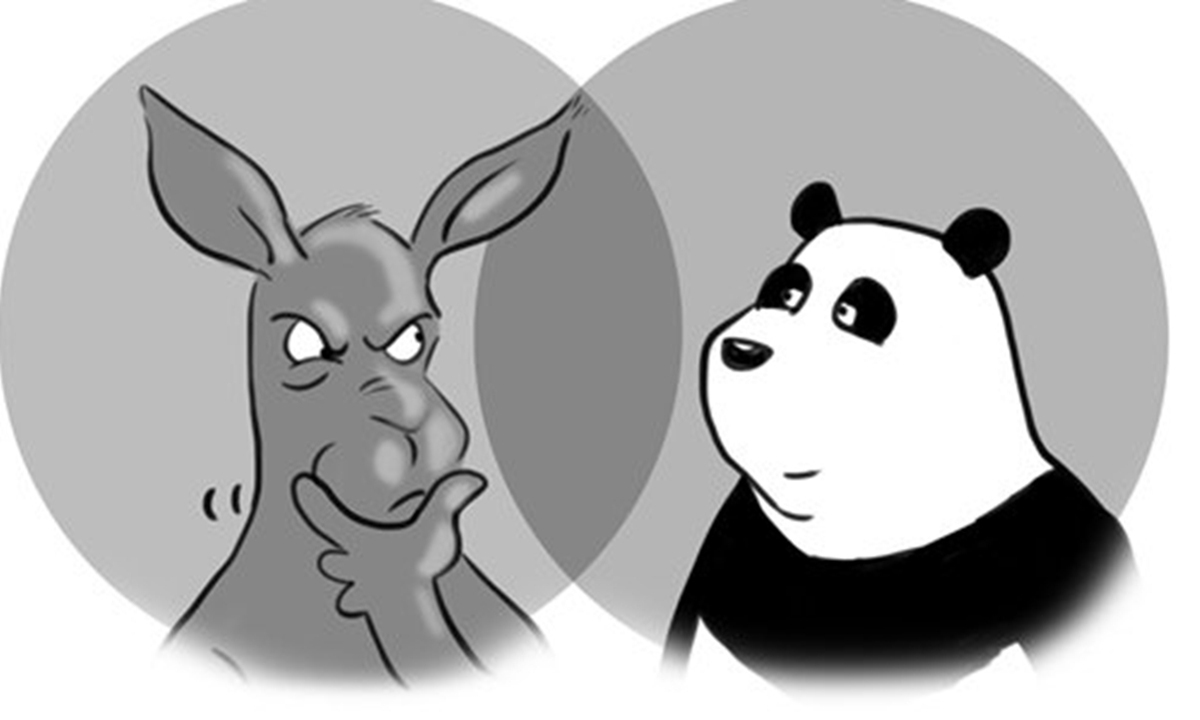

China Australia Illustration: Liu Rui/GT

When Australian companies are tangled with worries of losing the Chinese market - from agricultural products of barley and wine to the pillar exports of iron ore and coal - the Australian government has staged another "juvenile" political stunt by accusing China for violence by Australia's own soldiers in Afghanistan. This is a move that experts said is adding insult to injury in the China-Australia ties and showed that Canberra is too blind to see a more miserable future for itself as China is diversifying its import channels to avoid its economic lifeline being hijacked by down under amid rising tensions.

Previous days have witnessed a spike in the tensions between China and Australia as Australian Prime Minister on Monday demanded China to apologize after one of the spokespersons of the Chinese Foreign Ministry reposted a satirical cartoon on Australian soldiers killing innocent civilians in Afghanistan. The Australian government is also clamoring to turn to the WTO for China's "anti-dumping" measures on barley.

As the responsibility for the free fall in bilateral ties falls with Australia, its recent moves show that instead of reversing the all-around and profound damages it has caused to the bilateral ties, the Morrison administration is too blind to see the hidden risks of damaged relations to its economy, as China has gained an upper hand in reducing dependence on Aussie exports while the latter needs at least three years to recover from China's absence from its pillar industries, analysts said.

They noted that China is firmly on the winning side of any trade tussle with Australia as the principal buyer for a wide range of Australian goods and services and Australia's status as the world's most China-reliant developed economy.

For Australia's coal industry, a shocking piece of news over the weekend was that China secured 28.72 million tons of coal from Indonesia in a deal worth $1.467 billion. China was the second-largest importer of Australia's coal exports in terms of value in 2019.

The new order could serve as a significant counterweight to Australian coal, which accounted for 25 percent of the Chinese coal imports, with 94.5 million tons worth of shipments in 2019.

From 2015 to 2019, China's imports of Indonesian coal nearly doubled, reaching 138 million tons in 2019.

The news came as some Australian coal shipments are held off outside Chinese ports due to quality issues.

A trader in Caofeidian, a large coal port in North China's Hebei Province, told the Global Times that the imports of coal and other ores from Australia had been stopped.

"We need quotas for imports, but the import quota for Australia has been set at zero," said the trader, who believes the curbs on Australian coal will continue in 2021.

The trader, who spoke to the Global Times on condition of anonymity, estimated that there is some 3.4 million tons of seaborne coal from Australia currently off the shores of Caofeidian waiting for customs clearance.

Asked about over 50 vessels anchored off Chinese ports waiting to offload coal from Australia, a Chinese Foreign Ministry spokesperson said on November 25 that Chinese customs has found many cases where the imported coal didn't meet China's environmental protection standards.

"[The recent halt] could be a result of deviations from the stated purity level in the contract, or simply put, substandard goods," Li Chaolin, an expert at the China Coal Transportation and Sale Society, told the Global Times on Monday.

Zhang Zhibin, a fund manager following coal trading with Shanghai-based Chaos Investment, said currently no one wants to place orders for Australian coal as it may end up being a money-losing business due to huge policy uncertainty arising from strained political ties.

Chinese analysts believe China's diversification strategy for key items, such as the deal locking in Indonesian coal, is absolutely necessary and timely given Australia's dominance in exports of raw materials to China.

Despite warnings by some Australian academics, including former Australian ambassador to China Geoff Raby, that Australia could face "significant cost to our living standards" by the stoush between the two countries, there are nationalist voices within the country calling for a boycott of vital resources exports to China.

Nonetheless, Chinese analysts said coal-producing countries including Indonesia, South Africa, Russia and Mongolia stand to benefit as Chinese buyers diversify their purchases.

Even for iron ore, which initially escaped the fallout of strained bilateral relations, a diversification process is slowly taking shape and is reducing Australia's dominance.

Australia's share in China's iron ore imports has decreased to 57 percent in October from a high of 68 percent in May, a decrease of 11 percentage points in just five months, data from the industry portal Beijing Lange Steel Information Research Center showed.

From January to October, Australian iron ores accounted for 61.4 percent of China's total iron ore imports, down 0.7 percentage points from the same period in 2019.

"China's import channels are definitely optimizing with more players joining the game, with a particular increase seen from Central Asian countries," Wang Guoqing, research director at Lange Steel, told the Global Times on Monday.

At Khorgos, a key border city in Northwest China's Xinjiang Uygur Autonomous Region linking China's trade with Central Asian countries, imports of iron ore products reached 972,700 tons during the first 10 months of the year. The figure is 10 times the aggregate sum of all iron ore imports during the three years from 2017 to 2019, according to customs data.

Iron imports from South Africa are also gaining weight, accounting for 4.2 percent of total Chinese iron ore imports in the first 10 months, up 0.2 percentage point from the same period last year.

Chinese analysts said that amid a rising trade tussle with Australia, China is prepared to go through a legal process to defend its rightful actions.

Australian trade minister Simon Birmingham threatened over the weekend to take the barley issue to the WTO.

Wang Shiming, professor with the School of Advanced International and Area Studies at East China Normal University, said Australia has the right to bring the matter to the WTO but China's mechanism of initiating the probe is in full compliance with relevant protocols and China is confident of defending its actions at the WTO should the Australian side bring the matter to the dispute settlement mechanism at the world trade body.

But settlement at the WTO usually takes a long time, sometimes years, and Australian industry should be prepared to bleed, while its government takes this approach, Wang said.

Putting salt on an open wound

Experts said that it is really a pity to see that China and Australia have stepped into the current situation especially as it was caused by Australia's unilateral moves of provoking China. What's worse, instead of thinking of restoring the bilateral ties to facilitate trade exchanges, the Morrison administration is putting salt on an open wound by more juvenile actions and will have to swallow the bitter pills finally.

Chen Hong, professor and director of the Australian Studies Centre at East China Normal University, called Morrison's remarks on demanding China's apology over FM spokesperson Zhao Lijian's tweet as "juvenile" action that is pushing bilateral ties lower into the abyss.

"Morrison wants to use this opportunity to shift the domestic and international blame on its soldiers' savage act to China, which is unedifying. It also shows his incompetence in not only dealing with the country's own scandal but also diplomatic ties," Chen told the Global Times, noting that Australia should reflect on the all-around and profound damage it has caused to the bilateral ties before it is too late.

The trade between China and Australia is complementary and win-win for both sides. However, in recent years, Australia has been closely following the US to cooperate in the latter's anti-China strategies, which has highly raised the risks for China's trade and investment in the country and pushed China to seek other import channels, Song Wei, an associate research fellow at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times on Monday.

Australia's attempt to keep previous dual-option - developing economic ties with China while following the US on security and political issues to contain China - will not work anymore, especially as the Regional Comprehensive Economic Partnership trade deal could offer China more channels for the rare materials it needs, while Australia would find it hard to find another country to replace China.

Given the impact of the coronavirus epidemic on the Australian economy and the recent economic slump, Australia's economic development in the post-COVID-19 period is not optimistic, Song noted.